Checkout this preview of Splitting Pennies - Understanding Forex

Get it at www.splittingpennies.com

Friday, March 18, 2016

Thursday, March 17, 2016

JPM Announces $1.9 Billion Buyback One Month After CEO Jamie Dimon Buys 500,000 Shares In The Open Market

On February 12, Jamie Dimon made headlines when he bought 500,000 shares, or some $26 million worth of JPM stock which coming one day after the market hit its lowest point in the recent selloff, has become known as the "Dimon Bottom." Was it just good timing or was there something more to the purchase some wondered. As it turns out the purchase may have been nothing more than Jamie frontrunning his own company's multi-billion buyback, because as JPM announced moments ago, the company of which he is a CEO, just authorized the repurchase of an additional $1.9 billion in stock over the next three months, thereby assuring CEO Jamie of an even great profits on his recent acquisition.

From the release:

JPMorgan Chase & Co. (NYSE: JPM) (“JPMorgan Chase” or the “Firm”) today announced that the Firm’s Board of Directors has authorized the repurchase of up to an additional $1.88 billion of common equity through the end of the second quarter of 2016 as part of the Firm’s current equity repurchase program. This amount is in addition to the $6.4 billion of common equity authorized for repurchase by the Board last year. The Firm has received a non-objection from the Board of Governors of the Federal Reserve System to this increase in the amount of common equity that may be repurchased under the Firm’s 2015 capital plan.The timing and exact amount of purchases of common equity by JPMorgan Chase under its equity repurchase program will depend on various factors, including market conditions, the Firm’s capital position, internal capital generation, alternative investment opportunities, and legal and regulatory considerations; the Firm’s repurchase program does not include specific price targets or timetables, and may be executed through open market purchases or privately negotiated transactions, including the use of Rule 10b5-1 programs, and may be suspended at any time.

And now the legal question: did Dimon have knowledge that JPMorgan would conduct this buyback just one month ago when he purchased JPM stock in the open market to make a "statement." We doubt any regulators will ask this obvious question as even if he did, it will surely be chalked up to merely just another "tempest in a teacup."

Plot Thickens In New York Fed Heist As $30 Million In Cash Said Delivered To Mystery Chinese Man

One week ago, we documented the Hollywood-esque theft of $100 million from accounts held at the NY Fed and belonging to the central bank of Bangladesh.

In many ways, the heist was elegantly planned and executed and in others it was comically amateurish.

Here are the basics: On February 5, Bill Dudley's New York Fed was allegedly “penetrated” when “hackers” (of supposed Chinese origin) stole $100 million from accounts belonging to the Bangladesh central bank. The money was then channeled to the Philippines where it was sold on the black market and funneled to “local casinos” (to quote AFP). After the casino laundering, it was sent back to the same black market FX broker who promptly moved it to “overseas accounts within days.”

Basically, hackers got ahold of Bangladesh’s SWIFT codes and bombarded the NY Fed with requests for funds from the country’s FX reserves. Mercifully, the Fed declined to clear separate transfers worth some $870 million, but not before $100 million got away.

Four transfer requests totaling $81 million went through, but a fifth was held up when whoever was making the request tried to have $20 million sent to an imaginary NGO called Shalika Foundation but accidentally spelled “foundation” as “fandation.”

According to the Philippine Daily Inquirer, the money was routed to three casino bank accounts via the Jupiter Street, Makati City, branch of Rizal Commercial Banking Corp. The country’s gaming regulator was investigating.

Now, we get new details on what is a truly fascinating story.

First, we learn that the hackers who spelled “foundation” wrong weren’t the only ones to do something silly. The requests came in on a Friday, which is notable because as WSJ writes, “Friday is the weekend in Bangladesh and the central bank’s offices were closed.”

So, “the fact that the money was being wired to personal bank accounts in the Philippines rang alarm bells,” but apparently, the fact that it was a weekend did not.

Still, there were people at the office.

