With such a spectacular source of impeccably timed, if always wrong, FX trading recommendations as Tom Stolper, who has cost his muppets clients tens of thousands of pips in currency losses in the past 5 years, and thus generated the inverse amount in profits for Goldman's trading desks, the last thing we expected to learn was that Goldman's currency traders, who by definition takes the opposite side of its Kermitted clients - because prop trading is now long forbidden, (right Volcker rule?) and any prop trading blow up in the aftermath of the London Whale fiasco is not only a humiliation but probably illegal - had lost massive amounts on an FX trade gone wrong. Which is precisely what happened.

According to the WSJ, "a complex bet in the foreign-exchange market backfired on Goldman Sachs Group Inc. during the third quarter, people familiar with the matter said, contributing to a revenue slump that prompted senior executives to defend the firm's trading strategy. Revenue in Goldman's currency-trading business fell sharply in the third quarter from the second. Within that group, the firm's foreign-exchange options desk posted a net loss during the period, the people said." The trade in question: "A structured options trade tied to the U.S. dollar and Japanese yen steepened the decline, according to the people. It isn't clear how large the trade was or how long it was in place."

Curious: does this perhaps explain why just after Q3 ended, on October 3, Goldman's head FX strategist Tom Stolper came out with an FX trade in which Goldman "recommend going short $/JPY at current levels of about 97.30 for a tactical target of 94.00, with a stop on a close above 98.80." Obviously, we promptly took the inverse side: "The only question we have: will the length of time before Stolper is once again Stolpered out be measured in days, or hours?" Naturally, Stolper was stolpered stopped out in a few short days, leading to a few hundred pips in profits for those who faded Stolper... and yet we wonder: was Goldman merely trying to offload its USDJPY exposure gone wrong on its clients in the days after the "trade tied to the USD and the JPY steepened the decline"? If so, that would be even more illegal than Goldman pretending to be complying with the Volcker Rule.

As for the size of the total loss we had a hint that something had gone very wrong when we reported Goldman's Q3 earnings broken down by group. Back then we said "the only bright light were Investment banking revenues which were $1.7 billion, unchanged from a year ago, if down 25% from Q2. It's all downhill from here, because the all important Fixed Income, Currency and Commodities group printed just $1.247 billion, down a whopping 44% Y/Y, well below expectations." Indicatively, Goldman had made $2.5 billion in FICC the prior quarter, and $2.2 billion a year prior. Obviously something bad had happened.

We now know that that something was an FX trading crashing and burning in Goldman's face. Reuters added:

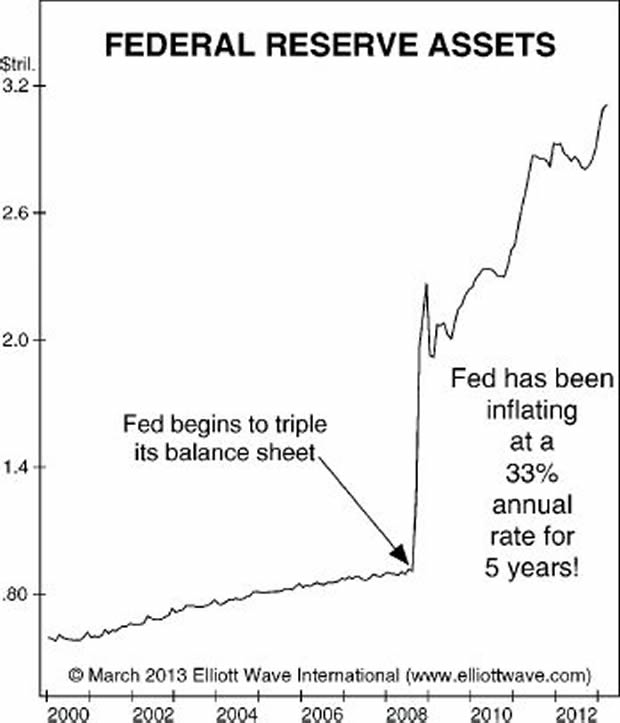

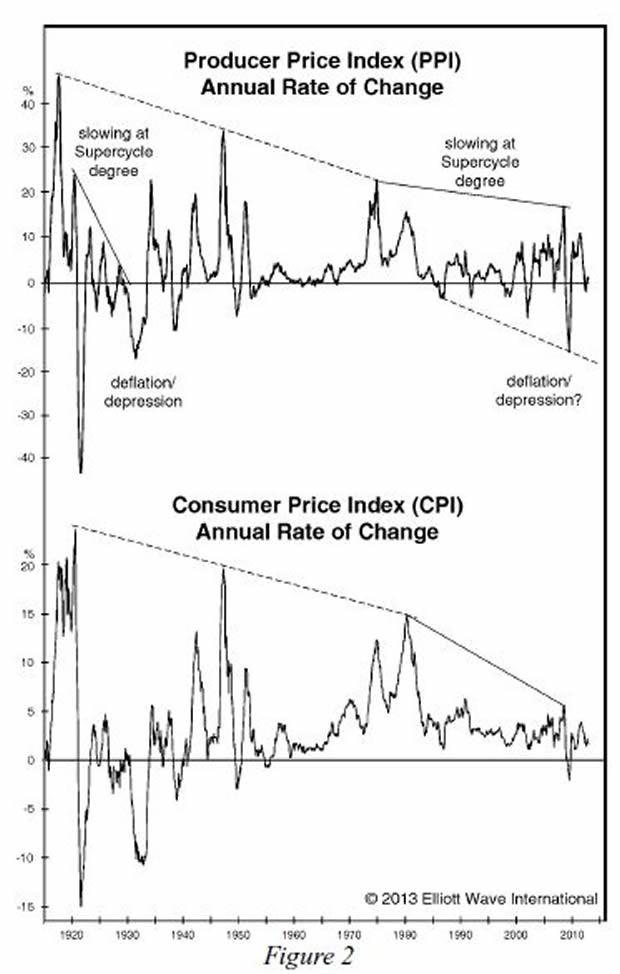

Goldman Sachs Group Inc lost more than $1 billion on currency trades during the third quarter, recent regulatory filings show, offering some insight into why the firm, considered one of Wall Street's most savvy traders, reported its worst quarter in a key trading unit since the financial crisis.Goldman's currency-trading problems came from the way the bank had positioned itself in emerging markets, two sources familiar with the matter said.Specific positions could not be learned, but the bank was anticipating that the Federal Reserve would begin winding down its monetary-easing programs, the sources said. When the Fed unexpectedly announced that it would keep its massive bond-buying program in place,Goldman was left with positions that, "absolutely got annihilated," as one person familiar with the matter put it.

Since as the WSJ first reported the position involved the USDJPY, which first spiked then plunged following the Fed's non-taper announcement, and kept sliding until it hit 96.50 in early October just when Stolper suggested putting on the short USDJPY trade (when USDJPY soared), it seems that at least this one time both Goldman's prop traders and the trade recommended by Stolper were on the same side.

Which resulted in a $1+ billion loss for Goldman.

Congratulations Tom: that in itself is worth ignoring that Goldman completely made a mockery out of any and all Volcker prop-trading prohibitions. In fact, keep it up and keep those trade recommendations coming.