This article appeared at The Daily Beast on

Tuesday, October 1, 2013.

Read it there.

It’s a telling coincidence that the latest scandalous revelation

about the National Security Agency (NSA) is hitting the front pages

just as the enrollment period specified by the Affordable Care Act

(ACA, a.k.a. Obamacare) is getting started.

Each of these things underscores different but related aspects

of the virtually unlimited state that has ruined the peaceful

slumber of libertarian-minded Americans for decades. Whether we’re

talking about surveilling citizens without any sort of serious

legal oversight or forcing them to participate in economic activity

in the name of health care über alles, the answer

always seems to favor the growth and power of the state to control

more and more aspects of our lives. Is it any wonder that a

record-high percentage of Americans think the federal

government is

too powerful?

In an explosive story, The New York

Times detailed

the ways in which the NSA, which was originally supposed

to spy on communications among foreign agents and provide

intelligence on threats posed by noncitizen actors and governments,

is increasingly focused on domestic activities. Since 2010,

according to an NSA memo obtained by the Times, “The

agency was authorized [by officials in the Obama administration] to

conduct ‘large-scale graph analysis on very large sets of

communications metadata without having to check foreignness’ of

every e-mail address, phone number or other identifier.”

Through a process known as “contact chaining,” the NSA is able

to suck up all sorts of email addresses, phone numbers,

social-media-network information, and more without regard to the

physical location or citizenship of each data point. The agency,

reports the Times, then “enriches” that metadata

“with material from public, commercial and other sources, including

bank codes, insurance information, Facebook profiles, passenger

manifests, voter registration rolls and GPS location information,”

and more. The result, as George Washington University law professor

Orin Kerr puts it, is “the digital equivalent of tailing a

suspect.”

The only restriction on the practice appears to be that the NSA

must make a claim that their data-gathering serves a foreign-policy

justification. Which is never a problem for the agency since, as a

spokesperson told the Times, “All of NSA’s work

has a foreign intelligence purpose.” While it’s clear that the

contact chaining results in vast webs of information that rope in

Americans completely uninvolved in terrorism, the NSA refuses to

divulge any relevant numbers or incidents.

The NSA originally sought such unrestricted use of metadata and

other information involving Americans back in 1999 but was rebuffed

due to concerns that it was not legal under the Foreign

Intelligence Surveillance Act (FISA), which governs the agency.

Legal opinions within presidential administrations—and after the

9/11 attacks—change, though, and there’s some indirect evidence

that the NSA may have engaged in contact chaining during the Bush

years. Despite his stated interest in protecting civil liberties,

Barack Obama has

disappointed even his staunchest defenders when it comes

to constitutional limits on executive power and the surveillance

state. Indeed, he has upped the ante from the Bush administration

by claiming not simply the right to hold U.S. citizens indefinitely

without charging them but the right to unilaterally kill them.

The one thing we know from past experience is that the NSA has

consistently abused its powers. During the Vietnam War, for

instance, the agency routinely intercepted communications outside

its legal purview and ran an

illegal operation known as “Minaret” that spied on

anti-war figures ranging from boxer Muhammad Ali to syndicated

humorist Art Buchwald to Sen. Frank Church (D-ID). The latter would

chair hearings in the 1970s exposing massive illegal and improper

actions by the NSA, FBI, and CIA, giving rise to FISA, which was

passed in 1978. In 2008, ABC

News reported on NSA operatives listening in on and

sharing recordings of phone-sex calls between U.S. troops and their

spouses in the States and routinely listening in on Red Cross and

other relief workers as well.

The legal justification for the NSA’s actions, according to

the Times, is the 1979 Supreme Court ruling that

found “no expectation of privacy about what numbers they had

called.” A more recent yet equally unfortunate Supreme Court

decision—the 2012 one upholding President Obama’s

health-care-reform plan—is the reason that the Obamacare exchanges

are theoretically going to be up and running come October 1

(pay

no attention to the massive and mounting delays with the

program).

The clearest argument against Obamacare was always the

specifically libertarian one against the individual mandate, or the

idea that the government could force you not only to follow certain

rules if you engaged in commercial or economic

activity but that it could force you to engage

in commercial or economic activity in the first place.

Like most federal laws dealing with powers specifically

enumerated in the Constitution, the legislative reasoning behind

the mandate is derived from the commerce clause, which gives

Congress the right to “regulate commerce ... among the several

states.” Once interpreted by legislators and courts alike in a

narrow sense, at least since the 1942 ruling Wickard v.

Filburn, the commerce clause has been interpreted to allow the

federal government virtually unlimited power. Indeed, during her

confirmation hearing, Justice Elena Kagan granted that she believed

Congress could legitimately pass a law mandating that people buy

broccoli. While it would be a “dumb law,” she said it would be

constitutional. (This short video,“Wheat,

Weed, and Obamacare” is a concise and engaging discussion

of differing views regarding the commerce clause.)

In the decision affirming the individual mandate, John Roberts

effectively rewrote the legislation by saying it could be enforced

through Congress’s taxing power rather than on commerce-clause

grounds. Some libertarian-minded observers took

solace in that fact, but the net result is the same: When

the government tells you to jump, we’re legally bound to say, “How

high?”

Conventional politics in terms of Team Red versus Team Blue

offer little insight into the current situation, since by and large

Republicans and Democrats are fine with a massive and growing state

as long as most of the spending and edicts work to the benefit of

each group’s favored constituencies. Whatever lip service they pay

to the individual, neither party betrays much interest in limiting

the size and scope of government. Indeed, it’s not an accident that

Obamacare—including the individual mandate—was inspired by a

proposal floated back in the ’90s by the GOP front group the

Heritage Foundation. And it’s not an accident that when it comes to

spending, regulating, sidestepping executive branch limits, and

dropping bombs, Barack Obama resembles no one so much as George W.

Bush.

Which is something to think about come tomorrow, when a new

fiscal year starts without a budget because House Republicans want

to spend $3.5 trillion and Senate Democrats want to spend $3.7

trillion (spending in 2001 came in at about $1.9 trillion in

nominal dollars). Indeed, it’s something to think about whether you

are excited to check out Obamacare’s insurance exchanges or you

view their very existence as simply the latest mile marker on the

road to serfdom.

And here’s something else to think about: there’s a reason why a

record-high 60 percent of Americans agree that the government has

too much power and why libertarian attitudes are on the rise (even

among GOP legislators, of all places!). It must be because people

are actually following the news, most of which is pretty appalling,

even (especially?) when you get past the partisan spectacle of it

all.

