Monday, December 3, 2012

Saturday, December 1, 2012

Friday, November 30, 2012

Probability Trailing Stop

Generic trailing stops maintain a steady pip distance between the most favorable price seen and the stop loss. One thing that I don't like about this is that trailing stops ignore the take profit. My goal was to increase the information available by using a trailing stop in the context of a take profit.

The only information needed for doing so is the ratio between the stop loss and take profit. If I use a 50 pip take profit and a ratio of 1, for example, then the stop loss is also 50 pips. If I used a ratio of 2, then the stop loss is 100 pips.

As the price moves closer to the take profit, the stop loss should maintain the same ratio over the remaining distance. The original take profit was 50 pips. Say that the price increased 20. Only 30 pips remain to hit the profit target. The probability trailing stop adjusts the stop loss to 30 pips from the current price if the ratio is 1. If the ratio was 2, then the stop would adjust to 30 * 2 = 60 pips. The idea was that perhaps the stop loss should ratchet closer to the take profit as it becomes increasingly likely to occur.

An easier way to think about where to set the stop is to ask, "How many pips are left until the trade hits its take profit?" If the answer is 40, then the stop loss adjusts to 40 pips away from the current price and not the entry. If the answer is 25, the stop loss changes to 25 pips from the current price. The stop loss adjusts faster and faster as a trade nears its take profit.

Changing the stop ratio to something like 0.5 makes it more complicated. If 40 pips remain before a trade reaches its limit, then the stop loss adjusts to 40 * 0.5 = 20 pips away. If 25 pips remain, then the stop ratchets to only 12.5 pips away.

All backtests were on M1 charts. The unit sizes of the trades don't matter much; I set the trade size to a standard lot on forex pairs and 1,000 shares for equities trades. All used a 50 tick take profit with an equidistant stop loss (the stop loss ratio was 1.0). The profit factors help keep the information consistent among the different instruments.

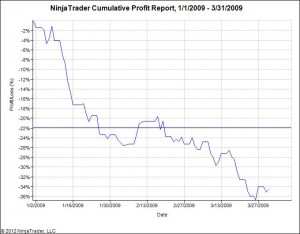

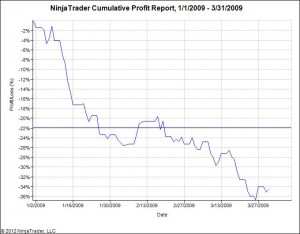

All of these backtests involve a minimum of 300 trades. The EURUSD backtest included more than 1,700 trades. The sample size for all tests are more than sufficient for drawing a conclusion. Using a probability stop with a ratio of 1.0 is a bad idea. Although the equity curves naturally varies among instruments - and would differ using new random numbers - the equity curve below shows what it generally looks like.

The equity curve for a probability trailing stop on Exxon (XOM) for Q1 2009.

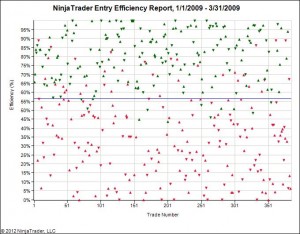

The entry efficiency of the system appears solid. However, that is because the worst possible exit always shifts up. The idea trades exit efficiency for a hint of entry efficiency. Knowing that the trades pick their direction using random numbers, it is not worthwhile to get excited about this seemingly non-random metric.

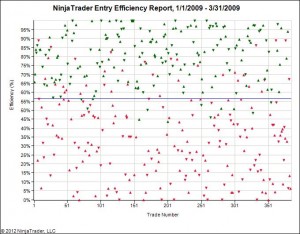

The entry efficiency consistently comes out near 55-60%. The above image shows the entry efficiency for trading Verizon (VZ).

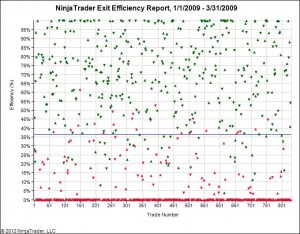

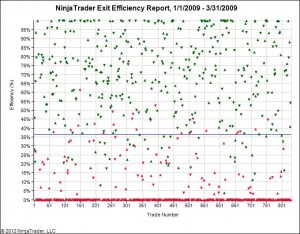

The losses have to come from somewhere. Clearly, as the image below demonstrates, it results from the terrible exit efficiency. Results typically ranged from 35-40%.

