We have been taking exception with the environmental, social and governance (ESG) con for the better part of the last few months, inconveniently pointing out that the funds that make "woke" investors feel warm and fuzzy on the inside are turning around and pouring their money into the very same corporate giants many investors likely think they are avoiding by investing in ESG funds.

But, since regulators haven't weighed in on use of the term "ESG", the con continues to roll on.

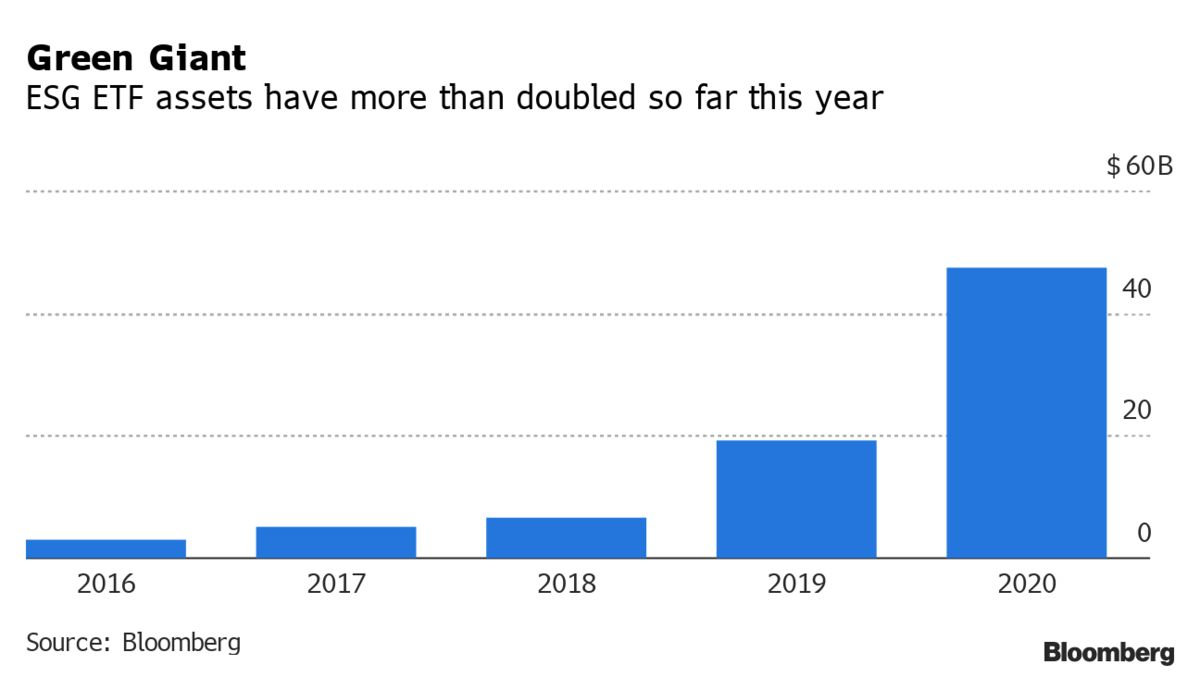

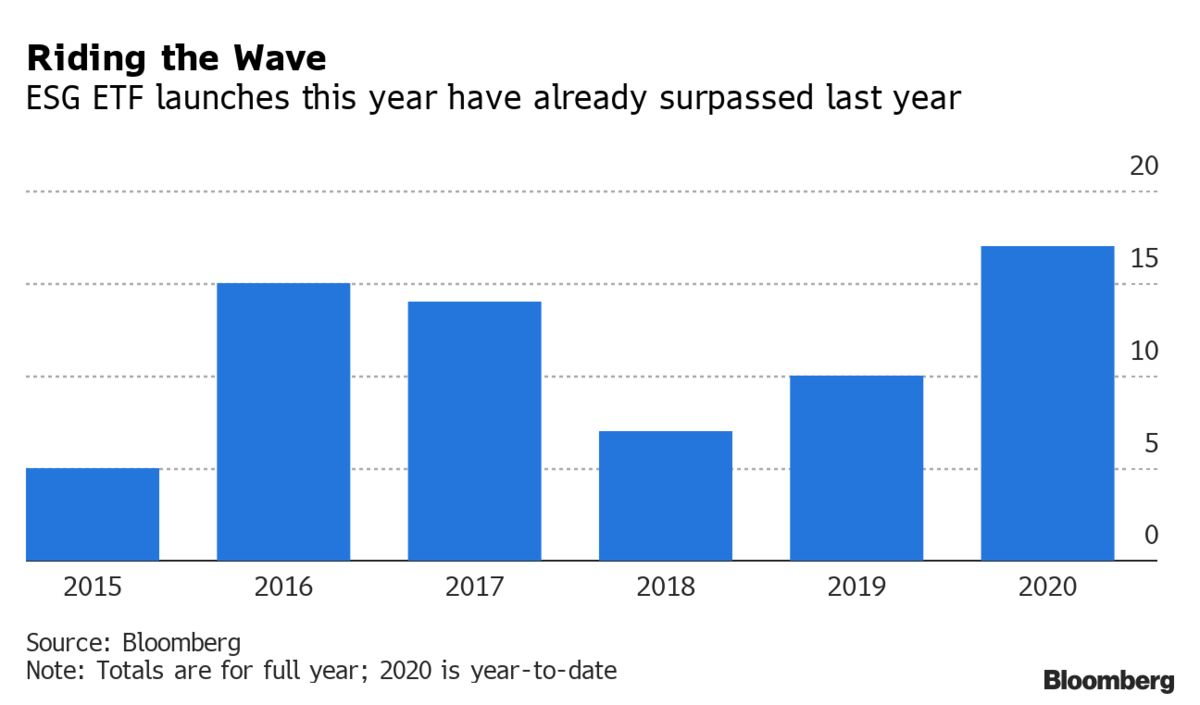

Inflows to ESG funds have skyrocketed to $22 billion in 2020 so far, which is about 3x the total inflows in 2019, according to Bloomberg. This is despite the fact that funds like BlackRock Inc.’s iShares ESG Aware MSCI USA ETF (ESGU) include names like Exxon and Chevron. In fact, its largest holdings are big tech companies under investigation for antitrust violations, Bloomberg notes.

Eric Balchunas, ETF analyst for Bloomberg Intelligence, said: “If you go in there thinking that you want to ‘woke’ up your portfolio, and you see those companies, you’re going to be like, ‘What? That’s not what I signed up for.’”

The ESGU, ESGE and ESGD make up $13.4 billion of those $22 billion. MSCI helps set inclusion and exclusion rules for the ETFs. The ESGU apparently tries to rule out "civilian firearms, controversial weapons, tobacco, thermal coal and oil sands" while Vanguard's ESGV steers clear of "adult entertainment, alcohol, tobacco, weapons, fossil fuels, gambling and nuclear power".

But the "social responsibility score" of other names included in many funds - even names like Amazon, who has been accused of poor work environment - can be easily challenged.

Ben Johnson, Morningstar’s global director of ETF research, said: “The preponderance of assets in ESG funds are in ESG light funds. The level of spiciness, if you will, goes from mild to medium to hot -- in terms of where the assets are right now, it’s all in pico de gallo.”

And until the SEC decides to weigh in with criteria on what constitutes an ESG fund, there is going to continue to be subjective differences in how ESG rating companies rate funds. One analyst for Bloomberg, who is developing an ESG rating service, said: “The question on everybody’s mind now revolves around green washing.”

Dylan Tanner, executive director of InfluenceMap, said: “Some of the data providers who rate companies on ESG tend to firstly rely on a company’s own disclosures and sustainability reports too much. How meaningful those numbers are, when you’re blending climate with labor, should be questioned.”