In fact, it was a printer error that tipped Bangladesh off to the scam. “Zubair Bin Huda, a joint director of Bangladesh Bank, found the printer tray empty when he looked on the morning of Feb. 5 for confirmations of SWIFT financial transactions that are normally printed automatically overnight,” Bloomberg reports. “Because it was a Friday -- a weekend in Muslim-majority Bangladesh -- Huda left the office around 11:15 a.m. and asked his colleagues to help fix the problem [but] it took them more than 24 hours before they could manually print the receipts, which revealed dozens of questionable transactions that sent the bank racing to stop cash from leaving its account with the Federal Reserve Bank of New York to the Philippines, Sri Lanka and beyond.”

As the story goes, Huda came into the office on Saturday and found a flashing message on the terminal connecting to the SWIFT system that read: “A file is missing or changed.” Finally, once Huda managed to get the things up and running his team found “receipts show[ing] the Federal Reserve Bank of New York sent back queries to Bangladesh Bank against 46 payment orders in different messages,” Bloomberg recounts.

Well at that point, it was panic time but because it was Saturday, no one was home at the NY Fed.

Anyway, the crack squad at the Philippine anti-money laundering agency has determined that someone needs to check out the branch manager at the bank where the money ended up. That manager is one Maia Santos Deguito. “[She] is a key player here because if you don’t have the cooperation of the branch manager, this could not have been done,” Senator Serge Osmena, vice chairman of the country’s blue ribbon committee, which investigates major issues, told reporters on Wednesday.

That’s correct. It’s also “slightly” suspicious that the CCTV cameras at the branch weren’t working when the money was withdrawn. Rizal wouldn’t immediately comment on the CCTV “issue.”

Deguito decided to essentially plead to fifth in a hearing and it’s easy to understand why. She apparently ignored requests from the Bangladesh central bank to stop the transfers.

After the money left the bank it went to two casinos and "a man of Chinese origin," according to Reuters.

"$29 million ended up in an account of Solaire, a casino resort owned and operated by Bloombery Resorts Corp which is controlled by Enrique Razon, the Philippines' fifth-richest man in 2015, a further $21 million went to an account of Eastern Hawaii Leisure Co., a gaming firm in northern Philippines," and that, according to Teofisto Guingona, head of the Philippine Senate's anti-corruption committee, is where "the paper trails ends" because "casinos are not covered by the country's anti-money laundering laws."

So what of the mysterious "Chinese" man? Well, we don't know. All we know is that he ended up receiveing $30 million in cash in three deliveries via an FX broker called Philrem Service Corp which of course wouldn't talk to Reuters.

Meanwhile, Bangladesh’s central-bank governor, Atiur Rahman - this poor guy...

... took the fall, saying he "took moral responsibility" for the loss. He resigned after seven years at the bank.

We're sure that any day now, Bill Dudley will set up a small table in his back yard, surround himself with reports sitting in the grass, and fall on his sword as well. After all, it's his "moral responsibility."

(Bangladesh... hmmm... is that some place we can see from the roof at 33 Liberty?)

Tuesday, March 15, 2016

EES: Making Sense of Cents

Forex remains to be the largest market in the world and the least understood. Central banks have more influence on global markets than any other force. In other words, monetary policy is the ONLY economic indicator(s) investors should be watching, because let's face it, if the Fed raised rates to 10% like they should do and called in all that QE money, stocks would collapse.

But yet Forex remains a mystery, something that someone may have mentioned or you heard about.. wait FX is a TV channel? or graphics? a movie?

One has to wonder who is more stupid, is it the clowns that worked for the big FX banks getting fined, jailed, or fired for misbehavior - or PBOC who seems intent to destroy not only any hope of becoming a 'real' currency (let alone a world reserve currency) but killing their trade markets as well:

In September last year, Chinese regulators stepped on the throat of a 'fair' market in equity futures trading and for all intent and purpose killed the Chinese equity market. Tonight - after 2 days of Yuan weakness - having warned everyon from Soros to Kyle Bass that "betting against the Yuan can't possibly work," The PBOC just unleashed plans for so-called "Tobin Tax" on FX transactions (which implicitly taxes each transaction, reducing liquidity, raising margins and reducing leverage).

