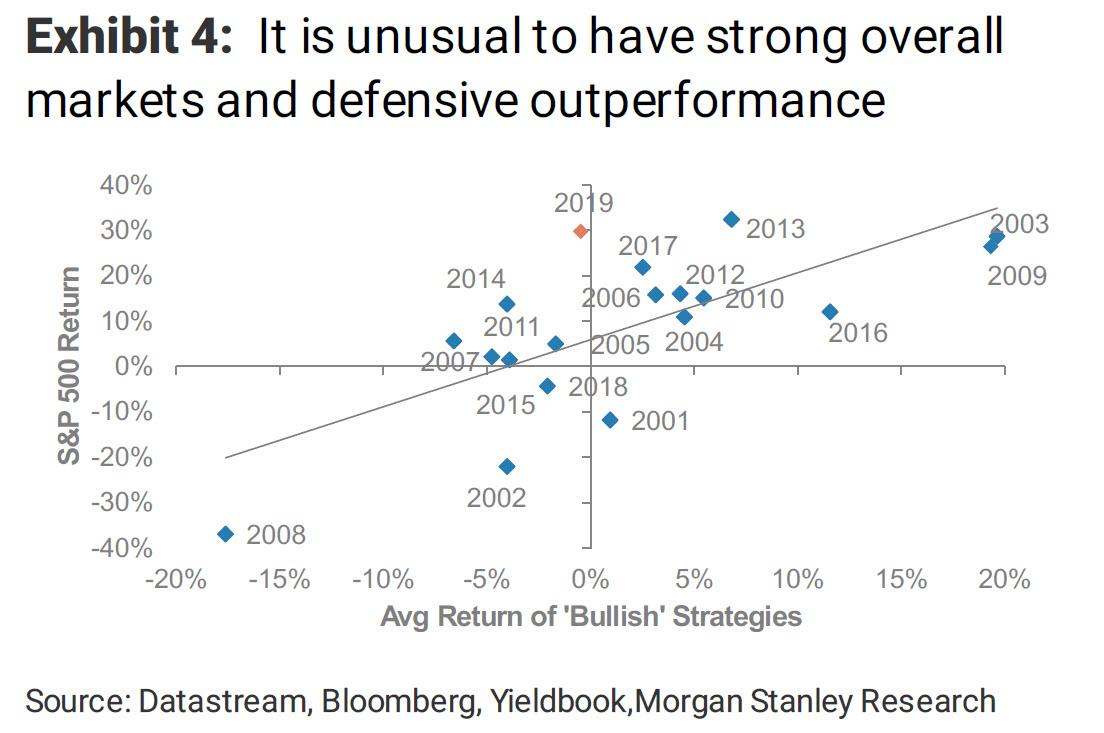

Two weeks ago, when looking back at 2019, Morgan Stanley concluded that the observed market action was indicative of one of the most bizarre years ever, because while the S&P ended up returning a whopping 29% in 2019, just shy of 2013's 29.3% and the second best year for the market since 1997, earnings actually dropped, which means that all the market upside came from multiple expansion. There was another bizarre aspect to 2019: it was a year when despite the blockbuster overall return of the S&P, "bullish" strategies actually underperformed.

Now, in his year in review weekly, Goldman's David Kostin makes some observations of his own, and reaches a similar conclusion to that from Morgan Stanley.

For one the S&P 500, which soared started in early October, just around the time the Fed launched QE4, reached 35 new all-time highs last year, with 20 of those days coming in the last two months. US equities also bested other major global markets, outperforming Japan (15%), Europe (23%), and emerging markets (15%).

So far so good, yet what is more notable is how the market reached its impressive returns, and here Goldman confirms what we already knew, namely that valuation expansion drove nearly all of the S&P 500 return in 2019. To wit, according to Goldman earnings growth explains just 8% of the S&P 500 return last year (others disagree, and Morgan Stanley for example observes that earnings were actually negative in 2019 meaning earnings growth subtracted from total returns). Instead, as Kostin notes, "three 25 bp Fed cuts helped lift company valuations. The S&P 500 forward P/E expanded from 14x to 19x and accounted for 92% of the index price gain."

