Bitcoin and other cryptocurrencies flash-crashed Saturday night, one day after the US Commodity Future Trading Commission (CFTC) sent subpoenas four cryptocurrency exchanges in an ongoing probe into bitcoin manipulation that began in late July - following the launch of bitcoin futures on the CME, according to the

Wall Street Journal.

CME’s bitcoin futures derive their final value from prices at four bitcoin exchanges: Bitstamp, Coinbase, itBit and Kraken. Manipulative trading in those markets could skew the price of bitcoin futures that the government directly regulates.

In delay reaction, Bitcoin fell as much as

$433 or 5.6% in Saturday night trading, with some noting that the flash crash happened shortly after a 90th ranked crypto exchange, Coinrail, had suffered a "

cyber intrusion", and was likely the more relevant catalyst for the crypto price drop.

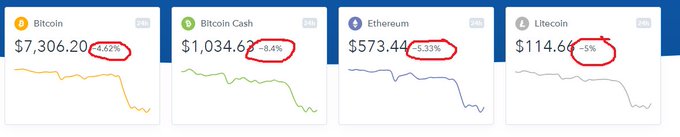

While major Cryptocurrencies were down from 4.5 - 5.5%, Bitcoin Cash dropped over 8.4%.

The CTFC subpoenas were issued after several of the exchanges refused to voluntarily share trading data with the CME after being asked last December. Of note, the CFTC regulates the CTC.

According

to the WSJ, the CME, which launched bitcoin futures in December, asked the four exchanges to share reams of trading data after its first contract settled in January, people familiar with the matter said.

But several of the exchanges declined to comply, arguing the request was intrusive. The exchanges ultimately provided some data, but only after CME limited its request to a few hours of activity, instead of a full day, and restricted to a few market participants, the people added.

What is curious, is that if there was indeed manipulation since the launch of bitcoin futures, it was to the downside, as the price of cryptos peaked around the time the crypto futures were launched, and are down well over 50% in the 6 months since.

Coinbase in particular has been under the watch government regulators.

On February 23, Coinbase sent an official notice to around 13,000 customers

to notify them they were legally required to turn over their information to the IRS.

The IRS had

initially asked Coinbase in July 2017 to hand over even more detailed information on

every one of its then over 500,000 users in an attempt catch those cheating on their taxes. However, another court order in Nov. 2017

reduced this number to around 14,000 “high-transacting” users, which the platform now reports as 13,000, in what Coinbase calls a “partial, but still significant, victory for Coinbase and its customers.”

Coinbase told the around 13,000 affected customers that the company would be

providing their taxpayer ID, name, birth date, address, and historical transaction records from 2013-2015 to the IRS within 21 days. Coinbase’s letter to these customers

encourages them “to seek legal advice from an attorney promptly” if they have any questions. Their website also states that concerns may also be addressed on Coinbase’s

Taxes FAQ. The ongoing legal battle between Coinbase and the US government dates back to

November, 2016, when the IRS filed a “John Doe summons” in the United States District Court for the Northern District of California.

And in April, former New York Attorney General, Eric "

we could rarely have sex without him beating me" Schneiderman, launched a probe of 13 major cryptocurrency exchanges according to the

Wall Street Journal - claiming that investors dealing in the fast-growing markets often don’t have the basic facts needed to protect themselves.

Former AG Schneiderman’s office said the program, called Virtual Markets Integrity Initiative, is part of its responsibility to protect consumers and ensure the integrity of financial markets, and its goal is to ensure that investors can have a better understanding of the risks and protections afforded them on these sites.

CFTC Commissioner: Crypto is a "modern miracle"

While the CFTC, IRS and New York Attorney General's office are all cracking down on cryptocurrency exchanges,

it seems to all be part of the government's embrace of virtual currencies. Last week CFTC Commissioner Rostin Benham

called cryptocurrencies a "modern miracle" at the

Blockchain For Impact Summit held at the UN in New York last week.

But virtual currencies may – will – become part of the economic practices of any country, anywhere. Let me repeat that: these currencies are not going away and they will proliferate to every economy and every part of the planet. Some places, small economies, may become dependent on virtual assets for survival. And, these currencies will be outside traditional monetary intermediaries, like government, banks, investors, ministries, or international organizations.

We are witnessing a technological revolution. Perhaps we are witnessing a modern miracle. -Rostin Benham

Rostin hinted at the upcoming legal action against the exchanges during his speech:

Under the CEA and Commission regulations and related guidance, exchanges have the responsibility to ensure that their Bitcoin futures products and their cash-settlement process are not readily susceptible to manipulation and the entity has sufficient capital to protect itself. The CFTC has the authority to ensure compliance. In addition, the CFTC has legal authority over virtual currency derivatives in support of anti-fraud and manipulation including enforcement authority in the underlying markets.

Meanwhile, the official Bitcoin website removed references to Coinbase, Blockchain.com and Bitpay, according to

Crypto News - only one of which, Coinbase, was subpoenaed.

The CFTC officially recognized bitcoin as a commodity in September of 2015 when it went after Coinflip for operating a platform for trading bitcoin options without the proper authorization.

Since the agency effectively asserted its dominance over the bitcoin market with that decision, this is the first time it has given its blessing to an bitcoin options trading platform. Expect a burst of institutional trading activity to follow -

especially since they approved institutional options trading in July.