This article appeared at The Daily Beast on Tuesday,

October 1, 2013. Read

it there.

Sunday, October 6, 2013

A Depressed Bank Of America Predicts "Agreement Is Almost Impossible As Long As Obamacare Is On The Table"

Bank of America's latest forecast on the

resolution, or lack thereof, of the government shutdown, which now seems

virtually certain to last at least one week into Monday night, when the

House and Senate return to work, is hardly encouraging. The bank's base

case now calls for "either a two-week shutdown or for multiple

shutdowns." Additional, BofA has now cut its Q3 GDP forecast from 2.0%

to 1.7% and from 2.5% to 2.0% for 4Q. It gets worse: "Much worse

outcomes are possible. In our view, agreement is almost impossible as

long as the Affordable Care Act is on the table." Finally, and

what ties it all together, is that as a result of the lack of

"government data", BAC now expects the Fed to delay tapering to their

January meeting, or later. Which may well have been the much needed

alibi all along to delayed tapering until 2014.

From Bank of America

The shutdown of the government has created a double dose of uncertainty. It comes at a time when the economy may be about to shift from second gear into third gear, triggering the beginning of a Fed exit. The longer the shutdown and the longer the games of brinkmanship, the longer the delay in that growth pick up. At the same time, the shutdown means almost no official data releases. In the face of this uncertainty, the Fed’s motto is: when in doubt, do nothing.

Our base case is now for either a two-week shutdown or for multiple shutdowns. We have cut our forecast for GDP growth from 2.0% to 1.7% for 3Q and from 2.5% to 2.0% for 4Q. We also expect the Fed to delay tapering to their January meeting, or later.

Much worse outcomes are possible. In our view, agreement is almost impossible as long as the Affordable Care Act is on the table. The President is very unlikely to agree to cuts in his proudest legislative achievement. Moreover, in our view, he is in a strong negotiating position vis-à-vis House Republicans. He does not have to run for office again, while they are all up for reelection next fall. Surveys show Americans strongly disapprove of the shutdown and put more blame on Republicans than Democrats. Surveys also show that Americans think it is not worth shutting the government down as a means to end the ACA. On the other hand, most Republicans strongly oppose the ACA and many support shutdowns as a means to an end. Ultimately we expect Republicans to drop the effort to weaken the ACA, but this could take a while.

It is very hard to measure the impact of the shutdown on the economy, although every economist has to come up with numbers. Most of the press reports seem very much on the low side, in our view. The direct impact is easy to calculate. The Clinton-Gingrich shutdown directly reduced GDP by about 0.3% in 4Q 1995 and a two-week shutdown today would have a similar impact. However, we think these narrow estimates are wishful thinking. There will likely be numerous spillover effects and, even if the shutdowns are brief, multiple brinkmanship moments will take a toll on confidence. We hear a lot of talk about buying on dips, but getting the timing right could be very tough.

[7]

[7]

From Bank of America

The shutdown of the government has created a double dose of uncertainty. It comes at a time when the economy may be about to shift from second gear into third gear, triggering the beginning of a Fed exit. The longer the shutdown and the longer the games of brinkmanship, the longer the delay in that growth pick up. At the same time, the shutdown means almost no official data releases. In the face of this uncertainty, the Fed’s motto is: when in doubt, do nothing.

Our base case is now for either a two-week shutdown or for multiple shutdowns. We have cut our forecast for GDP growth from 2.0% to 1.7% for 3Q and from 2.5% to 2.0% for 4Q. We also expect the Fed to delay tapering to their January meeting, or later.

Much worse outcomes are possible. In our view, agreement is almost impossible as long as the Affordable Care Act is on the table. The President is very unlikely to agree to cuts in his proudest legislative achievement. Moreover, in our view, he is in a strong negotiating position vis-à-vis House Republicans. He does not have to run for office again, while they are all up for reelection next fall. Surveys show Americans strongly disapprove of the shutdown and put more blame on Republicans than Democrats. Surveys also show that Americans think it is not worth shutting the government down as a means to end the ACA. On the other hand, most Republicans strongly oppose the ACA and many support shutdowns as a means to an end. Ultimately we expect Republicans to drop the effort to weaken the ACA, but this could take a while.

It is very hard to measure the impact of the shutdown on the economy, although every economist has to come up with numbers. Most of the press reports seem very much on the low side, in our view. The direct impact is easy to calculate. The Clinton-Gingrich shutdown directly reduced GDP by about 0.3% in 4Q 1995 and a two-week shutdown today would have a similar impact. However, we think these narrow estimates are wishful thinking. There will likely be numerous spillover effects and, even if the shutdowns are brief, multiple brinkmanship moments will take a toll on confidence. We hear a lot of talk about buying on dips, but getting the timing right could be very tough.

[7]

[7]Friday, October 4, 2013

Swiss regulator investigates banks over foreign exchange deals

Switzerland's financial regulator is

investigating possible manipulation of foreign exchange rates at several

Swiss financial institutions.

The regulator, FINMA, said several banks, including some from outside Switzerland, could be implicated.It is coordinating the investigation closely with authorities in other countries.

It would give no further details on the investigations or the banks potentially involved.

Swiss Banking, the group that represents the nation's banks, said it had no further information.

The Swiss announcement follows reports in June that the British regulator, the Financial Conduct Authority (FCA), was looking into whether traders manipulated benchmark foreign-exchange rates to increase profits.

This followed an investigation by Bloomberg News that found that dealers shared information and used client orders to move the rates.

The FCA, which does not announce its investigations, only its enforcement actions, said: "We are aware of the allegations and we have been speaking to relevant parties."

London is by far the world's biggest market for foreign currency trading, with 41% of global turnover, according to the Bank for International Settlements.

New York has a 19% share, followed by Singapore, Tokyo and Hong Kong.

Switzerland accounts for 3.2% of foreign exchange trading.

http://www.bbc.co.uk/news/business-24397525

Thursday, October 3, 2013

Wednesday, October 2, 2013

Government Called Privacy Office "Terrorists"

Former DHS Privacy Officer Mary Ellen Callahan: DHS Privacy Office was accused monthly of being "terrorists" by DHS, IC

"DHS" stands for the Department of Homeland Security; "IC" stands for the intelligence community [8].

This is not an isolated or melodramatic statement. Rather, it is how the homeland security and intelligence communities look at privacy.

For example, former NSA and CIA boss Michael Hayden compared privacy advocates to terrorists [9]:

Postscript (Irony Alert): University of Washington Law School professor Ryan Calo [15] points out an amusing irony [16] in this story:

Tech Dirt explains [18]:

"DHS" stands for the Department of Homeland Security; "IC" stands for the intelligence community [8].

