With the Ruble hitting record lows once again today against the USDollar, it appearsconcerns over USD liquidity are growing in Russia. The Russian central bank has unveiled an FX swap operation, allowing firms to borrow dollars in exchange for Rubles for a duration of 1 day (at a cost of 7%p.a.). Of course, this squeeze on USD funding - driven by Western sanctions - will, instead of isolating Russia, force Russian companies (finding USD transactions prohibitively expensive) into the CNY-axis, thus further strengthening the Yuanification of world trade and the ultimate demise of the USD as reserve currency.

USDRUB at record lows...

And funding sanctions appear to have driven the Central Bank to supply USDollar liquidity into an apparently squeezed market...

As Bloomberg reports,

"Sanctions and closed access to foreign-exchange liquidity from the West” is feeding demand for dollars, Dmitry Polevoy, chief economist ING.Foreign-exchange liquidity has “virtually dried out,” with volumes sinking to about $100 million per day, compared with $1 billion to $2 billion previously, according to Natalia Orlova, the chief economist for OAO Alfa Bank in Moscow....Companies have $22 billion in dollar-denominated payments to make in September and local banks are “anticipating demand for hard currencyfrom retailers and accumulating additional dollar liquidity,” Abdullaev said.

And as WSJ reports, the central bank has responded...

The Bank of Russia said Tuesday it introduced one-day currency swaps to aid banks "better management of the their short-term liquidity".Russian banks, unable to borrow abroad, are experiencing a shortage of currency liquidity."We see, naturally, some distortion on the (currency) swap market, which shows a structural deficit of dollars," Russia's Deputy Finance Minister Alexei Moiseev said Tuesday.

Russia will create a multi-billion dollar anti-crisis fund in 2015 of money destined for the Pension Fund and some left over in this year's budget to help companies hit by sanctions, Finance Minister Anton Siluanov was quoted as saying on Monday....Siluanov was quoted as saying by Russian news agencies that the decision to stop transferring money to the Pension Fund would hand the budget an extra 309 billion roubles ($8.18 billion US).He said not all of that sum would go into the anti-crisis fund, but that it would also receive at least 100 billion roubles of money left over in this year's budget."This 100 billion roubles will be added to the [anti-crisis] reserve next year, which will allow us to help our companies," RIA news agency citied Siluanov as saying."We are planning to create a reserve of a significant size."It was not clear how big the fund would be...."When a series of our partners, if they can be called that, test Russia's strength through sanctions and all kinds of threats, it is important not to succumb to the temptation of so-called easy solutions and to preserve and continue the development of democratic processes in our society, our state," Medvedev said in a televised speech.

* * *

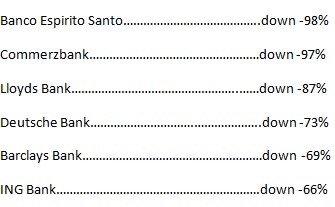

Increasingly making it prohibitively expensive for Russian firms to transact in USDollars...

Increasingly making it prohibitively expensive for Russian firms to transact in USDollars...

Which will merely serves to drive those firms to look for Chinese counterparts and further into the CNY-axis of de-dollarization (as UK Chancellor Osborne recently confirmed).