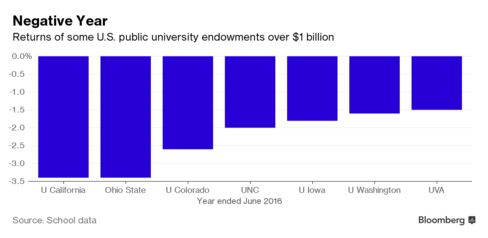

Seven public U.S. university endowments with assets of more than $1 billion including the University of California reported fiscal 2016 investment losses as lackluster economic growth and volatility drubbed markets.

College endowments are poised to take the worst slide in performance since the 2009 recession. Funds with more than $500 million lost a median 0.73 percent in the year through June 30, according to the Wilshire Trust Universe Comparison Service. The Wilshire data, from fund custodians, excludes fees while most schools report returns net of fees.

“It was a bit of a bloodbath,” as swings in the markets challenged stock pickers, Jagdeep Bachher, chief investment officer at the University of California system, said at an investment committee meeting on Sept. 9, according to a webcast of the meeting. “Last year was a bad year for active managers all around.”

Ohio State University and California had the largest declines through June 30 among the seven at 3.4 percent each while the University of Virginia fell 1.5 percent. It’s shaping up to be the worst year for endowment returns since 2009, when the richest schools had a loss of 21.8 percent, according to the Wilshire service. For fiscal 2016, a benchmark 60/40 portfolio of the Wilshire 5000 Total Stock Market Index for U.S. equities and the Wilshire Bond Index returned 4.5 percent.

Hedge Funds

The value of the University of California’s endowment rose 2.2 percent to $9.1 billion from the prior year due to inflows from shifting cash from short-term funds to the endowment and royalty payments, Bachher said. The investment losses were driven by poor returns from public equity fund managers and hedge funds, he said.

Market volatility was due to “central bank actions, slow-to-no growth worldwide, the oversupply of oil on a worldwide basis resulting in prices collapsing and the unexpected Brexit vote,” John Lane, chief investment officer at Ohio State’s endowment, said in an e-mail.

Virginia’s best-performing strategies -- private real estate and domestic buyouts -- couldn’t offset losses in its public and growth equity sectors and its resources portfolio, the school said. The fiscal 2016 investment loss follows gains of 7.7 percent and 19 percent in the previous two years, showing how even the best-performing funds are saddled with a new reality of low returns.

The University of Virginia Investment Management Co. is committed to its long-term philosophy, Lawrence Kochard, the chief investment officer, wrote in a report.

‘Significant’ Impact

“We expect a wide variety of investment challenges going forward and believe macro-level factors will continue to have a significant impact on markets,” Kochard wrote.

Kochard said the school is finding “pockets of opportunity” in areas such as non-U.S. equities.

“We also continue to observe an investment community fixated on global macro risks -- including a slowing Chinese economy, the implications of Brexit, the U.S. presidential election and central bank policies -- which provides a good environment in which our global public managers can identify mispriced securities,” Kochard wrote.

The fund has made changes to its asset allocation over time, according to the report. Public equities were increased in fiscal 2016 to 24.6 percent from 20.5 percent in 2012; and marketable alternatives and credit went to 14 percent from 9.3 percent. The management company decreased its allocation to resources to 4.5 percent from 7 percent, and real estate to 6.6 percent from 8.6 percent.

Despite the investment loss, the value of the long-term pool increased to $7.6 billion from $7.5 billion because of contributions in excess of distributions and investment losses.

Global Equities

Ohio State’s biggest loss came from its global equities portfolio. The state’s flagship public school’s 7.2 percent loss in the allocation dragged down a 10.8 percent gain in real assets, according to the school.

The University of Washington’s fund lost 1.6 percent. The drop was led by declines in its “capital appreciation” bucket, which includes a 20 percent asset allocation to emerging markets equity; 38 percent in stocks of developed markets; and 12 percent in private equity, according to the school.

The University of North Carolina at Chapel Hill’s endowment posted a 2 percent decline. The University of Iowa endowment’s investments fell 1.8 percent in fiscal 2016, with global equities leading the decline. The investment loss reflects the portion of the endowment managed by the foundation.

The University of Colorado’s investment fund, which is managed by Perella Weinberg Partners, lost 2.6 percent, according to the school. The value declined to $1.06 billion from $1.09 billion a year ago. About 43 percent of the fund’s holdings are in private capital, real assets and hedge funds, with 6 percent in cash and fixed income, according to a report.

While the annual returns were hurt by Brexit at the end of June, the fund was up almost 3 percent in July, Mike Pritchard, vice president and chief financial officer of the University of Colorado Foundation, said in an interview.

“This is a time for all universities to consider what does the future look like,” Pritchard said. “Endowments are long term. You want to meet the short-term needs -- scholarships, professorship chairs -- and you also want to sustain the long-term spending power. That’s the balance were all looking at right now.”

http://www.bloomberg.com/news/articles/2016-09-12/seven-college-endowments-report-annual-losses-in-choppy-markets