This is not an isolated or melodramatic statement. Rather, it is how the homeland security and intelligence communities look at privacy.

For example, former NSA and CIA boss Michael Hayden compared privacy advocates to terrorists [9]:

“If and when our government grabs Edward Snowden, and brings him back here to the United States for trial, what does this group do?” said retired air force [10] general Michael Hayden, who from 1999 to 2009 ran the NSA and then the CIA, referring to “nihilists, anarchists, activists, Lulzsec, Anonymous, twentysomethings who haven’t talked to the opposite sex in five or six years”.Similarly, Slate reported [11] last year:

“They may want to come after the US government, but frankly, you know, the dot-mil stuff is about the hardest target in the United States,” Hayden said, using a shorthand for US military networks. “So if they can’t create great harm to dot-mil, who are they going after? Who for them are the World Trade Centers? The World Trade Centers, as they were for al-Qaida.”

Hayden provided his speculation during a speech on cybersecurity to a Washington group, the Bipartisan Policy Center, in which he confessed to being deliberately provocative.

Sadly, in its paranoid bunker mentality, the government considers just about all Americans [14] to be terrorists.If you’ve ever cared about privacy while using the Internet in public, you might be a terrorist. At least that’s the message from the FBI and Justice Department’s Communities Against Terrorism initiative. The project created flyers to help employees at several types of businesses—including military surplus [10] stores, financial institutions, and even tattoo shops—recognize “warning signs” of terrorism or extremism. An admirable goal, perhaps, but the execution is flawed—particularly for the flyers intended to help suss out terrorists using Internet cafes.

The flyers haven’t been publicly available online, but Public Intelligence, a project promoting the right to access information, collected 25 documents [12] that it found elsewhere on the Web. As Public Intelligence puts it [13], “Do you like online privacy? You may be a terrorist.”

Postscript (Irony Alert): University of Washington Law School professor Ryan Calo [15] points out an amusing irony [16] in this story:

Former DHS chief privacy officer says # of privacy officers at NSA, including the chief privacy officer, was zero.(Calo was reporting on a statement made by former chief DHS Privacy Officer Mary Ellen Callahan at a recent talk [17].)

Tech Dirt explains [18]:

Mary Ellen Callahan [19] was the Chief Privacy Officer (and the Chief Freedom of Information Act Officer) at the Department of Homeland Security from 2009 until 2012 (though, don't tell DHS, since they still have a page on their website about her [20] claiming she still has that role -- even though she left over a year ago [21]).In other words, the DHS considers government privacy officers to be terrorists, doesn't have any ... and yet - in blatant propaganda - pretends it does.

Have We Reached Peak Government?

Submitted by Charles Hugh-Smith of OfTwoMinds blog [4],

If we are not yet at Peak Debt, we are getting close, and that means we are also getting close to Peak Government.

Have we reached Peak Government? That is, a structural point beyond which government can no longer grow sustainably?

