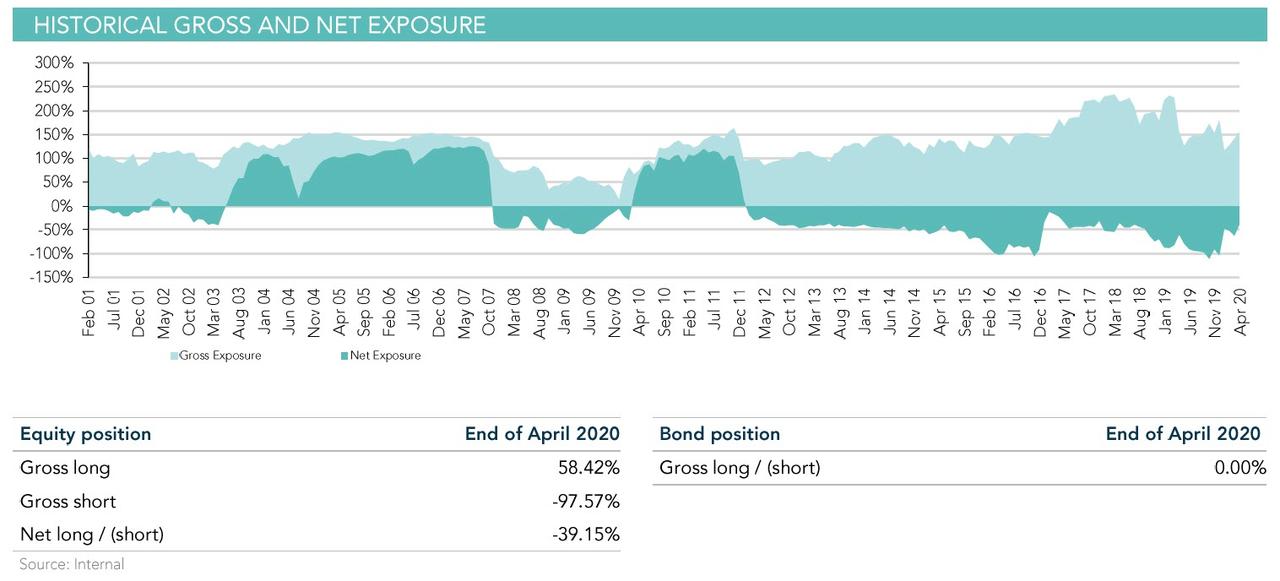

There are two notable highlights in the latest note from the CIO of Horseman Global, Russell Clark, the man we dubbed years ago as the "world's most bearish hedge fund manager" (a name that appears to have stuck) due to his penchant to run a net short book for the past 8 years (see chart below).

The first is that in the same vein as Paul Tudor Jones, Clark - who reports that in April his hedge fund was down 7.1% bringing the YTD gain to 18% - is rotating out of deflation and into inflation: "The conditions for both good and bad inflation are now in place." This may explain why Clark has pushed up the net short position of his hedge fund from -100% as recently as late 2019 to just -39.15%, the lowest in a year and a half.