CME Group (NASDAQ:CME), one of world’s leading derivatives marketplaces, announced that on March 10 it reached record trading volumes for forex futures and options. The record 2 517 334 contracts were traded on the Chicago Mercantile Exchange (CME). The number is 6% higher than the previous record of March 6, 2010. Also on March 10, were traded the record 2 350 478 forex futures contracts, exceeding by 142 061 the previous record of 2 208 417 contracts from May 6, 2010.The record volumes were driven by the Euro FX Futures (EUR/USD) trade: $127.13 billion in notional value in futures and $18.5 billion in options.

As central banks become more and more like big hedge funds, and Forex markets become more volatile, there will be a growing need for Forex for any investment portfolio.

More and more public companies report 'currency headwinds' - the most notable recent report comes from Toys R Us:

Toys “R” Us Inc. said revenue slipped 2.6% in the latest quarter as the retailer faced currency headwinds over the holiday period.The foreign exchange volatility was partially offset by the rise of same store sales of 2.3% in the fourth quarter. Currency woes, however, had a negative $169 million impact.For the year, the toy store’s same store sales increased a modest 0.9%.“Throughout the year, and especially during the holiday season, we focused on improving our execution to deliver a positive and memorable shopping experience to our customers,” said Dave Brandon, chief executive officer. “We significantly improved our performance, but we can and will make further progress on our quest to achieve flawless execution in every aspect of our operations.”

It must take a multi-million dollar salary to make such a bombastic statement... losing millions because of a lack of internal financial controls (i.e. no Forex hedging) and at the same time, state that we are on a 'quest to achieve flawless execution in every aspect of our operations.' Or maybe 'flawless' is executive-speak for misplacing a few million in the Forex market. This guy should run for political office!

But it shouldn't be alarming, in the meetings leading to the "Nixon Shock" and the modern free floating Forex system, genius statesman Henry Kissinger admitted honestly "Economics is not my Forte."

Secretary Kissinger: But if they ask what they're doing—let me just say economics is not my forte. But my understanding of this proposal would be that they—by opening it up to other countries, they're in effect putting gold back into the system at a higher price.Mr. Enders: Correct.Secretary Kissinger: Now, that's what we have consistently opposed.Mr. Enders: Yes, we have. You have convertibility if they—Secretary Kissinger: Yes.Mr. Enders: Both parties have to agree to this. But it slides towards and would result, within two or three years, in putting gold back into the centerpiece of the system—one. Two—at a much higher price. Three—at a price that could be determined by a few central bankers in deals among themselves.So, in effect, I think what you've got here is you've got a small group of bankers getting together to obtain a money printing machine for themselves. They would determine the value of their reserves in a very small group.There are two things wrong with this.Secretary Kissinger: And we would be on the outside.

We want money printing machine! We want money printing machine! (childish dancing and yelling)

If The Fed had any sense, they would immediately raise rates to 10%, the US Dollar would soar. Prices of imports would plummet. Money would flow to USA like a river. Exports, would need to be managed - but anyway the USA is a net-importer and it costs us nothing to print money and buy from foreigners.

It's amazing, the lack of understanding out there for the most important market in the world - the global money markets; FOREX. On the one hand, our money is worth less and less every year (most economic actors are Forex losers). On the other hand, Forex hedging is simple to use; and it's possible to even make money by trading Forex.

Elite E Services, Inc. published a book for those who want to know more about Forex "Splitting Pennies" on sale on kindle and in print from Lulu.

Having Killed Their Equity Market, China Unleashes "Tobin Tax" For FX Market

In September last year, Chinese regulators stepped on the throat of a 'fair' market in equity futures trading and for all intent and purpose killed the Chinese equity market. Tonight - after 2 days of Yuan weakness - having warned everyon from Soros to Kyle Bass that "betting against the Yuan can't possibly work," The PBOC just unleashed plans for so-called "Tobin Tax" on FX transactions (which implicitly taxes each transaction, reducing liquidity, raising margins and reducing leverage).

Deputy central bank governor Yi Gang raised the possibility of implementing a Tobin tax late last year in an article written for China Finance magazine, and now, as Bloomberg reports, it is on!