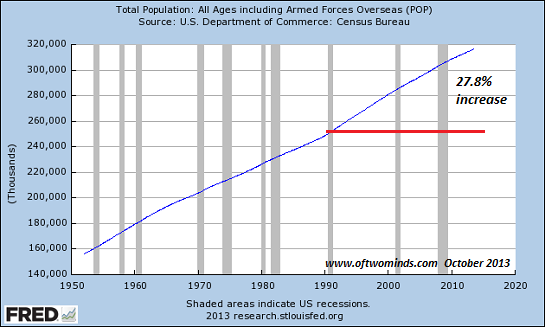

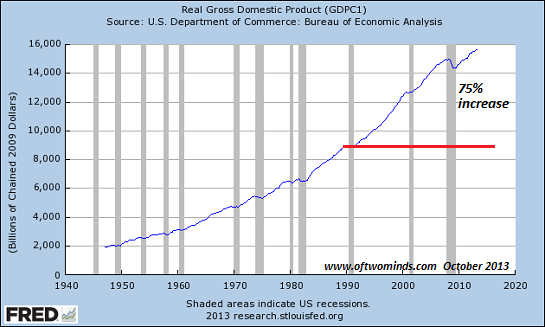

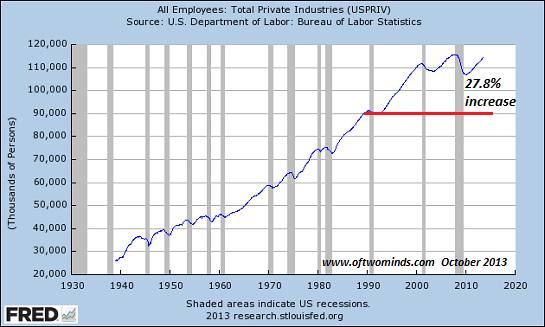

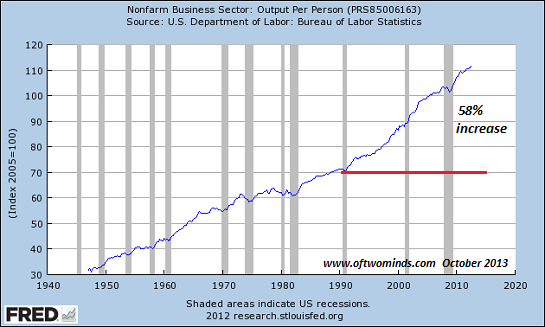

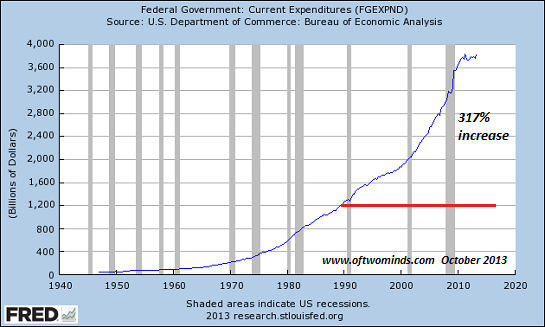

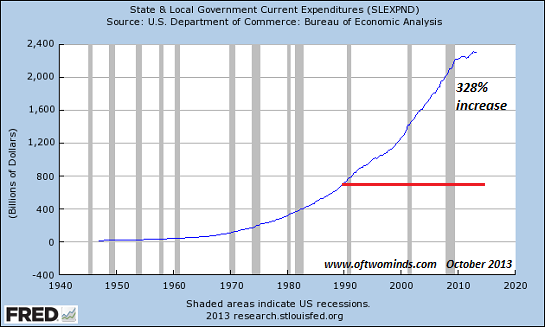

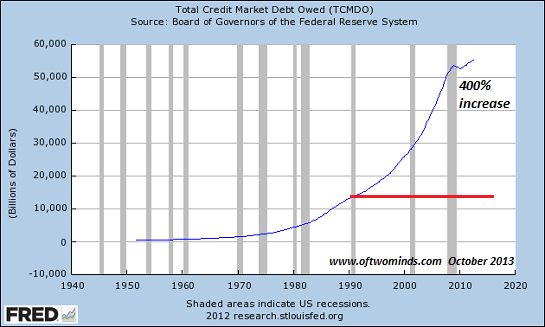

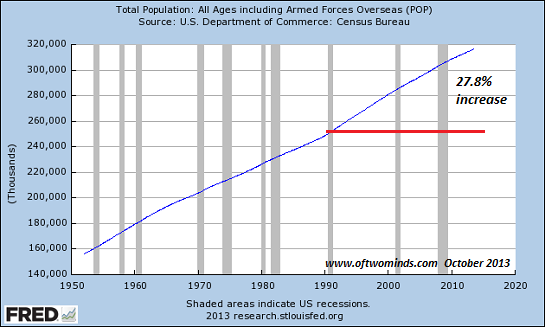

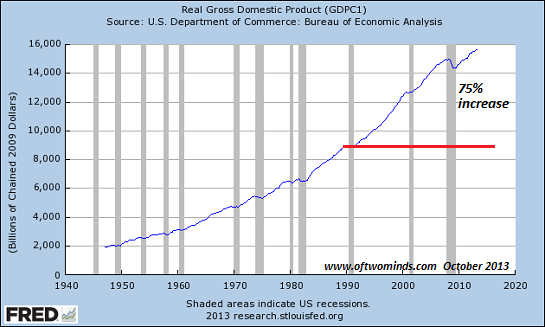

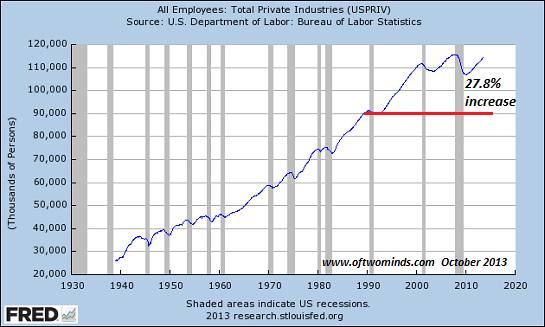

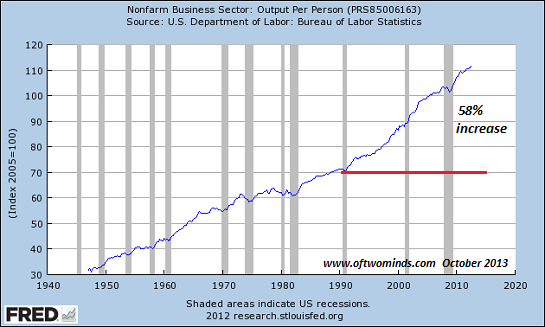

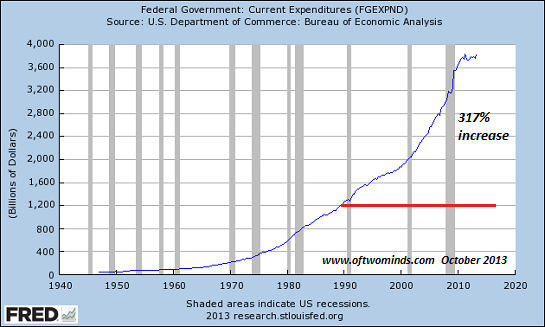

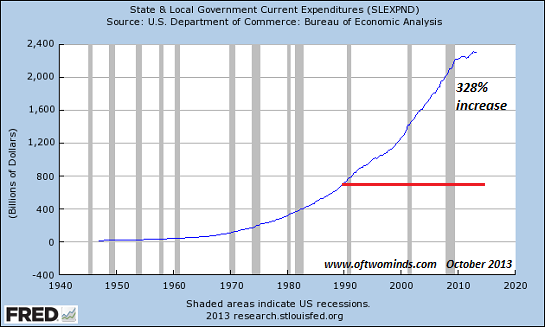

To help answer the question, I've assembled charts of the foundations of growth: population, gross domestic product (GDP), private employment and output per person (i.e. productivity). These have grown 28%, 75%, 28% and 58% respectively. (I have used 1990 as a baseline, as the past 23 years gives us a reasonably accurate clue as to the long-term trendlines of the current economy.)

In other words, if growth depended entirely on population growth, the real (inflation-adjusted) economy would have grown 28% since 1990. Instead, the GDP rose by 57%. This is the result of rising output per person, i.e. an increase in productivity.

U.S. population:

GDP: ( US Real GDP by Year [5]: 1990: $8 trillion, 2013: $14 trillion; the $9 trillion and $15.7 trillion shown on this chart yield the same results)

Private employment:

Output per person:

Since the state (government) depends on the economy to generate its tax revenues, government cannot grow sustainably at a rate that exceeds the expansion of the economy. Thus we expect government to grow at around the same rate as the economy and productivity, i.e. around 60% to 75%.

But Federal government expenditures have risen by 317% and state/local government spending has leaped by 328% since 1990. In other words, government has expanded at roughly four or five times the underlying growth rate of the economy.

State/local government spending:

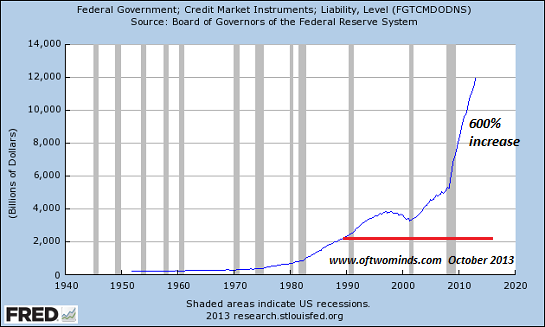

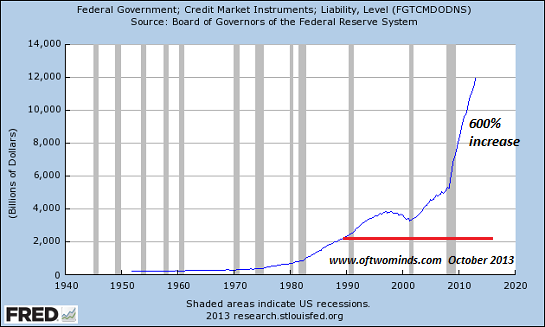

How can government expand 300+% while the underlying economy that supports it expanded by 75%? Answer: borrowing money, i.e. debt--lots of it. Federal debt has skyrocketed by 600% since 1990.