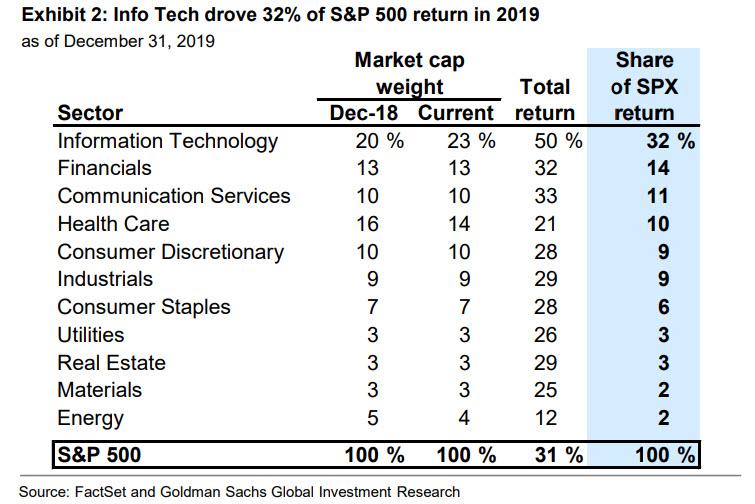

But while it was largely known that the entire market gain was on the back of multiple expansion (and record buybacks), where things get far more interesting is the sectoral composition of the upside: here as Goldman notes, just one sector, Information Technology, posted a 50% total return and accounted for 32% of the S&P 500 index return. Financials contributed 14% to the index return, followed by Communication Services at 11%.

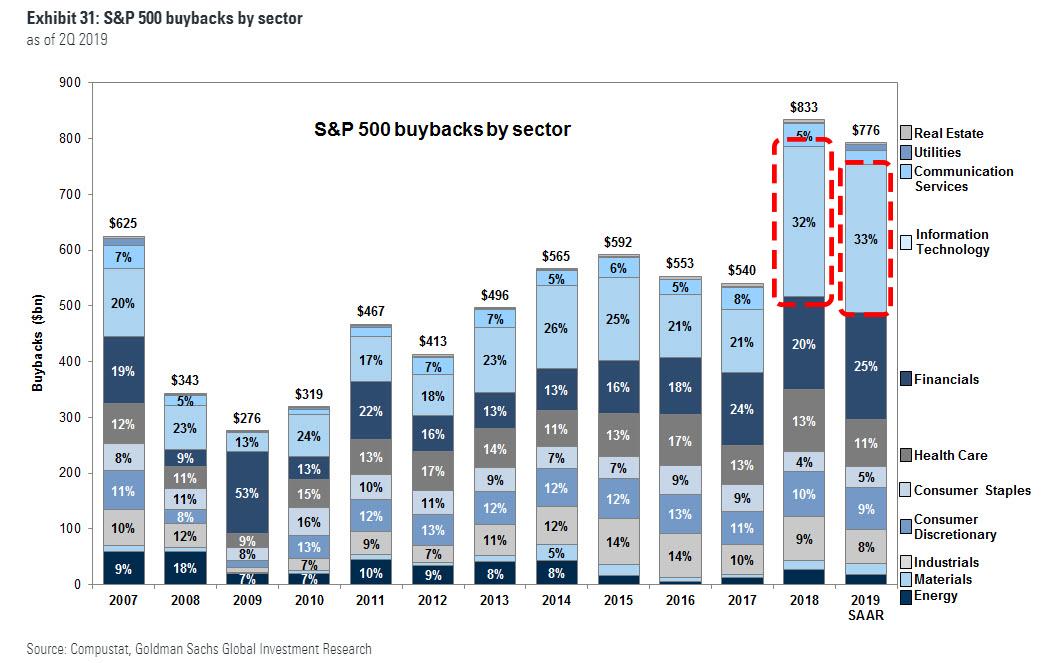

As a reminder, we also know who the source of stock buying was for most of 2019: companies themselves, which in 2018 and 2019 unleashed a record buyback spree, with IT, until recently sporting the most debt flexibility, buying back the most stock of any market sector funded with a tidal wave of debt issuance.

Away from tech, while all sectors posted positive double-digit returns, Energy fared the worst (+12%) due to weak earnings and volatile oil prices, although spot Brent rose by 23% during the year.

