By Natalie Winters of The National Pulse

A host of corporate media outlets including CNN, The New York Times, The Washington Post, and MSNBC have participated in private dinners and sponsored trips with the China-United States Exchange Foundation, a Chinese Communist Party-funded group seeking to garner “favorable coverage” and “disseminate positive messages” regarding China, The National Pulse can reveal.

Other outlets involved in the propaganda operation include Forbes, the Financial Times, Newsweek, Bloomberg, Reuters, ABC News, the Economist, the Wall Street Journal, AFP, TIME magazine, LA Times, The Hill, BBC, and The Atlantic.

The relationship is revealed in the Department of Justice’s Foreign Agent Registration Act (FARA) filings, which reveal a relationship spanning over a decade between establishment media outlets and the China–United States Exchange Foundation (CUSEF).

‘Neutralize Opposition.’

CUSEF is a Chinese Communist Party-funded initiative founded by Tung Chee Hwa. The group also targets American universities with offers to fund policy research, high-level dialogues, and exchange programs.

Tung also serves as Vice-Chairman of the Chinese People’s Political Consultative Conference (CPPCC), identified by the U.S.-China Security and Economic Review Commission as a key component of the Chinese Communist Party’s United Work Front.

The effort, according to the U.S. government report, aims to “to co-opt and neutralize sources of potential opposition to the policies and authority of its ruling Chinese Communist Party.”

“The United Front strategy uses a range of methods to influence overseas Chinese communities, foreign governments, and other actors to take actions or adopt positions supportive of Beijing’s preferred policies,” it continues.

This strategy appears to have been deployed in conjunction with outlets such as CNN, New York Times, and the Washington Post.

Targeting Reporters, Journalism Students.

A 2011 FARA filing highlighted by Axios detailed CUSEF’s agreement with American lobbying firm BLJ. It outlines how CUSEF set out to “effectively disseminate positive messages to the media, key influencers and opinion leaders, and the general public” regarding China.

To do so, CUSEF targeted working journalists and journalist students:

In order to develop favorable coverage in key national media, BLJ will continue to organize and staff “familiarization trips” to China. This includes recruiting top journalists to travel to China, selected for effectiveness and opportunities for favorable coverage.

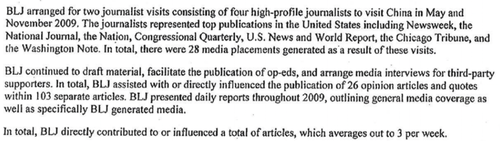

In 2009 alone, CUSEF generated 28 media placements as a result of its four journalist visits and BLJ secured “the publication of 26 opinion articles and quotes within 103 separate articles” on behalf of CUSEF.

Outlets included Newsweek, the National Journal, the Nation, Congressional Quarterly, U.S. News, World Report, The Chicago Tribune, and the Washington Note.

“BLJ directly contributed to or influenced” an average of three articles “per week.”

Guilty.

While universities, including the University of Texas at Austin, have divested from CUSEF in light of its Chinese Communist Party ties, the same cannot be said for dozens of Western media outlets.

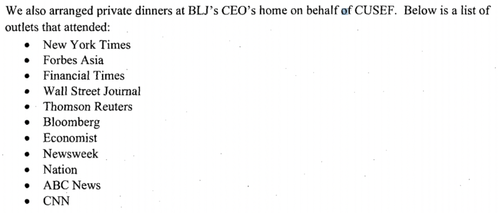

FARA filings from CUSEF’s American lobbying firm BLJ reveal American media organization participating in “private dinners at BLJ’s CEO’s home on behalf of CUSEF,” trips to China, and meetings with CUSEF officials.

A filing dated January 1st, 2012, show outlets including The New York Times, The Wall Street Journal, Reuters, CNN, and more participating in “private dinners” at the home of CUSEF’s American lobbying firm’s CEO.

The same filing reveals that outlets including National Public Radio (NPR), The Atlantic, MSNBC, and Reuters had journalists visit China to meet with CUSEF officials.

Since then, filings continue to reveal a host of Western outlets attending private dinners and visiting China. Most outlets are included more than once.

In 2013, The Washington Post joined a China-bound journalism delegation, in 2014 Harvard Business Review also joined a delegation, and in 2015, the Los Angeles Times and The Huffington Post also visited the communist country.

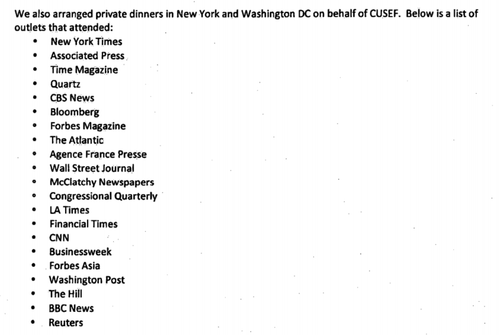

A 2014 filing reveals that lobbying firm BLJ “arranged private dinners in New York and Washington DC on behalf of CUSEF” with over 20 attendees including The New York Times, The Washington Post, Reuters, Associated Press, BBC, and more:

Images in CUSEF brochures shed light on the entities visited by journalists.

Between 2011 and 2013 images reveal journalist touring Huawei – a telecommunications firm labeled a “national security threat” and military collaborator by the U.S. government – along with Chinese military bases:

Results.

Following the ongoing pressure campaigns, CUSEF has escaped significant criticism in the corporate press. There have only been a few mentions in broader pieces concerning Chinese Communist Party influence operations on American college campuses.

Such behavior from news outlets implies a conflict of interest, or worse: that the ostensible news outlets have been bought off.

Even when CUSEF is criticized, such as in The Washington Post article “China’s reach into U.S. campuses,” CUSEF’s Executive Director Alan Wong was offered a rebuttal: something that even Americans on the political right fail to obtain from outlets such as the Post.

Vox, another outlet participating in CUSEF’s journalism trips, prefaced an article on President Trump and North Korea by noting author Yochi Dreazen “wrote it while on a trip to China sponsored by the China-United States Exchange Foundation (CUSEF)”:

The author of this article wrote it while on a trip to China sponsored by the China-United States Exchange Foundation (CUSEF), a privately funded nonprofit organization based in Hong Kong that is dedicated to “facilitating open and constructive exchange among policy-makers, business leaders, academics, think-tanks, cultural figures, and educators from the United States and China.” Vox.com’s reporting, as always, is independent.

The article, which featured quotes from Chinese Communist Party officials, appeared to regurgitate the party line, noting “Beijing won big.”

As Foreign Policy magazine noted, to its credit, CUSEF is scarcely a privately funded non profit but rather is “a registered foreign agent bankrolled by a high-ranking Chinese government official with close ties to a sprawling Chinese Communist Party apparatus that handles influence operations abroad.”