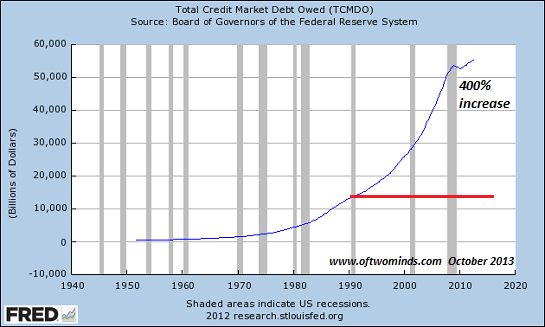

This is simply part of a vast, unprecedented expansion of debt in both public and private sectors since 1990:

So the question of Peak Government is ultimately a question of Peak Debt: how much money can the government borrow to sustain its current spending? Can public and private debt expand at rates four or five times that of the underlying economy? If so, for how long?

If we are not yet at Peak Debt, we are getting close, and that means we are also getting close to Peak Government.

If we are not yet at Peak Debt, we are getting close, and that means we are also getting close to Peak Government.

Have we reached Peak Government? That is, a structural point beyond which government can no longer grow sustainably?

To help answer the question, I've assembled charts of the foundations of growth: population, gross domestic product (GDP), private employment and output per person (i.e. productivity). These have grown 28%, 75%, 28% and 58% respectively. (I have used 1990 as a baseline, as the past 23 years gives us a reasonably accurate clue as to the long-term trendlines of the current economy.)

In other words, if growth depended entirely on population growth, the real (inflation-adjusted) economy would have grown 28% since 1990. Instead, the GDP rose by 57%. This is the result of rising output per person, i.e. an increase in productivity.

U.S. population:

GDP: ( US Real GDP by Year [5]: 1990: $8 trillion, 2013: $14 trillion; the $9 trillion and $15.7 trillion shown on this chart yield the same results)

Private employment:

Output per person:

Since the state (government) depends on the economy to generate its tax revenues, government cannot grow sustainably at a rate that exceeds the expansion of the economy. Thus we expect government to grow at around the same rate as the economy and productivity, i.e. around 60% to 75%.

But Federal government expenditures have risen by 317% and state/local government spending has leaped by 328% since 1990. In other words, government has expanded at roughly four or five times the underlying growth rate of the economy.

State/local government spending:

How can government expand 300+% while the underlying economy that supports it expanded by 75%? Answer: borrowing money, i.e. debt--lots of it. Federal debt has skyrocketed by 600% since 1990.

This is simply part of a vast, unprecedented expansion of debt in both public and private sectors since 1990:

So the question of Peak Government is ultimately a question of Peak Debt: how much money can the government borrow to sustain its current spending? Can public and private debt expand at rates four or five times that of the underlying economy? If so, for how long?

If we are not yet at Peak Debt, we are getting close, and that means we are also getting close to Peak Government.

Wonderful President of USA and Munchkins

The Chief Economist at Citi Willem Butler has said

today on CBC in an interview that the fiasco over the US budget and the

lack of money is nothing more than irresponsible on all political wings

and that the country is being run by Munchkins in the Land of Oz. Most

of us will agree that he has got it spot on with the second label and

all we can wonder is if President Obama [11] will be wearing the red shoes in Judy-Garland fashion, banging out an old tune of theStar Spangled Banner even

if it is on an untuned piano. Will he be clicking those heels together

and wishing he were at home with Aunt Em and Uncle Henry or will the

Wicked Witch of the East come along and gobble him and the US up because

the country is being run by cowardly darragh duffy the Lion?

The first statement made by Butler about the irresponsibility of not

voting the budget is largely an open debate and must be questioned.

Think about the knock on effects. The tourists that won’t be visiting those sights, that won’t be spending their hard-earned cash in the parks and at the national sites. It’s not because something has happened endless times that it becomes more acceptable. It’s not because that’s the only thing that the media is talking about today that it makes it less prominent in your everyday life. The knock-on effect will filter through. It always does. The only way it won’t be going is up. But, it will be going down and sideways and that’s where the people are. If that’s not important, then what is? Maybe when it comes down to the fact that you won’t be able to get a passport because that department will be closed, or you won’t be able to get a gun permit because the workers there will have been sent home. Maybe that will start to affect everyone else.

If there’s one thing that runs through all of these shutdowns, it’s the feuding between the Senate and the House of Representatives or both that are against the President. Is that the crux of the matter? The real cause behind all of this? Three parties vying for power and pulling the bed sheets to their side so that they can keep themselves warm? But, they are not the ones that suffer, are they? They just vote the bills or veto and it’s as easy as all that.

Washington is the Emerald Green City with the greenbacks the line the walls of the offices of the lawmakers and Congress. That fake charlatan, the Wizard? You decide who he might well be. Looks as if we might just be needing a new scarecrow to replace that Wizard. But, scarecrows are just dummies too, anthropomorphic personifications of man, made just to scare the birds away.

[12]

OZ-bama or Obama?

The Land of Oz

The Wonderful Wizard of Oz may have been written more than a century ago, but it is such a fitting tale of today’s sorry state (in more ways than one) of affairs in the USA. Butler was right more than he probably thinks when he spoke of the Land of Oz, the land where the ounce of gold will now shoot through the roof because of the irresponsibility of all political parties that have held power in the USA in the past decades. Investors will seek a safe haven in gold from today onwards and the price of gold will inevitable increase. Politicians can never be trusted to do the right thing (if there is a right thing to do in the circumstances) and that means that the markets will be volatile. The partial shutdown has happened today as hundreds of thousands of Americans stay at home because the government spent too much money. Will the Senators and the Representatives and the government aides or evenPresident Obama take a cut in their salaries in steadfast solidarity for the nation? They should, but they won’t. We all know that.- According to analysts, gold will possible fall marginally and then rise this week.

- That’s exactly what is happening today with COMEX gold ready for delivery in December that has fallen by 2.3%(down -30.5 to $1.296.5).

- It is suggested that gold will increase to between $1, 500 and $1, 575 in the coming weeks as investors move into a safe haven.