China’s central bank has drafted rules for a Tobin tax on currency trading, according to people with knowledge of the matter.Rules are aimed at curbing speculative trading, say the people, who asked not to be identified as the discussions are privateAn initial tax rate may be set at zero so as to allow authorities time to set up rules without immediately implementing the levy, people sayTax is not designed to disrupt hedging and other FX transactions undertaken by companies, people sayRules still need final approval by central government and it’s not clear how quickly they may be implemented, people sayPeople’s Bank of China doesn’t immediately respond to faxed request seeking comment

What happens next? Well that's easy... This!~

NOTE: Yes that is real... and Yes there is 'some' volume there

Good luck unwinding those levered shorts... and even if the hedgies are profitable, we suspect the tax will be tiered to enable the maximum pain to be extracted from so-called speculators.

“The Tobin tax can be considered as a form of capital control,” says Andy Ji, a foreign-exchange strategist and economist at CBA in Singapore.“The levy will hurt market sentiment and cause investors more panic, as this shows that the existing capital controls are not enough to curb outflows,” Ji says; “Now is not a good time to roll out Tobin tax as the market is already concerned about whether China will be able to increase capital account convertibility in the coming years, and this is another step backward to achieve that goal”

Simply put this imposition of a Tobin Tax suggests PBOC is expecting a lot of volatility and is trying to minimize any possibility of momentum ignition and speculation as much as possible.

Charts: Bloomberg

Friday, March 11, 2016

EES: Splitting Pennies the book released

Forex is all around you, even now, as you read this webpage.

You have had a feeling all your life, something is wrong with our world.

Something about our economic system just doesn't add up.

Where does all the money go? The government? What do "They" do with it?

Every minute, our money is worth less and less.

We are forced to work more, and more; to compensate for this discrepancy.

Who is to blame? How does this system function?

Is there a way to profit from it?

Is there a way to protect ourselves from this financial Matrix?

What does the future hold?

Splitting Pennies answers all this and more. Splitting Pennies is the defining doctrine describing our global financial system through the prism of its mechanism: Forex. Increase your Forex IQ or enjoy a story of modern finance.

DISCLOSURE: FOREX IS THE BIGGEST BUSINESS IN THE WORLD THAT YOU KNOW NOTHING ABOUT.

BY READING THIS BOOK YOU'LL KNOW MORE THAN A HARVARD MBA.

BECOME A SOPHISTICATED FOREX INVESTOR (SFI).

Learn more at Splitting Pennies website www.splittingpennies.com

Thursday, March 10, 2016

Ex-JPMorgan Broker Blew $20M of Client Money Gambling, Gets 5 Years

A former JPMorgan Chase & Co. broker who said he stole millions of dollars from customers because his brain was “hijacked” by an addiction to sports gambling was sentenced to five years in prison.

Michael Oppenheim, who at one point had about 500 clients and almost $90 million under management at JPMorgan, got so deeply in debt that, according to his lawyer, even his bookie expressed sympathy for him.

The former broker also got a break from U.S. District Judge Analisa Torres, who said at a hearing in Manhattan Tuesday that his battle with gambling addiction and his care for his disabled daughter were why she gave him less than the 10 years prosecutors sought. She also noted that Oppenheim’s gambling intensified just months after the daughter was born.

“I am cognizant that gambling is a mental disorder which is aggravated during periods of stress and depression,” said Torres, who also credited Oppenheim for expressing remorse for his crimes.

Oppenheim wagered on weekly National Football League games starting in 1993 and eventually moved to online sports betting, his lawyer, Paul Shechtman, told Torres during the hearing. After losing hundreds of thousands of dollars while working at JPMorgan, Oppenheim began stealing from clients to attempt to make up his losses, he said. Oppenheim eventually began options trading in technology stocks like Apple Inc., losing as much as $2.7 million in one day in a fruitless effort to pay back clients, Shechtman said.

Draghi Delivers The Bazooka: ECB Announces Surprise Refi, Marginal Rate Cuts; Boosts QE To €80BN, Adds IG Bonds

Well, the people wanted a "bazooka-sized" surprise from Draghi, and they got it.