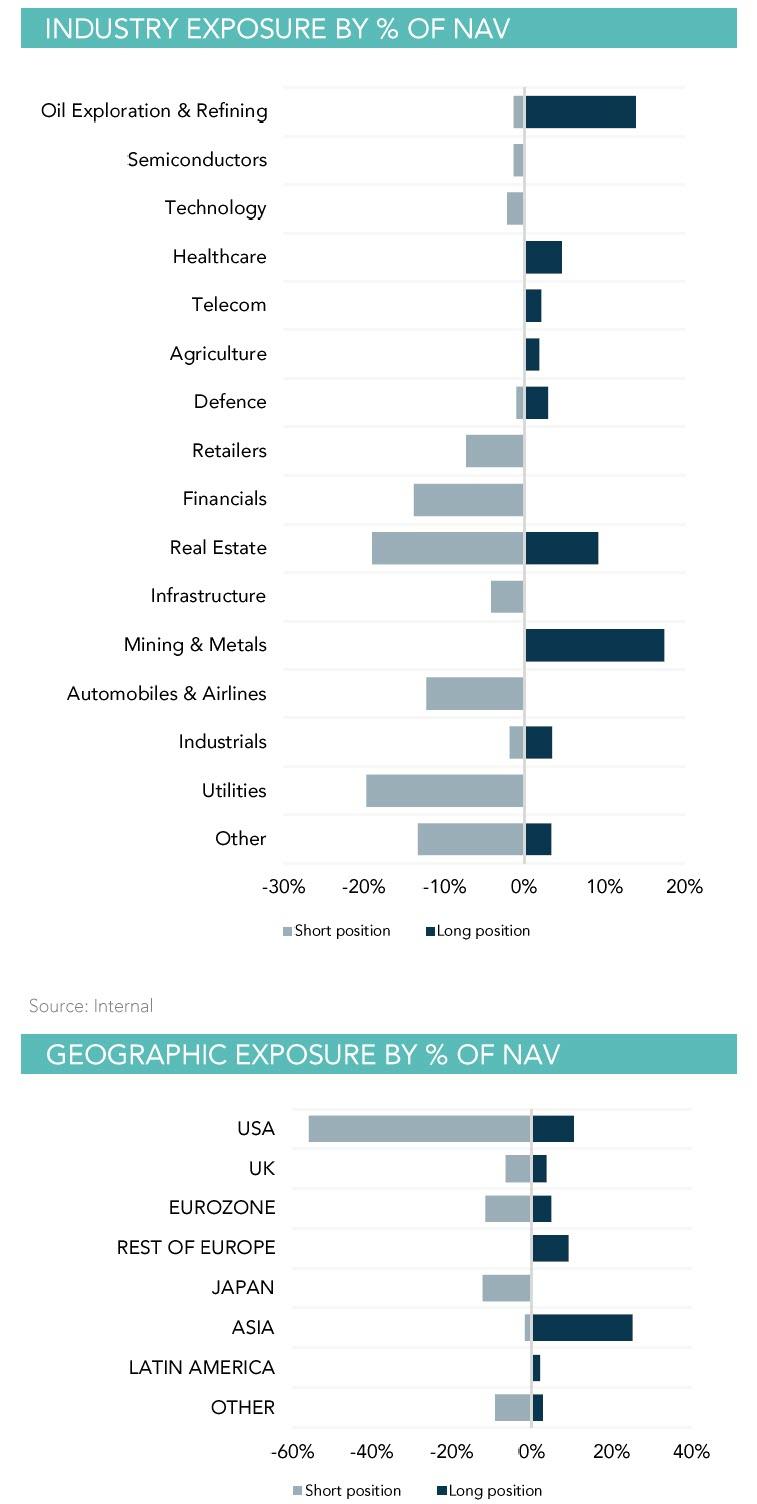

It also explains why Horseman has turned decidedly bullish on beaten down "value" sectors such as oil exploration and mining & metals, while boosting his short in rate-sensitive sectors such as real estate and utilities. And while still expecting pain for US stocks, Clark is now very bullish on China and Russia.

... with Chinese and Russian companies making up most of his top 10 positions.

As Clark summarizes it:

So what are we doing? We are shorting winners, and buying losers. China and Russia — buyers. US — sellers. LNG and Cement - buyers. Civil aviation, Utilities and Private Equity — sellers. We still hate the US dollar — but we are now willing to shift into currencies other than Swiss Franc and Yen.

* * *

His second point - which we find notable for various reasons - is his explanation how and why central banks tend to interfere at just the right times to spoil his bearish trades:

The other question I get is about autocallables and clearinghouses. This trade was about to pay off in March, and the central banks bailed them out. Which is their prerogative. But I think the thing I take away from that is that Central Banks read Zerohedge too. If it's in Zerohedge, then they have already devised a plan to stop if from happening. The irony of life is that the existence of Zerohedge make Zerohedge's existence unnecessary, in some sort of strange financial existentialist conundrum.

Which probably begs the question: can Zerohedge's stay in existence longer than central banks can print money in their pursuit of confidence-inspiring fake markets?