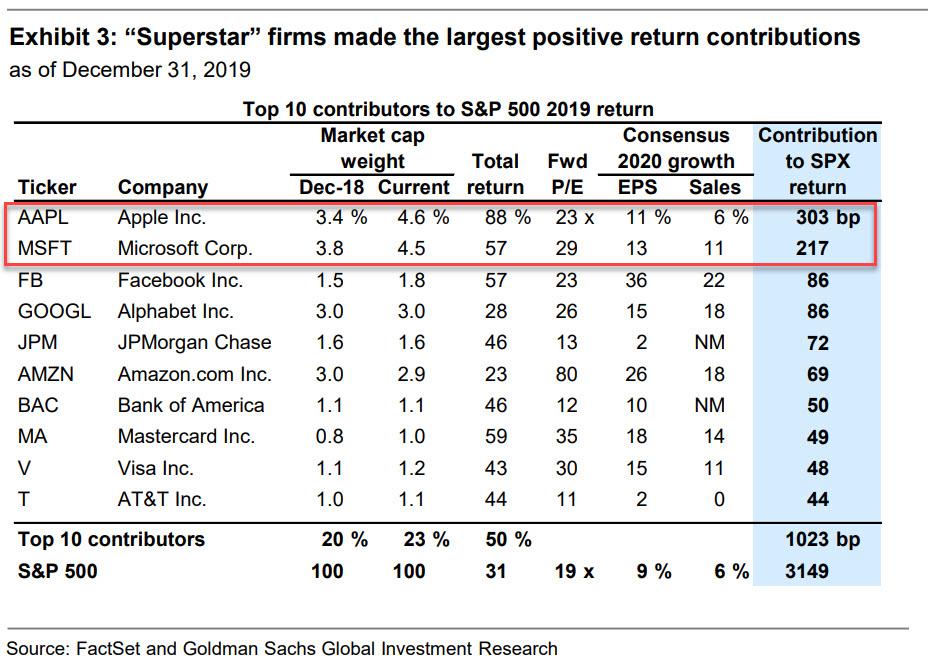

But what is most remarkable is just how skewed the market has become in representing the moves of just a handful of what Goldman calls large-cap “superstar” firms, which powered most of the S&P 500 return. While three Semiconductor companies – AMD (+148%), LCRX (+119%), and KLAC (+104%) – were the best-performing S&P 500 stocks, "superstar" firms AAPL (+89%) and MSFT (+58%) were the top two contributors to the S&P 500 index gain. In fact, combined the two firms accounted for nearly a fifth of the entire S&P 500 return, or 17% to be exact, in 2019. Extending that list, just the top 10 companies contributed over 10%, or exactly a third, of the S&P's total 31% return.

Not all superstars soared: regulatory scrutiny and slowing growth weighed on other superstar firms, although it's funny that Goldman says that GOOGL, which was up +28% and AMZN, up+23%, "lagged the index." Because up 28% is just so disappointing. At the opposite end of the spectrum, ABIOMED (-48%), Macy’s (-38%), and Occidental Petroleum (-28%) were the worst performing S&P 500 constituents last year.

What else? Well, as Kostin writes, "the 10th anniversary of the bull market has drawn parallels to the late 1990s."

Indeed, as discussed extensively here previously, in 1998, the Fed delivered 75 bp of “insurance cuts” and the S&P 500 rallied by 27%. And just like now, valuations exploded - from 18x to 23x - and accounted for nearly all of the index return. Furthermore, amid global economic turmoil - also just like now - investors flocked to US stocks. Back then, Russia defaulted on its sovereign debt and the hedge fund LTCM collapsed, as Treasury yields fell from 5.8% to 4.7%. And yes, just like now, Info Tech was also the best-performing sector (+77%) and accounted for 35% of index return.

Indeed, as discussed extensively here previously, in 1998, the Fed delivered 75 bp of “insurance cuts” and the S&P 500 rallied by 27%. And just like now, valuations exploded - from 18x to 23x - and accounted for nearly all of the index return. Furthermore, amid global economic turmoil - also just like now - investors flocked to US stocks. Back then, Russia defaulted on its sovereign debt and the hedge fund LTCM collapsed, as Treasury yields fell from 5.8% to 4.7%. And yes, just like now, Info Tech was also the best-performing sector (+77%) and accounted for 35% of index return.

Looking ahead, Goldman writes that "given the parallels between 1998 and 2019, many investors are looking to history as a potential guide for the future." Specifically, in 1999, the S&P 500 rallied by 20%, a number which Goldman thinks may actually be conservative because unlike late 1990’s, the current forward P/E of 19x is well below the 23x P/E at the start of 1999. Relative to interest rates, the current earnings yield of 5.3% is 341 bp above the 10-year yield of 1.9%. At the start of 1999, the earnings yield of 4.4% was 26 bp below the Treasury yield of 4.7%.

In short, Goldman expects at least another year of superstar returns before the late 1990s comp ends... and everyone remembers what happened in 2000.

What may catalyze the second tech bubble bursting? Perhaps it will be the key political event of 2020 - the November presidential elections. As Goldman concludes, "looking ahead to 2020, politics will be the key focus for investors."

Following the recent rally, we expect S&P 500 will hover around 3250 until November. Prediction markets currently imply that a divided government is the most likely election outcome. Democrats are expected to maintain control of the House (71%), and are slight favorites to win the presidency (52% probability), but appear unlikely to regain control of the Senate (30% likelihood). A divided government would limit the prospect that legislation is passed reversing the 2017 corporate tax cut."

And while Goldman expects the election to resolve policy uncertainty and lift S&P 500 by 5% to 3400 by year end, should there be a surprise and Democrats succeed in sweeping Washington, and eventually reversing the Trump tax cuts, under a higher corporate tax rate regime, 2021 estimated EPS would equal $162 (v. Goldman's baseline estimate of $183), the P/E would compress to 16x, and S&P 500 would end at 2600.

Of course, now that Trump knows just how to manipulate the market, stocks may soon explode higher as the president dangles "optimism" over a Phase 2 deal, which may potentially push the S&P as high as 3,600 - 4,000 by the election, before the Fed finally admits it has blown the world's biggest ever asset bubble and everything comes crashing down. The only question is whether Powell will follow the advice of Bill Dudley and burst the bubble before the election, or does so just after.