Moments ago the ECB announced not only a 10 bps cut to the deposit rate expected pushing it to -40%, but also announced a 5 bp rate cut to the refinance (pushing it to 0.00%) and the marginal lending rate (now at 0.25%), and also boosted QE by €20bn to €80 billion per month, the addition of afour new targeted TLTROs each with a maturity of 4 years, but the most surprising announcement was that the ECB would also for the first time include investment grade euro-denominated bonds issued by non-bank corporations along the list of assets that are eligible for regular purchases.

In other words, Draghi finally delivered his bazooka.

Monetary policy decisionsAt today’s meeting the Governing Council of the ECB took the following monetary policy decisions:(1) The interest rate on the main refinancing operations of the Eurosystem will be decreased by 5 basis points to 0.00%, starting from the operation to be settled on 16 March 2016.(2) The interest rate on the marginal lending facility will be decreased by 5 basis points to 0.25%, with effect from 16 March 2016.(3) The interest rate on the deposit facility will be decreased by 10 basis points to -0.40%, with effect from 16 March 2016.(4) The monthly purchases under the asset purchase programme will be expanded to €80 billion starting in April.(5) Investment grade euro-denominated bonds issued by non-bank corporations established in the euro area will be included in the list of assets that are eligible for regular purchases.(6) A new series of four targeted longer-term refinancing operations (TLTRO II), each with a maturity of four years, will be launched, starting in June 2016. Borrowing conditions in these operations can be as low as the interest rate on the deposit facility.The President of the ECB will comment on the considerations underlying these decisions at a press conference starting at 14:30 CET today.

More from Draghi in 45 minutes.

Tuesday, March 8, 2016

This 4,000-Year-Old Financial Indicator Says That A Major Crisis Is Looming

Over 4,000 years ago during Sargon the Great’s reign of the Akkadian Empire, it took 8 units of silver to buy one unit of gold.

This was a time long before coins. It would be thousands of years before the Lydians in modern day Turkey would invent gold coins as a form of money.

Back in the Akkadian Empire, gold and silver were still used as a medium of exchange.

But the prices of goods and services were based on the weight of metal, and typically denominated in a unit called a ‘shekel’, about 8.33 grams.

For example, you could have bought 100 quarts of grain in ancient Mesopotamia for about 2 shekels of silver, a weight close to half an ounce in our modern units.

Both gold and silver were used in trade. And at the time the ‘exchange rate’ between the two metals was fixed at 8:1.

Throughout ancient times, the gold/silver ratio kept pretty close to that figure.

During the time of Hamurabbi in ancient Babylon, the ratio was roughly 6:1.

In ancient Egypt, it varied wildly, from 13:1 all the way to 2:1.

In Rome, around 12:1 (though Roman emperors routinely manipulated the ratio to suit their needs).

In the United States, the ratio between silver and gold was fixed at 15:1 in 1792. And throughout the 20th century it averaged about 50:1.

But given that gold is still traditionally seen as a safe haven, the ratio tends to rise dramatically in times of crisis, panic, and economic slowdown.

Just prior to World War II as Hitler rolled into Poland, the gold/silver ratio hit 98:1.

In January 1991 as the first Gulf War kicked off, the ratio once again reached 100:1, twice its normal level.

In nearly every single major recession and panic of the last century, there was a sharp rise in the gold/silver ratio.

The crash of 1987. The Dot-Com bust in the late 1990s. The 2008 financial crisis.

These panics invariably led to a gold/silver ratio in the 70s or higher.

In 2008, in fact, the gold/silver ratio surged from below 50 to a high of roughly 84 in just two months.

We’re seeing another major increase once again. Right now as I write this, the gold/silver ratio is 81.7, nearly as high as the peak of the 2008 financial crisis.

This isn’t normal.

In modern history, the gold/silver ratio has only been this high three other times, all periods of extreme turmoil—the 2008 crisis, Gulf War, and World War II.

This suggests that something is seriously wrong. Or at least that people perceive something is seriously wrong.

There are so many macroeconomic and financial indicators suggesting that a recession is looming, if not an all-out crisis.

In the US, manufacturing data show that the country is already in recession (more on this soon).

Default rates are rising; corporate defaults in the US are actually higher now than when Lehman Brothers went bankrupt back in 2008.