The full April note to investors from Horseman is below:

Your fund lost 7.06% in April. Losses came mainly from the short book.Due to Covid-19, we had our first ever webcast in April. It was well received and a recording is available via our website. If I had to characterize the calls I got after the webcast, most of them were along the lines of, "Hey Russell, you sound like you expect inflation". And I guess I do.Many, many years ago, from 2009 to 2010 I tried to fight the inflation story that the market was pricing, as it made no sense to me. Commodity prices were high, supply was coming on line, the US dollar was weak and likely to strengthen, and China was heading for a downturn. It made the years from 2009 to 2011 very difficult for me, but eventually when the cycle turned, we were able to make good money. I remember I used to get a lot of hostility to the deflation views back as late as 2014. But that was then, and this is now.All the reasons that made me believe in deflation for nearly 10 years, do not really exist anymore. China looks okay to me, and potentially very good. Commodity supply is getting cut at a rate I have never seen before. The US dollar is strong but will likely weaken from here. And it is clear to me Western governments will only ever attempt fiscal austerity as a last resort, not a first. The conditions for both good and bad inflation are now in place. When I look at markets, they are pricing in deflation as far as the eye can see. 10 year UK gilts at 0.2%? That will be a hard NO from me!The problem for markets is that deflationary trades dominate everything. If you believe in deflation, you hate banks and love private equity. If you think we are on the cusp of depression, then you love gold and hate copper. If you think commodity prices will be weak forever, then you hate Aussie dollar and love Yen. In equities you will pay up for secular growth (10 times sales? Bargain!) and hate old economy stocks (0.3 times book for stocks like Gazprom — not cheap enough!)."But Russell," I hear you say, "we have so much debt, and China has debt too, and demographics all say deflation". Yes, true now, and true 10 years ago. But as I pointed out in my webcast, data from ASEAN has been strangely good recently, and makes me wonder if China's Belt Road Initiative is starting to bear fruit. Is it possible, that by investing heavily in its near neighbors China has managed to create export markets for itself? Given that it successfully penetrated western markets, and has had good success in building infrastructure at home, it certainly seems possible to me. If my analysis is correct, then in one or two years time every investment bank will be talking about the opportunity of approx., 3.5bn people industrializing (China 1.4bn, India, 1.4bn, Indonesia 0.25bn, Pakistan 0.2bn, Bangladesh 0.15bn, Vietnam 0.lbn, rest of MEAN 0.3bn).The risk of buying 10 year gilts here versus, say a Gazprom, well it goes without saying which one looks better. But the funny thing is that, most people are now committed to investment strategies that require yields to stay low. Can Private Equity make money in a rising rate environment? Almost certainly not! What happens to equities with rising rates, and the month end rebalance to sell equities to buy bonds? If you started getting a decent yield on bonds, would you pay 10 times sales for a loss-making tech stock? I doubt it...The other question I get is about autocallables and clearinghouses. This trade was about to pay off in March, and the central banks bailed them out. Which is their prerogative. But I think the thing I take away from that is that Central Banks read Zerohedge too. If it's in Zerohedge, then they have already devised a plan to stop if from happening. The irony of life is that the existence of Zerohedge make Zerohedge's existence unnecessary, in some sort of strange financial existentialist conundrum.So what are we doing? We are shorting winners, and buying losers. China and Russia — buyers. US — sellers. LNG and Cement - buyers. Civil aviation, Utilities and Private Equity — sellers. We still hate the US dollar — but we are now willing to shift into currencies other than Swiss Franc and Yen. Given the unknowns of coronavirus, and other things, we are still net short. But the changing composition of the short book and long book means we have much less downside risk should economies normalise more quickly. In fact, if commodity prices move higher, and bond yields rise, the fund could do well. I think it would be a stretch to say we are long inflation — but I am definitely short deflation, which makes an awful lot of sense to me!

We wish Horseman Global - whose AUM is now down to just $130MM from $373MM a year ago - the best of luck in trying to outthink what Bank of America last week called a "fake market" in which "government and corporate bond prices have been fixed by central banks" so "why would anyone expect stocks to price rationally?"