The exit efficiency for a probability trailing stop ranges from 35-40%. The above image is taken from trading McDonalds (MCD).

If you would like to test the concept for yourself, you can download the NinjaTrader export file by clicking Probability Trailing Stop. You need to email me for the random number file, which needs to be placed in the "C:\" directory. The code will not function without it. Although the tests for a stop ratio of 1.0 look terrible, all is not lost. I can flip this on its head and turn it into a profitable concept by blending it with the random trailing limit. Outcomes using a ratio of 3.0 also offer potential hope. We'll cover those outcomes in future blog posts.

The only information needed for doing so is the ratio between the stop loss and take profit. If I use a 50 pip take profit and a ratio of 1, for example, then the stop loss is also 50 pips. If I used a ratio of 2, then the stop loss is 100 pips.

As the price moves closer to the take profit, the stop loss should maintain the same ratio over the remaining distance. The original take profit was 50 pips. Say that the price increased 20. Only 30 pips remain to hit the profit target. The probability trailing stop adjusts the stop loss to 30 pips from the current price if the ratio is 1. If the ratio was 2, then the stop would adjust to 30 * 2 = 60 pips. The idea was that perhaps the stop loss should ratchet closer to the take profit as it becomes increasingly likely to occur.

An easier way to think about where to set the stop is to ask, "How many pips are left until the trade hits its take profit?" If the answer is 40, then the stop loss adjusts to 40 pips away from the current price and not the entry. If the answer is 25, the stop loss changes to 25 pips from the current price. The stop loss adjusts faster and faster as a trade nears its take profit.

Changing the stop ratio to something like 0.5 makes it more complicated. If 40 pips remain before a trade reaches its limit, then the stop loss adjusts to 40 * 0.5 = 20 pips away. If 25 pips remain, then the stop ratchets to only 12.5 pips away.

Test Results

I backtested the idea using a variety of forex pairs and DOW 30 stocks for the first quarter of 2009. The direction of a trade, whether long or short, was chosen using a random number. The date chosen was simply because I have M1 data for multiple instruments. The broad spectrum of results would reflect the same trend regardless of the time periods used.All backtests were on M1 charts. The unit sizes of the trades don't matter much; I set the trade size to a standard lot on forex pairs and 1,000 shares for equities trades. All used a 50 tick take profit with an equidistant stop loss (the stop loss ratio was 1.0). The profit factors help keep the information consistent among the different instruments.

| Instrument | Profit Factor |

|---|---|

| EURUSD | 0.96 |

| USDCAD | 0.88 |

| DIS | 0.91 |

| MSFT | 1.0 |

| WMT | 0.87 |

| XOM | 0.87 |

All of these backtests involve a minimum of 300 trades. The EURUSD backtest included more than 1,700 trades. The sample size for all tests are more than sufficient for drawing a conclusion. Using a probability stop with a ratio of 1.0 is a bad idea. Although the equity curves naturally varies among instruments - and would differ using new random numbers - the equity curve below shows what it generally looks like.

The equity curve for a probability trailing stop on Exxon (XOM) for Q1 2009.

The entry efficiency of the system appears solid. However, that is because the worst possible exit always shifts up. The idea trades exit efficiency for a hint of entry efficiency. Knowing that the trades pick their direction using random numbers, it is not worthwhile to get excited about this seemingly non-random metric.

The entry efficiency consistently comes out near 55-60%. The above image shows the entry efficiency for trading Verizon (VZ).

The losses have to come from somewhere. Clearly, as the image below demonstrates, it results from the terrible exit efficiency. Results typically ranged from 35-40%.

The exit efficiency for a probability trailing stop ranges from 35-40%. The above image is taken from trading McDonalds (MCD).

If you would like to test the concept for yourself, you can download the NinjaTrader export file by clicking Probability Trailing Stop. You need to email me for the random number file, which needs to be placed in the "C:\" directory. The code will not function without it. Although the tests for a stop ratio of 1.0 look terrible, all is not lost. I can flip this on its head and turn it into a profitable concept by blending it with the random trailing limit. Outcomes using a ratio of 3.0 also offer potential hope. We'll cover those outcomes in future blog posts.