These defaults have put a ton of pressure on banks, whose stock prices are tanking worldwide as they scramble to reinforce their balance sheets against losses.

I just had a meeting with a commercial banker here in Sydney who told me that Australian regulators are forcing the bank to increase its already plentiful capital reserves by over 40% within the next several months.

This is an astonishing (and almost impossible) order.

The regulators wouldn’t be doing that if they weren’t getting ready for a major storm. So even the financial establishment is planning for the worst.

Good times never last forever, especially with governments and central banks engineering artificial prosperity by going into debt and printing money.

These tactics destroy a financial system. And the cracks are visibly expanding.

So while the gold/silver ratio isn’t any kind of smoking gun, it is an obvious symptom alongside many, many others.

Now, the ratio may certainly go even higher in the event of a major banking or financial crisis. We may see it touch 100 again.

But it is reasonable to expect that someday the gold/silver ratio will eventually fall to more ‘normal’ levels.

In other words, today you can trade 1 ounce of gold for 80 ounces of silver.

But perhaps, say, over the next two years the gold/silver ratio returns to a more historic norm of 55. (Remember, it was as low as 30 in 2011)

This means that in the future you’ll be able to trade the 80 ounces of silver you acquired today for 1.45 ounces of gold.

The final result is that, in gold terms, you earn a 45% “profit”. Essentially you end up with 45% more gold than you started with today.

So bottom line, if you’re a speculator in precious metals, now may be a good time to consider trading in some gold for silver.

http://www.zerohedge.com/news/2016-03-08/4000-year-old-financial-indicator-says-major-crisis-looming

Thursday, March 3, 2016

OANDA agrees acquisition of FX accounts of IBFX/TradeStation Forex

Talking of the consolidation that has taken hold of the US Forex market is hardly bringing any news. Today saw one more piece of proof in this respect, as provider of online trading services OANDA has just announced an agreement to acquire all of the forex accounts of IBFX, Inc. (TradeStation Forex), in a transaction whose financial terms were not disclosed.

IBFX (TradeStation Forex) is the forex dealer firm subsidiary of TradeStation Group, Inc. and is exiting the forex dealer business.

The transfer is set to happen on March 4, 2016.

From March 5, 2016, TradeStation Technologies will offer to the IBFX customers who switch to OANDA, subscriptions for a real-time TradeStation FX platform integrated with OANDA’s forex price feed. This will enable those customers to continue to perform research and analysis on TradeStation FX, including charting, strategy design and strategy testing and optimization, before placing their trades as OANDA clients on their new OANDA order execution platform.

Ed Eger, President and Chief Executive Officer, OANDA Global Corporation, says,

“TradeStation Forex clients are used to top technology and a broker that puts them first. This will continue with OANDA. Our shared values on these crucial matters were a key reason for striking this deal, rather than any others we’ve recently considered. These new clients join a rapidly growing OANDA community at a time when market volatility is high. We’re showing our new clients why OANDA is known for innovative tools and technologies to assist the FX trader as well as exceptional execution and client service. We’re confident that both professional and part-time traders will be happy at OANDA. In fact, we’ve even arranged for introductory free access to some of our advanced services used by elite traders.”

John Bartleman, President of IBFX and TradeStation Securities, Inc., TradeStation Group’s broker-dealer/futures commission merchant operating subsidiary, says,

https://leaprate.com/2016/02/oanda-agrees-acquisition-of-fx-accounts-of-ibfxtradestation-forex/“We believe that OANDA is one of the best online forex dealers in the world and are confident that TradeStation Forex clients will be well served. Forex has always been a small part of our business, and now we will be able to focus all of our online brokerage resources on TradeStation Securities’ equities, options and futures business, and our forex clients will have the benefit of being served by a firm that dedicates its focus to forex trading.”

Friday, February 26, 2016

EES: Liquidity System now on MQL marketplace

Checkout Liquidity at the MQL5 marketplace or you can simply search "Liquidity" on the "Market" tab inside your MT4/MT5 terminal!

Liquidity is designed specifically to create volume. It is designed for those with existing sufficient positive alpha in their Forex accounts, but with little volume. Liquidity trades constantly, on both sides of the market.

