Summary

The Panama Papers is the most US positive event of the year.

High probability that many US Stocks will be impacted, mostly for the better.

Investors should research and prepare themselves.

Expect long term real money flows to support the US Dollar.

No US bank was involved in illegal activities.

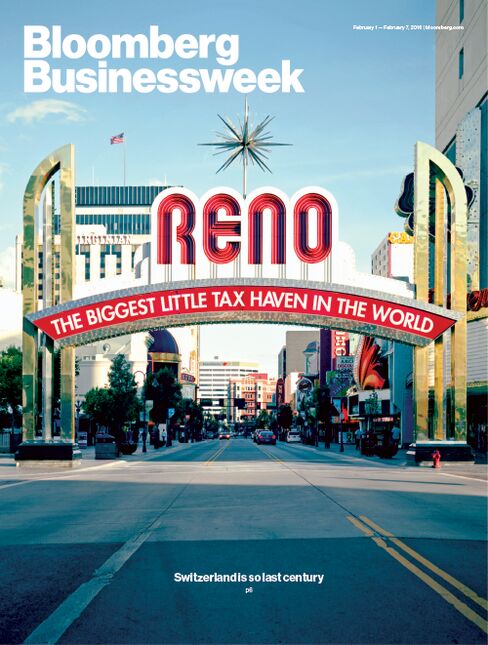

In case you didn't hear yet, 11 million documents have been leaked in what's being called the largest data leak of all time. It's being called the "Panama Papers" and it makes all other data leaks look like nothing. We're talking heads of state, billionaires, celebrities, drug kingpins, and even Jackie Chan.You can read more about it here, and here. Already it seems a Prime Minister (Iceland) will resign over this, although he says he will not resign. The implications for political corruption are staggering. But what is even more alarming, is the implications for Wall St. We've witnessed the fall of Switzerland as a banking haven, and more specifically a secret private banking haven. We've seen the slow demise of 'offshore' tax havens such as Caymans, Bahamas, and others. But today marks the day when the United States of America is the world's favorite tax haven. Recently, Bloomberg published an article for Business Week based on a presentation by Rothschild, painting a picture that America is "The New Switzerland."

After years of lambasting other countries for helping rich Americans hide their money offshore, the U.S. is emerging as a leading tax and secrecy haven for rich foreigners. By resisting new global disclosure standards, the U.S. is creating a hot new market, becoming the go-to place to stash foreign wealth. Everyone from London lawyers to Swiss trust companies is getting in on the act, helping the world's rich move accounts from places like the Bahamas and the British Virgin Islands to Nevada, Wyoming, and South Dakota.The firm (Rothschild) says its Reno operation caters to international families attracted to the stability of the U.S. and that customers must prove they comply with their home countries' tax laws. Its trusts, moreover, have "not been set up with a view to exploiting that the U.S. has not signed up" for international reporting standards, said Rothschild spokeswoman Emma Rees. Others are also jumping in: Geneva-based Cisa Trust Co. SA, which advises wealthy Latin Americans, is applying to open in Pierre, S.D., to "serve the needs of our foreign clients," said John J. Ryan Jr., Cisa's president.Trident Trust Co., one of the world's biggest providers of offshore trusts, moved dozens of accounts out of Switzerland, Grand Cayman, and other locales and into Sioux Falls, S.D., in December, ahead of a Jan. 1 disclosure deadline. "Cayman was slammed in December, closing things that people were withdrawing," said Alice Rokahr, the president of Trident in South Dakota, one of several states promoting low taxes and confidentiality in their trust laws. "I was surprised at how many were coming across that were formerly Swiss bank accounts, but they want out of Switzerland."

So how does this impact US Stocks, the markets, and the global financial system as a whole?

It's a coup for USA and for the USD

Markets don't get it yet - but this is a boon for the USD. That means bullish for (NYSEARCA:UUP), (NYSEARCA:USDU), and bearish for (NYSEARCA:UDN). But this is a long term trend - much of it is already priced in. The point is that the US Dollar itself will be supported by real money flows into the United States, as foreigners utilize corporate structures offered in Nevada, Wyoming, and other US states. It's a great kick start to Rothschild's new Nevada office, it's great for US markets (When the money's here, it will invest in US markets), it's great for the US economy, it's just a win-win-win for USA. And through the process, another outlet has been closed for terrorist/criminal financing, and possibly even provided authorities with evidence to close even more black holes.

US markets have undergone many regulatory changes, in parallel to electronic-ization. It's hard to hide money, now that everything is electronic, and connected, and online. Holes needed to be plugged - such as Panama. Those 'in the know' have known for some time that Panama is a CIA trap. Certainly since the Bush Sr. sponsored invasion of Panama, the US has controlled this small banana republic. They use the US dollar in Panama. Anyone who believes otherwise, is an uneducated fool. The release of the Panama papers prove this. For years and years, meticulously information was collected, they patiently waited, for this climatic moment. All in one move, this operation nicely supports the US dollar, ensnares financial criminals, political enemies, and closes yet another outlet not controlled by the mainstream western financial legal/regulatory system. Genius!

The Forex elements of such an operation are explained in great detail in the Forex book "Splitting Pennies", for example - how offshore tax jurisdictions utilize Forex tax rules for legitimate, legal tax savings. Now a real solid argument can be made, to those US entities thinking of going 'offshore' - we can do the same thing for you, in Nevada. Why take all the risk, spend the money, and other hassle associated with offshoring - when all can be done right here at home in USA.

What to watch out for

Banks that were involved in illegal activities, may have penalties. These banks include:

- HSBC Holdings PLC (NYSE:HSBC)

- Deutsche Bank AG (NYSE:DB)

- Credit Suisse Group AG (NYSE:CS)

- UBS Group AG (NYSE:UBS)

- Commerzbank AG (OTCPK:CRZBF)

- Societe Generale (OTCPK:SCGLF)

These are the known banks, listed in the Panama Papers - of course there may be others. Of course, these banks are huge global banks involved in almost market in the world. But some of these connections can prove disastrous, without getting into detail. It's hard to prove you didn't know that someone was a terrorist, drug dealer, or human trafficker. If those payments were laundered through your bank, it's not good.

The good news for US banks - there's no US bank on the list. That means as more and more 'dirty laundry' is released, it will be better and better for regulated, US banks such as JPMorgan Chase & Co. (NYSE:JPM), Goldman Sachs Group Inc. (NYSE:GS), and other Wall St. banks.

It should be good for the whole US financial sector, so if one wanted to play this, may as well buy a sector ETF such as (NYSEARCA:KBE), (NYSEARCA:XLF), (NYSEARCA:VFH), or (NYSEARCA:KRE). Any boutique bank based in the US that offers wealth management, private trust services, and related services, should benefit from this event, in the short, medium, and long term.

Now, there's few places in the world left to hide money. Investors who for whatever reason would consider going to Panama and other places to operate, may need to consider instead utilizing intelligent structures that are country/jurisdiction independent. Because the only real currency - is intelligence.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.