Thursday, November 29, 2012

France In Big Trouble

Over the past few weeks, an extraordinary cry of alarm has risen from chief executives who warn that the French economy has gone dangerously off track. In an interview to be published on Nov. 15 in the magazine l’Express, Chief Executive Officer Henri de Castries of financial-services group Axa (CS:FP) warns that France is rapidly losing ground, not only against Germany but against nearly all its European neighbors.“There’s a strong risk that in 2013 and 2014, we will fall behind economies such as Spain, Italy, and Britain,” de Castries says.

On Nov. 5, veteran corporate chieftain Louis Gallois released a government-commissioned report calling for “shock treatment” to restore French competitiveness. And on Oct. 28, a group of 98 CEOs published an open letter to Hollande that said public-sector spending, which at 56 percent of gross domestic product is the highest in Europe, “is no longer supportable.” The letter was signed by the CEOs of virtually every major French company. (The few exceptions included utility Electricité de France, which is government controlled.)

Sunday, November 25, 2012

People lose trust in bankers

Deutsche Bank AG (DBK) co-Chief Executive Anshu Jain says telling people he works in banking is a conversation-killer at parties, as the industry fails to convince the general public that it’s changing.

“If you go to a party these days, you’re asked what you do and you say you’re a banker, people go all quiet,” Jain said before a conference on Europe’s finance industry began in Frankfurt. “We’re still the subject of anger.”

http://www.bloomberg.com/news/2012-11-22/jain-gets-silent-treatment-as-bankers-eat-humble-pie.html

Saturday, November 24, 2012

Black Friday Riots

Just a few stories...

'Gang fight' at Black Friday sale...

Man Punched in Face Pulls Gun On Line-Cutting Shopper...

Shots fired outside WALMART...

Shoppers smash through door at URBAN OUTFITTERS...

Customers run over in parking lot...

Woman busted after throwing merchandise...

Thousands storm VICTORIA'S SECRET...

VIDEO: Insane battle over phones...

Mayhem at Nebraska mall where 9 murdered in 2007...

Shoplifter tries to mace security guards...

Men Steal Boy's Shopping Bag Outside BED, BATH & BEYOND...

Heckler calls them zombies...

Manhattan cop busted for shoplifting...

Shopper Robbed At Gunpoint Ouside BEST BUY...

Man Punched in Face Pulls Gun On Line-Cutting Shopper...

Shots fired outside WALMART...

Shoppers smash through door at URBAN OUTFITTERS...

Customers run over in parking lot...

Woman busted after throwing merchandise...

Thousands storm VICTORIA'S SECRET...

VIDEO: Insane battle over phones...

Mayhem at Nebraska mall where 9 murdered in 2007...

Shoplifter tries to mace security guards...

Men Steal Boy's Shopping Bag Outside BED, BATH & BEYOND...

Heckler calls them zombies...

Manhattan cop busted for shoplifting...

Shopper Robbed At Gunpoint Ouside BEST BUY...

If Americans will trample one another just to save a few dollars on a television, what will they do when society breaks down and the survival of their families is at stake? Once in a while an event comes along that gives us a peek into what life could be like when the thin veneer of civilization that we all take for granted is stripped away. For example, when Hurricane Sandy hit New York and New Jersey there was rampant looting and within days people were digging around in supermarket dumpsters looking for food. Sadly, "Black Friday" also gives us a look at how crazed the American people can be when given the opportunity. This year was no exception. Once again we saw large crowds of frenzied shoppers push, shove, scratch, claw, bite and trample one another just to save a few bucks on cheap foreign-made goods. And of course most retailers seem to be encouraging this type of behavior. Most of them actually want people frothing at the mouth and willing to fight one another to buy their goods. But is this kind of "me first" mentality really something that we want to foster as a society? If people are willing to riot to save money on a cell phone, what would they be willing to do to feed their families? Are the Black Friday riots a very small preview of the civil unrest that is coming when society eventually breaks down?

Thursday, November 22, 2012

A Deeply Divided European Union Faces Its Own Budgetary Cliff

The U.S. may plunge over a fiscal cliff if a budget deal can’t be concluded first, but the European Union is hurtling toward a budgetary precipice of its own amid clashing views over the bloc’s future financing. To avert that collision, E.U. officials and leaders of the 27 member states will huddle in Brussels starting Nov. 22 in search of that elusive fiscal compromise they can all live with. Don’t bank on any of them returning home with an agreement very soon.