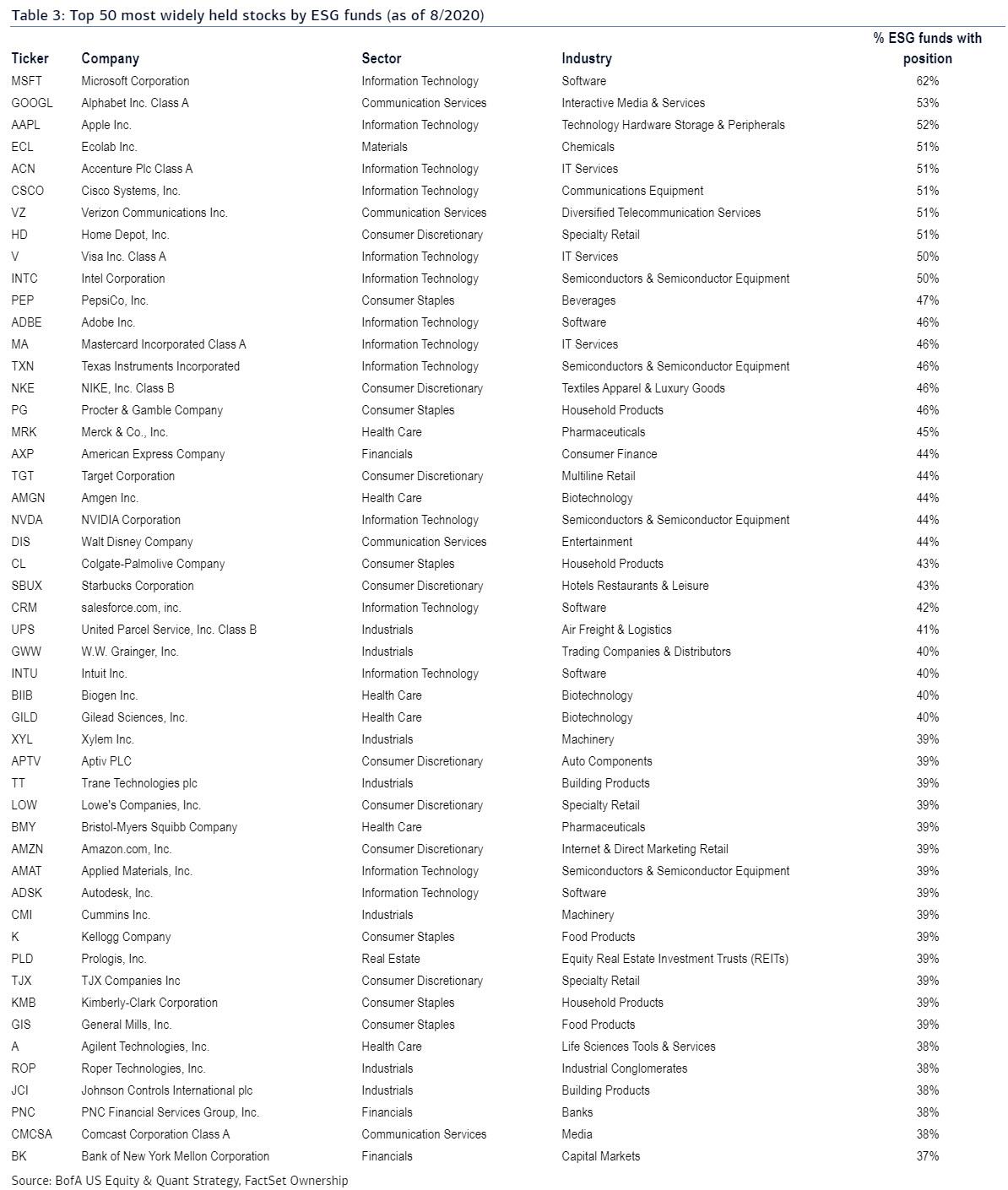

We documented back in September what some of the most popular ESG fund holdings were. The list included many of the same massive corporations one would find in the SPY or QQQ funds: Microsoft, Apple, Google, Cisco, Verizon, Nike, Pepsi and many other massive corporate conglomerates associated with all types of "socially responsible" behavior, including overseeing sweat shops and employing underpaid Foxconn workers who routinely hurl themselves off of the top of skyscrapers due to their work environment.

As we noted then, the ESG term is just a brilliant hook with which to attract the world's most gullible, bleeding-heart liberals and frankly everybody else into believing they are fixing the world by investing when instead they are just making Jeff Bezos richer beyond his wildest dreams.

Here is Bank of America's summary of the 50 most popular ESG funds. Try not to laugh:

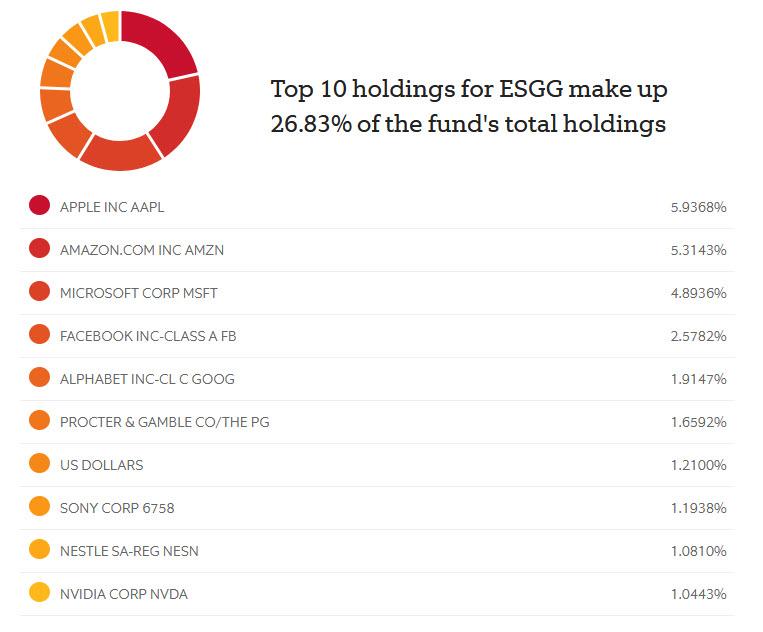

As confirmation here are the Top 10 Holdings of the purest ESG ETF available: the FlexShares ESGG fund. Below we present, without further commentary, its Top 10 holdings:

As we said in September:

Two centuries ago, PT Barnum said "there's a sucker born every minute."

Little did he know how appropriate that phrase would be more than a hundred years later to describe investors in the virtue-signaling craze that has taken over markets today.