By using a parameter rich open skeleton design, Liquidity can be used in near infinite ways (inside the mathematical confines of the Forex market, and broker limitations). Also because of this design, Liquidity can become a plethora of micro-strategies.

For example, Liquidity can be used to trade during a market lull, such as in between important data announcements. During this time normally the majority of algorithms are quiet or inactive. If this is the case for your algos, Liquidity is the perfect overlay / companion strategy to add to your quant portfolio!

In its most basic form, liquidity can be used to grid the market with a combination of market orders and limit orders. In its most advanced form, liquidity can be used to trade constantly, on both sides of the market, with risk management.

Liquidity is designed specifically to create volume. It is designed for those with existing sufficient positive alpha in their Forex accounts, but with little volume. Liquidity trades constantly, on both sides of the market.

By using a parameter rich open skeleton design, Liquidity can be used in near infinite ways (inside the mathematical confines of the Forex market, and broker limitations). Also because of this design, Liquidity can become a plethora of micro-strategies.

For example, Liquidity can be used to trade during a market lull, such as in between important data announcements. During this time normally the majority of algorithms are quiet or inactive. If this is the case for your algos, Liquidity is the perfect overlay / companion strategy to add to your quant portfolio!

In its most basic form, liquidity can be used to grid the market with a combination of market orders and limit orders. In its most advanced form, liquidity can be used to trade constantly, on both sides of the market, with risk management.

Cable Gets Pounded

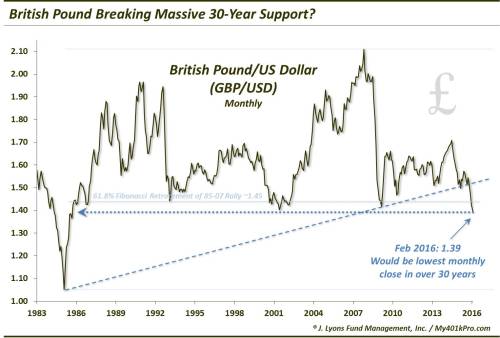

Amid the biggest weekly drop in GBPUSD (cable) in 7 years, a surge in UK credit risk, and a spike in cable volatility, Brexit risk has never been higher, but, as Citi notes, is only 30% priced in at current levels (while polls are more 50-50) even as The British Pound is plumbing 30-year lows versus the U.S. Dollar.

And, as Dana Lyons details, cable is experiencing a potentially massive breakdown at this juncture, making it the current MVP of the global currency wars.

The central banks’ global game of debase your currency remains alive and well. In fact, in some ways, it is the only game in town. That bodes very poorly for the global economy and equity markets as good old-fashioned organic economic growth is hard to come by these days (non-partisan economists and historians will look back at this epic experiment with bewilderment…but I digress). The latest player to take center stage in this game? The United Kingdom. Owing ostensibly to “Brexit” talk the price of the British Pound versus the U.S. Dollar – aka, “cable” – has dropped to near 30-year lows.

Trading at 1.39 currently, should the GBP/USD close here in 2 days, it will be the lowest monthly close since September 1985 –notably breaking the lows near 1.40 from 1986, 1993, 2000-2002 and 2009. A solid break below 1.40 opens up the all-time lows around 1.05, eventually.

Who saw this one coming? Well, since you asked, we did. At least we suggested it in a post last April titled “Is the British Pound the Next Currency to Collapse?”. Yes, that was 10 months ago, but the cable was in the midst of a 9-month selloff and due for a breather. It was also hitting the colossal 30-year support area near 1.40. Thus, we concluded that:

As you can see, the 140′s area is a colossally important level in the British Pound. Given its inability to break that area for 30 years, it will not fail there easily. However, given factors involved related to its price momentum, futures positioning and policy flexibility, an eventual break of the 140′s level would not be a surprise.