Not only are France, Germany and the U.K. each dug into conflicting positions on a number of budgetary items. Those disagreements also center on issues central to the E.U.’s functioning, financing and even conception. In many ways the fractures over the next European budget reflect the differences on policy, reform and austerity separating Germany and France in managing the euro crisis. Wrangling elsewhere also directly echoes debate in the U.K. over Britain’s continued membership in the E.U. All else failing, summiteers might agree on a name change to the European Disunion.

Read more: http://world.time.com/2012/11/21/a-deeply-divided-european-union-faces-its-own-budgetary-cliff/#ixzz2D0uklI33

http://world.time.com/2012/11/21/a-deeply-divided-european-union-faces-its-own-budgetary-cliff/print/

http://www.bbc.co.uk/news/world-europe-20435667

Sunday, November 18, 2012

Shadow Banking Grows to $67 Trillion Industry, Regulators Say

The shadow banking industry has grown to about $67 trillion, $6 trillion bigger than previously thought, leading global regulators to seek more oversight of financial transactions that fall outside traditional oversight.

The size of the shadow banking system, which includes the activities of money market funds, monoline insurers and off-balance sheet investment vehicles, “can create systemic risks”and “amplify market reactions when market liquidity is scarce,” the Financial Stability Board said in a report, which utilized more data than last year’s probe into the sector.

http://www.bloomberg.com/news/print/2012-11-18/shadow-banking-grows-to-67-trillion-industry-regulators-say.html

Q&A: The US fiscal cliff

The US faces a deadline to agree new legislation that

could make or break the global economic recovery.

The so-called "fiscal cliff" has been on the horizon for two years, but now

the 31 December deadline is almost here.Now that the presidential election is over it is hoped that policymakers will knuckle down to find a solution.

http://www.bbc.co.uk/news/business-20237056?print=true

Saturday, November 17, 2012

Bernanke blames banks for holding back housing market

Ben Bernanke has said that the overly stringent lending requirements of banks are hurting the US housing recovery.

In a speech, he said the housing market showed signs of recovery but was "far from being out of the woods".

The Federal Reserve chairman said "the pendulum has swung too far" from the easy lending days of the housing boom.

Thursday, November 15, 2012

How A Manhattan Jeweler Wound Up With Gold Bars Filled With Tungsten

In March, certain corners of the Internet exploded when a one-kilo gold bar was allegedly found to have been "salted" with Tungsten, a metal with a similar weight but far less valuable.

In other words, a gold bar was filled with a much cheaper metal to defraud buyers. An ounce of gold is worth $1,766, while an ounce of Tungsten is worth about $360.

An alarmed, if skeptical, post from Felix Salmon first drew attention to it.

Read more: http://www.businessinsider.com/tungsten-filled-gold-bars-found-in-new-york-2012-9#ixzz2CL553M96

Here's what Fadl found:

Rob Wile for Business Insider

|

Rob Wile for Business Insider

|

Ten ounce bars are thicker, making them harder to detect if counterfeited — the standard X-rays used by dealers don't penetrate deep enough.

Read more: http://www.businessinsider.com/tungsten-filled-gold-bars-found-in-new-york-2012-9#ixzz2CL4v243d

http://www.silverdoctors.com/10-more-tungsten-filled-gold-bars-discovered-in-manhattan/

Stock, Bond Certificates in DTCC Vault Damaged by Sandy Flooding

Stock and bond certificates held in an underground Manhattan vault owned by the Depository Trust & Clearing Corp. were damaged by flooding in Hurricane Sandy, according to the DTCC.

The New York-based company that processes transactions in U.S. equities and government, municipal and corporate bonds said it’s too early to determine how many of the 1.3 million physical certificates can be restored, according to a statement. The 40- year-old vault was submerged when the Atlantic Ocean’s largest- ever tropical storm slammed New York City. DTCC has hired “disaster recovery and expert restoration firms” to work on the project, the firm said yesterday.

http://www.bloomberg.com/news/print/2012-11-15/stock-bond-certificates-in-dtcc-vault-damaged-by-sandy-flooding.html

Tuesday, November 13, 2012

Stocks, Commodities Fall as Leaders Grapple With Finances

U.S. equities retreated and European stocks fell for a fifth day as leaders disagreed over a target for Greece’s debt reduction and President Barack Obama prepared for talks to avert a so-called fiscal cliff. Spanish 10-year yields approached 6 percent and metals dropped.

http://www.bloomberg.com/news/2012-11-13/japanese-stocks-gain-yen-falls-on-stimulus-hopes-oil-slides.html

http://www.bloomberg.com/news/2012-11-13/japanese-stocks-gain-yen-falls-on-stimulus-hopes-oil-slides.html

Friday, November 9, 2012

Ex-Goldman Trader Accused of Hiding $8.3 Billion Position

A former Goldman Sachs Group Inc. (GS) commodities trader was accused by U.S. regulators of concealing an $8.3 billion position and causing the firm to lose $118 million.