- The Euro is up against the Dollar by 0.22% (+0.0031 to 1.3557)

- Sterling is also up by 0.32% (to 1.6237, +0.0051)

- The Australian Dollar increased also by 0.79% (up +0.0074 to 0.9391)

- The Dollar fell against the Japanese Yen by 0.41% (down -0.4 to 97.87).

Irresponsibility of the US Government(s)

For those out there that believe this is nothing, for those that think that this has happened for the 18th time in the history of the USA today, think on and think again. It may be nothing, but then you are probably not a federal government worker that has been sent home without pay. This is not just hyperbole. It’s happening. You are probably not one of the guys that has to look for a way to pay your bills this month because the government hasn’t been able to pay the bills and because successive governments have been winging it on both a prayer and on the evil credit that we are told not to live on day in and day out. Certainly, it’s nothing much to write home about in the I’m-alright-Jack-couldn’t-give-a-damn-world, but what about the 700, 000 federal workers from the national parks and the monuments that are joining the soup kitchens and the breadlines [13] today because they aren’t getting a paycheck (and it happens to more than you think)?Think about the knock on effects. The tourists that won’t be visiting those sights, that won’t be spending their hard-earned cash in the parks and at the national sites. It’s not because something has happened endless times that it becomes more acceptable. It’s not because that’s the only thing that the media is talking about today that it makes it less prominent in your everyday life. The knock-on effect will filter through. It always does. The only way it won’t be going is up. But, it will be going down and sideways and that’s where the people are. If that’s not important, then what is? Maybe when it comes down to the fact that you won’t be able to get a passport because that department will be closed, or you won’t be able to get a gun permit because the workers there will have been sent home. Maybe that will start to affect everyone else.

Federal-Government Shutdowns

Today is just a long line of shutdowns in the history of the USA. The others have all taken place since 1976:- 10 days between September 30th and October 11th 1976

- 12 days between September 30th and October 13th 1977

- 8 days between October 31st and November 9th 1977

- 8 days between November 30th and December 9th 1977

- 18 days between September 30th and October 18th 1978

- 11 days between September 30th and October 12th 1979

- 2 days between November 20th and November 23rd 1981

- 1 day between September 30th and October 2nd 1982

- 3 days between December 17th and December 21st 1982

- 3 days between November 10th and November 14th 1983

- 2 days between September 30th and October 3rd 1984

- 1 day between October 3rd and October 5th 1984

- 1 day between October 16th and October 18th 1986

- 1 day between December 18th and December 20th 1987

- 4 days between October 5th and October 9th 1990

- 5 days between November 13th and November 19th 1995

- 21 days between December 16th 1995 and January 6th 1996

- ? (unknown so far) days as from October 1st 2013

If there’s one thing that runs through all of these shutdowns, it’s the feuding between the Senate and the House of Representatives or both that are against the President. Is that the crux of the matter? The real cause behind all of this? Three parties vying for power and pulling the bed sheets to their side so that they can keep themselves warm? But, they are not the ones that suffer, are they? They just vote the bills or veto and it’s as easy as all that.

[14]

Wizard of Oz and the US Government Shutdown

Oz and the USA

The Wizard of Oz was a satirical parody of money and politics. But, the Munchkins were the ordinary people that were enslaved and held in the bondage of the Wizard. The ordinary federal workers and the average Americans are those Munchkins and it’s not the US that is being run by them. But, the US is the flawed utopic Land of Oz where every man would make it rich. Yes, that was possible while the credit line was there. Now is ancient history and fairytale material.Washington is the Emerald Green City with the greenbacks the line the walls of the offices of the lawmakers and Congress. That fake charlatan, the Wizard? You decide who he might well be. Looks as if we might just be needing a new scarecrow to replace that Wizard. But, scarecrows are just dummies too, anthropomorphic personifications of man, made just to scare the birds away.

The irresponsibility of the governments that have done nothing but spend since Ronald Reagan jacked in acting to play the role of President of the USA, there has been nothing but a successive line of Presidents that have been playing a role-game for the entire country. It’s about time that all that changed.

Originally posted: Wonderful President of USA and Munchkins [15]

Goldman's Global Leading Indicator Plunges Back To "Slowdown"

Everything looked so good in August. Goldman's

global leading indicator (GLI) "swirlogram" had recovered quickly from a

'growth scare' in Q1 and was holding firmly in "expansion" territory.

Then reality hit as new-orders-less-inventories worsened, various

manufacturing surveys rolled over, industrial metals gave up gains, and

Korean exports provided no help. Among the few factors holding up the

index from already plunging levels was the Baltic Dry Index (which has

collapsed now in the last few days) and Consumer Confidence (which

appears to also be rolling over). September's plunge into "slowdown" for the GLI is the biggest drop in 8 months.

[7]

[7]

Chart: Goldman Sachs

http://www.zerohedge.com/print/479649

[7]

[7]Chart: Goldman Sachs

http://www.zerohedge.com/print/479649

Tuesday, October 1, 2013

The Beginning of the End for Washington

Step back. Try for a moment to extrapolate what a government shutdown

and discredited U.S. currency could do to the economy and the public's

faith in government. Think beyond next year's congressional elections or

even the 2016 presidential race. Factor in existing demographic and

social trends. I did, and this is what I concluded:

1. The Republican Party is marginalizing itself to the brink of extinction.

2. President Obama can't capitulate to GOP demands to unwind the fairly legislated and litigated Affordable Care Act. To do so would be political malpractice and a poor precedent for future presidents.

3. Despite the prior two points, Obama and his party won't escape voters' wrath. Democrats are less at fault but not blameless.

4. This may be the beginning of the end of Washington as we know it. A rising generation of pragmatic, non-ideological voters is appalled by the dysfunctional leadership of their parents and grandparents. History may consider October 2013 their breaking point. There will come a time when Millennials aren't just mad as hell; they won't take it anymore.

http://www.nationaljournal.com/politics/the-beginning-of-the-end-for-washington-20131001

1. The Republican Party is marginalizing itself to the brink of extinction.

2. President Obama can't capitulate to GOP demands to unwind the fairly legislated and litigated Affordable Care Act. To do so would be political malpractice and a poor precedent for future presidents.

3. Despite the prior two points, Obama and his party won't escape voters' wrath. Democrats are less at fault but not blameless.

