China keeps telling the world to stop buying the yuan, and the world keeps refusing to listen.

Just over two weeks after Beijing made it easier to short the yuan after the PBOC cut the reserve requirement ratio for FX derivative sales from 20% to 0%, a move which was "an attempt to moderate the yuan's increase", and which Goldman said "likely signals the PBOC's discomfort with the recent rapid appreciation of CNY", yet which failed to lead to a sustainable drop in the yuan, On Tuesday China lobbed another shot across the bow of the increasingly strong yuan when a statement on website of China Foreign Exchange Trade System announced that some banks that contribute to the yuan’s daily reference rate have recently halted the use of the counter-cyclical factor (CCF).

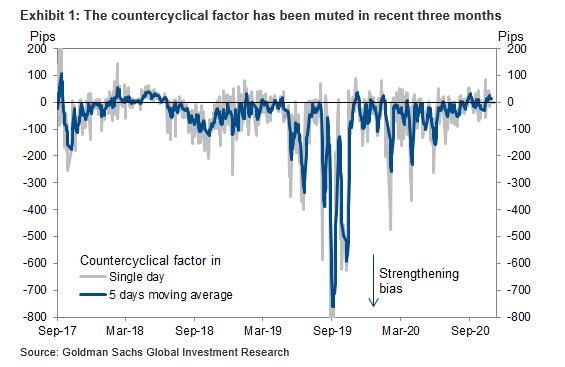

The confirmation followed a Reuters reports that the PBoC has asked banks to neutralize the counter-cyclical factor which is typically used when the currency is weakening at a pace that is uncomfortable for the central bank i.e. effectively removing it in the midpoint fixing. Under the reported tweak, lenders would have more room to submit quotes for a weaker fixing and guide the currency lower in the spot market, which is precisely Beijing's goal in light of the recent yuan appreciation. The move comes as Goldman writes that the "countercyclical factor has been muted recently" as a result of the recent strength in the Yuan.

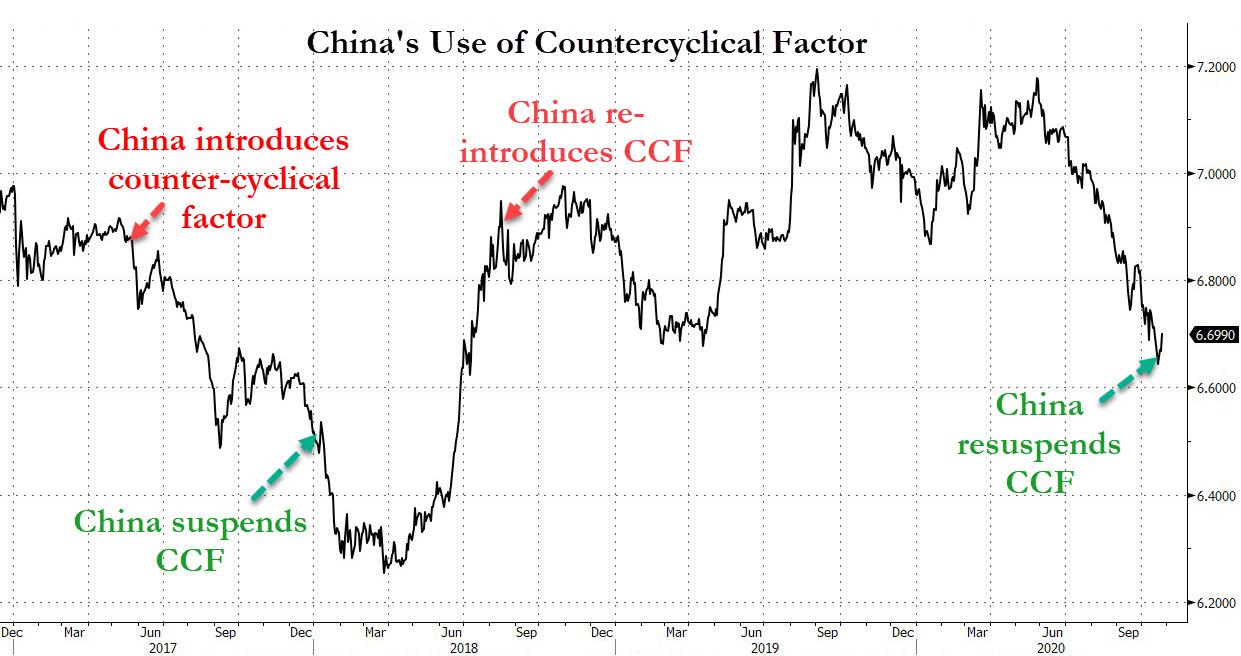

As a reminder, the counter-cyclical factor was introduced by the PBOC on May 26, 2017 to reduce exchange-rate volatility while undermining efforts to increase the role of market forces. At the time, the move was seen as Beijing "moving the goalposts" in its bid to reduce yuan volatility, to punish currency manipulators (read Yuan shorts) and limit capital outflows (the currency had weakened for three straight years, triggering draconian capital controls and the surge of bitcoin). The CCF was then suspended in January 2018 when the yuan surged, only to be reinstalled later that year when the Yuan slumped again.

And now the CCF has been re-suspended again.

According to Citi FX trader Charmaine Cheok this is "yet another signal from the central bank that they are loosening the reins on the currency and allowing for more flexibility. I reckon the reason the market is moving higher on spot now is merely a reflection of positioning, this announcement doesn't have any immediate impact on spot."

Other trading desks agreed, noting that this is in line with the policy direction to allow the FX to be more market driven and ties into the goal to promote RMB internationalization. Or at least allowing it to be market driven when it is strong, hoping the recent deflationary appreciation in the yuan will end.

In any case, now that China has confirmed the move, strategists expect higher volatility of the CNH/CNY given the CCF typically dampens stronger USD impact on fixing more than the appreciation side, even if the actual impact could be relatively limited.

While the market impact was muted indeed, the offshore yuan fell after the Reuters report, dropping as much as 0.34% to 6.7234 a dollar afterward. The currency has rallied 6.9% from a low in May and last week reached a two-year high.

And now that the PBOC has both cut reserves and re-suspended the CCF in hopes of weakening the yuan, and seemingly failed...

... the question everyone should be asking is what will China do now to further devalue its currency which continues to surge on the back of dollar weakness and China's "V-shaped recovery" One wonders: is China's economy about to suffer an "unexpected" sharp spike in covid cases to help the PBOC hammer the yuan?