Matthew Marshall Taylor in 2007 fabricated trades and obstructed the firm’s discovery of his position, risk and profits and losses, the U.S. Commodity Futures Trading Commission said in a complaint filed yesterday in federal court in New York.

Thursday, November 1, 2012

EES: Long Forint, Short US Dollar

Go Long Hungarian Forint, And Short US Dollar As Carry Currency

For those looking to capitalize on the Fed's new QE Infinity policy, opportunities in the Forex market present a way to both ride the US Dollar's decline as well as profit with interest payments.

This is known as the 'carry trade' - however today's US Dollar carry trade is a bit different than the carry trade of the past.

Hungarian Forint

The Hungarian Forint (HUF) is the currency of Hungary, an EU member. It is one of the few EU members that has not adopted the Euro. x

The introduction of the forint on 1 August 1946 was a crucial step of the post-WWIIstabilization of the Hungarian economy, and the currency remained relatively stable until the 1980s. Transition tomarket economy in the early 1990s deteriorated the value of the forint, inflation peaked at 35% in 1991. Since 2001, inflation is single digit and the forint was declared fully convertible.[1] As a member of the European Union, the long term aim of the Hungarian government is to replace the forint with the euro.

USD/HUF Technicals

If we look at a D1 Daily chart of USD/HUF, we see that the trend from the peak of 248 is down. But the line is not straight down, there are peaks and valleys. We've indicated the peaks with red arrows, which could be good selling points.

The strategy

We suggest to sell USD/HUF by using a multiple order entry system as follows:

Take 1 short USD/HUF position regardless of where the market is, using 1:1 leverage. If you are an experienced Forex trader you can use more leverage, but this strategy should not have stop losses as the idea is to hold USD/HUF short for a long time (at least several months) Then, wait for any significant move up to sell again; at least 200 pips. See the red arrows above for selling points. When you have established several trades, stay short. You will be paid interest daily, depending on your broker. Click here to read more about Forex rollover. Profits should only be taken in the valleys after positions are deep in the money. Never close all of your orders, meaning you should always have some position in USD/HUF.

Important points on this strategy

The Forint is commonly traded with the Euro, not the US Dollar. USD/HUF is offered at many brokers. But in news and analysis you will likely see HUF compared to EUR not USD. This is because there is significantly more liquidity in EUR/HUF than USD/HUF. But remember, it's possible the HUF could go down against the EUR but up against the USD. So the point here is to trade USD/HUF and not EUR/HUF. Experienced traders might use EUR/USD as a partial hedge.

Secondly, while the HUF is a liquid currency, it is still considered an exotic and can move rapidly in one direction with relatively small order sizes (it takes less money to move the HUF rapidly, compared to EUR or GBP). So you can expect big moves to happen quickly.

Finally, spreads on USD/HUF are higher than most pairs, especially during certain market sessions. This is balanced by the fact that while the spread may be 10, 20, or even 30 pips, it may move 200 or 300 pips in a day. This is not a pair you would trade for a quick profit.

Do check with your broker for the swap rates, with using leverage, this strategy could pay 50% or more per year just in interest payments.

The current central bank base rate of the Forint is 6.25%. With the USD rate being near zero, this provides a decent swap rate. With leverage, this is multiplied by the following:

Swap rate short USD/HUF = 5%

10:1 leverage, swap rate short USD/HUF = 50%. 20:1, 100% and so on. Of course as you increase your leverage you increase your risk of the HUF moving against you, which if you used small leverage would not be so difficult to wait out.

Hungarian Forint research resources

Open a Forex Account - Information about opening a Spot Forex trading account.

(Forex Risk Disclosure - Click here to read)

The risk of loss in trading foreign exchange markets (FOREX), also known as cash foreign currencies, or the FOREX markets, can be substantial.

Subscribe to:

Comments (Atom)