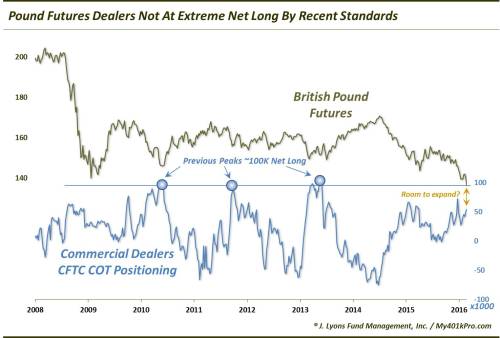

Regarding the futures positioning, our point was that, despite the extreme lows in Pound futures at the time, Commercial Dealers’ net long positioning was still well below that at prior lows in the contract. This group is typically correctly positioned at major turns in futures contracts. Our thought was that the Dealers’ net long position had room to expand still, and could accommodate a further drop in the Pound. That did not transpire. However, the Dealers’ positioning right now is in a similar spot as it was last spring (at least as of last week). Thus, their net long position would appear to have room to expand should the Pound look as if it might suffer this momentous breakdown.

In terms of policy (and we do not want to stray too far down this tangent), it would appear that the Bank Of England has much more ammo, arrows, tools, etc. at its disposal than most central banks should it want to “persuade” the Pound lower still. At least, it has not fired off its version of currency “shock and awe” yet. Thus, perhaps the central bank has some credibility on its side (which by the way is perhaps the weakest “currency” of all among global central banks).

Whatever happens (e.g., Brexit, debasement, etc.) cable is experiencing a potentially massive breakdown at this juncture, making it the current MVP of the global currency wars.

Tuesday, February 23, 2016

California Bankruptcy Judge Says Bitcoin is Property, Not Currency

A US district judge has ruled, for the purposes of a bankruptcy case in California, that bitcoins are a kind of intangible property.

As reported earlier this month by CoinDesk, the US Bankruptcy Court for the Northern District of California is hearing a case filed by the bankruptcy trustee for HashFast, a bitcoin mining firm that declared bankruptcy in 2014.

The trustee is suing a former promoter for HashFast, Mark Lowe, and is seeking the return of 3,000 bitcoins alleged to have been fraudulently transferred to Lowe prior to the firm's collapse.

In recent weeks, both sides have submitted arguments over whether bitcoin should be considered a currency or a commodity for the purposes of the case.

At stake is roughly $1m in value. If bitcoin is deemed a currency, then Lowe would only have to return the 3,000 BTC at the value they held when he received them, which amounts to about $360,000. If deemed a commodity, then the appreciated value of that 3,000 BTC – about $1.3m today – is up for grabs.

During a hearing on 19th February, US Bankruptcy Judge Dennis Montali sided with the trustee, declaring that bitcoin is an "intangible personal property" rather than a currency.

Lawyer Brian Klein of law firm Baker Marquart, one of the attorneys representing Lowe, pushed for the court to pay attention to how the bitcoins were treated when Lowe was being paid for promoting HashFast's products – in this case, bitcoins were being treated as the same as dollars at the time.

Yet, Montali disputed that notion, stating that bitcoins and dollars are not the same, saying:

"But that doesn't make [bitcoins] dollars, that’s my point. I understand how the parties acted, but that doesn't make them dollars."

The matter up for discussion wasn't entirely settled, as Montali indicated that he would, for now, only weigh in on the currency vs commodity angle.

Montali said that he would return to the question of whether, if required, Lowe would transfer the 3,000 bitcoins or the equivalent dollar amount.

The judge indicated that he would issue an order on the decision, which at press time is currently unavailable.

Limited impact

As noted by industry experts, the ruling will add to relevant case law concerning the question of how bitcoin should be treated in civil legal cases, though it is likely to have few larger ramifications.

For example, while US agencies like the US Commodity Futures Trading Commission (CFTC) and the Internal Revenue Service (IRS) have ruled bitcoin should be treated as a commodity, other federal agencies are likely to rule differently as they seek to define the technology under their mandates.

The US Securities and Exchange Commission (SEC), for instance, has been encouraged by blockchain advocacy group Coin Center to consider how some uses for bitcoin may meet its definition for security, while others may not.

Other US regulatory bodies may come to similar conclusions, suggesting there may be no one definition for how bitcoin ultimately falls under US law.

This article has been updated for clarity.

Subscribe to:

Posts (Atom)