4. This may be the beginning of the end of Washington as we know it. A rising generation of pragmatic, non-ideological voters is appalled by the dysfunctional leadership of their parents and grandparents. History may consider October 2013 their breaking point. There will come a time when Millennials aren't just mad as hell; they won't take it anymore.

http://www.nationaljournal.com/politics/the-beginning-of-the-end-for-washington-20131001

4 week tbill surge

A look at the stocks surge today and one would get the impression that

not only should the government shutdown be permanent (closing the Fed

would have a vastly different result on the S&P), but that the debt

ceiling is completely irrelevant and immaterial for risk assets. One

would get a far different impression by looking at today's just concluded 4-Week Bill [8]

auction. Today's outlier rate on the just priced $35 billion in 4-week

bills can be seen quite dramatically on the chart below, and is evidence

that someone (or someones) is getting quite nervous ahead of the events in the next few weeks.

[9]

[9]

What is going on here and why the spike? Recall what we said a week ago in "Here Is How To Trade The Debt Ceiling Showdown [10]."

End result: today's auction was an absolute abortion and absent some deus ex machina agreement between the GOP and Democrats, one can expect the October 31 bills (and others just around them) to continue blowing wider as quietly but confidently those holding the most at risk paper exit stage left.

But that's not all. We also noted the following:

[13]

[13]

http://www.zerohedge.com/print/479629

[9]

[9]What is going on here and why the spike? Recall what we said a week ago in "Here Is How To Trade The Debt Ceiling Showdown [10]."

... there is a simple pair trade for those who would like to position for a contentious debt ceiling fight with an ETA mid-October and skip the bipolar and HFT-dominated equity markets. Recall that in the summer of 2011 when the last big debt ceiling debacle loomed and resulted in a last minute outcome that also led to the downgrade of the US by a rating agency that has since sold out, rates of bills due just before the debt ceiling D-Date soared, while those sufficiently after the ceiling interval tightened. Well, the same trade is just as applicable this time.Sure enough, today is the first day of the next quarter (window dressing is over), and the bond market, if not so much the stock market, has finally awakened that the government shutdown is merely an indication of just how contenuous the debt ceiling negotiation very likely ill be, and that it is increasingly likely that the X-Date of October 18 [11]may come and go without a deal, which just may result in a technical default on the nearest maturity Bills.

Sell October 31 Bills versus 12 Month Bills

Supply dynamics and potential market concerns around a debt ceiling stand-off in Washington should push the 1M1Y bill curve flatter... The October 31 bills are likely the most vulnerable, and should cheapen significantly versus 12 month bills in a protracted fight.

One-month and three month bills are already trading close to zero, having briefly traded negative last week. With bill supply to remain flat heading into the end of October, suggesting that supply should keep bills yields across the curve under pressure. With bill yields largely beholden to supply dynamics, the greatest scope for further compression is in year bills, which are currently trading around 10bp. Given historical relationship between bills yields and bills outstanding, year bills are roughly 3bp rich to supply-implied fair value, while 3-month bills are about 3.5bp rich.

This trade may be difficult to put on in size until after quarter end due to dealers balance sheet constraints. But as noted above, we believe that the market will not begin to fully price the risk to front end bills until about two weeks before the end date. We expect the opportunity to remain available at for the first week of October.

End result: today's auction was an absolute abortion and absent some deus ex machina agreement between the GOP and Democrats, one can expect the October 31 bills (and others just around them) to continue blowing wider as quietly but confidently those holding the most at risk paper exit stage left.

But that's not all. We also noted the following:

The last go-round, the 1m1y curve flattened to 3bp. Though the curve is just 6bp away from that right now, it is beginning from a starting point that is 10bp flatter than one month prior to the 2011 debt ceiling. The securities that the market viewed as “at risk” traded with yields above year bills, hence our recommendation to sell the October 31 issue rather than the current one month bills.As of moments ago, the curve has gone beyond flat and into "further" as the 1M1Y just went negative.

[12]

We think that the curve has scope to flatten to zero, if not further, depending on how close to the wire negotiations come.

[13]

[13]http://www.zerohedge.com/print/479629

U.S. Government Shutdown - CFTC DSIO Contacts

U.S. Government Shutdown - CFTC DSIO Contacts

Due to the U.S. government shutdown, the CFTC has asked NFA to

send this information to our Members from Gary Barnett - CFTC Director,

Division of Swap Dealer and Intermediary Oversight:

As you know, the U.S. government has shut down due to a lack of

Congressional appropriations. The CFTC, as well as a number of other agencies,

have accordingly been shut down.

Under authority provided in the law, there are a limited number

of personnel that have been "excepted" and, as such, are permitted to

work to help protect life and public property. These personnel are available to

respond to emergency situations, and should be contacted if the need arises.

Please note that they are not authorized to respond to normal operating

activities.

In the event your firm has any circumstances arise where you

need to contact the CFTC for reasons other than normal operating activities,

for the Division of Swap Dealer and Intermediary Oversight, please contact the

individuals listed below.

|

Name |

Title |

Work |

Cell |

Email |

|

Gary Barnett |

Director |

202-418-5977 |

202-413-6181 |

gbarnett@cftc.gov |

|

Kevin Piccoli |

Deputy Director, Examinations |

646-746-9834 |

201-888-4936 |

kpiccoli@cftc.gov |

|

Erik Remmler |

Deputy Director, Registration and Compliance |

202-418-7630 |

202-725-3381 |

eremmler@cftc.gov |

|

Tom Smith |

Deputy Director, Capital and Margin |

202-418-5495 |

|

tsmith@cftc.gov |

You are receiving this message because you are either a

Member of National Futures Association (NFA) or you subscribed to the email

subscription list on NFA's website. If you are a subscriber, you can cancel or

change your subscription at any time, visit the Email Subscriptions page on our

website at http://www.nfa.futures.org/news/subscribe.asp.

US government shutdown: Barack Obama is presiding over the end of America's superpower status

For a country that is supposed to be the most powerful in the world,

the fact that Americans have today woken up to find large swathes of

their nation closed for business is humiliating.

• Reaction to shutdowns is overdone, but the Republicans will suffer

• Barack Obama is likely to come out on top

• 10 things affected by the US shutdown

• Dollar falls but markets steady on US shutdown

Thanks to President Barack Obama obduracy over his flagship healthcare policy, Democrats and Republicans have failed to reach agreement in Congress on the federal budget, forcing the US Government to close down for the first time in 17 years, with around 700,000 federal workers being placed on indefinite leave.

While the White House insists that essential areas of the government, such as the military, will continue to function, the shut down represents yet a further blow to the prestige of the Obama administration at a time when it is still reeling from its inept handling of the recent Syrian crisis.

There was a time not so long ago when the world looked to America for both political and economic leadership. But now that can no longer be taken for granted thanks to Mr Obama's inability to provide decisive leadership on either front.

Republicans rightly argue that by pressing ahead with Obamacare before the implications of the programme have been properly assessed risks adding to America's debt mountain at a time when the American economy is still recovering from the biggest economic crisis in recent history.

The emergence of Russia, meanwhile, as the main power broker in the Syria crisis has severely damaged America's standing as a major global player.

In short, the longer the Obama presidency continues, the more America's status as a superpower ebbs away.

http://blogs.telegraph.co.uk/news/concoughlin/100238900/us-government-shutdown-barack-obama-is-presiding-over-the-end-of-americas-superpower-status/

• Reaction to shutdowns is overdone, but the Republicans will suffer

• Barack Obama is likely to come out on top

• 10 things affected by the US shutdown

• Dollar falls but markets steady on US shutdown

Thanks to President Barack Obama obduracy over his flagship healthcare policy, Democrats and Republicans have failed to reach agreement in Congress on the federal budget, forcing the US Government to close down for the first time in 17 years, with around 700,000 federal workers being placed on indefinite leave.

While the White House insists that essential areas of the government, such as the military, will continue to function, the shut down represents yet a further blow to the prestige of the Obama administration at a time when it is still reeling from its inept handling of the recent Syrian crisis.

There was a time not so long ago when the world looked to America for both political and economic leadership. But now that can no longer be taken for granted thanks to Mr Obama's inability to provide decisive leadership on either front.

Republicans rightly argue that by pressing ahead with Obamacare before the implications of the programme have been properly assessed risks adding to America's debt mountain at a time when the American economy is still recovering from the biggest economic crisis in recent history.

The emergence of Russia, meanwhile, as the main power broker in the Syria crisis has severely damaged America's standing as a major global player.

In short, the longer the Obama presidency continues, the more America's status as a superpower ebbs away.

http://blogs.telegraph.co.uk/news/concoughlin/100238900/us-government-shutdown-barack-obama-is-presiding-over-the-end-of-americas-superpower-status/

US shutdown: a guide for non-Americans

Please explain what just happened

The US government has begun shutting its non-essential services. Hundreds of thousands of workers are waking up to the news that they are on unpaid leave, and they don't know how long it will last. The shutdown, triggered at midnight Washington time, will bring a range of services to a standstill across the world's largest economy.Why?

The Federal government had no choice. The US financial year ended on 30 September, and politicians on Capitol Hill have failed to agree a new budget for the 2013-2014 financial year. Even a 'stopgap' funding deal proved beyond them. Without a budget deal approved by both parts of Congress, the House of Representative and the Senate, there's no legal agreement to pay non-essential staff.Weren't they supposed to fix this last night?

They tried. A series of proposals rattled between the two sides on Monday night until midnight struck without a deal.Why couldn't they agree a deal?

Under the US constitution, the president cannot unilaterally bring in legislation. And despite weeks of talks, Republicans continue to include cuts and delays to Barack Obama's Affordable Care Act in the budget legislation they sent up to the Senate.The House of Representatives is controlled by the Republican Party, whose Tea Party movement remain deeply opposed to Obamacare. They tried to use the budget as leverage to crowbar changes to the Act. The Senate, which is under the control of Obama's Democrats, has stood firm.

Will the shutdown mean the entire US government grinds to a halt?

No, it's not an anarchist's (or libertarian's?) dream. Essential services, such as social security and Medicare payments, will continue.The US military service will keep operating, and Obama signed emergency legislation on Monday night to keep paying staff. But hundreds of thousands of workers at non-essential services, from Pentagon employees to rangers in national parks, will be told to take an unpaid holiday.

So what happens how?

US politicians are meeting again in Washington on Tuesday. Before Monday's session broke up, the lower house proposed a 'bipartisan committee' to consider a way forward. The Senate is expected to reject this proposal, sticking to its position that Obamacare cannot be unravelled. Federal staff will remain unpaid until a budget is agreed. A 'stopgap' funding plan is an option, but Obama appeared wary of that option, arguing that would simply guarantee a repeated fight in a few weeks' time.How much damage will it cause?

If people aren't getting paid, they won't spend as much in the shops. They may be unable to meet essential financial commitments, such as mortgages and credit card payments.Analysts at IHS Global Insight have calculated that it will knock $300m a day off US economic output (total US nominal GDP, or output, was around $16 trillion last year).

The key issue is how long it lasts. Moody's Analytics reckons that a two-week shutdown would cut 0.3% off US GDP, while a month-long outage would knock a whole 1.4% off growth.

When did this last happen?

It's the first shutdown since 1995-1996, when Bill Clinton and the House of Representatives (and its speaker, Newt Gingrich) also failed to agree on a budget to fund federal services. That row ran for 28 days (over two stages).But it was a more regular event in the 1980s, usually for a few days at a time. In total, the US government has partially shut down on 17 occasions before today.

Why doesn't it happen in other countries?

The shutdown situation is a product of the US democratic system. The president is both head of state and head of the federal government, without a guaranteed majority in either of the legislative bodies where new laws are debated and voted upon (because presidents, congressmen and women and senators are elected separately). The president can't simply ram laws through Capitol Hill.In Britain, for example, tax and spending policies are outlined in the budget, presented to parliament by the chancellor of the exchequer. These changes are brought into law in a finance bill in the House of Commons. That's in effect a confidence vote in the government, and even the most fractious backbench MP would balk at rebelling on it.

Finance bills are also one area where the elected House of Commons has the upper hand over the unelected House of Lords. The Lords have no power to reject a money bill; they can only delay it for a month.

How does the US shutdown row tie in with the debt ceiling battle?

They are separate issues, but the shutdown is raising fears over the debt ceiling.America has a legal limit on its borrowing of $16.7tn dollars, and it's likely to hit that point in mid-October.

If a deal isn't reached, then America would run out of borrowing room, meaning the world's biggest economy would default on its debts. Both problems need solving – and a shutdown is now eating into valuable time to fix the debt ceiling.

Why can't they just raise the debt ceiling?

Again, legislation is needed. Republicans are again trying to link the plan to Obamacare – arguing that the healthcare reforms are unaffordable.How are the markets reacting?

So far, there's no panic. Investors are calculating that the shutdown will be short. But prepare for nervousness as that debt ceiling deadline gets closer.The dollar, though, is being hit – dropping half a cent against major currencies.

This article originally confused the two Houses of Congress. Now corrected. Apologies. Thanks to readers who flagged up. GW.

http://www.theguardian.com/world/2013/sep/30/us-shutdown-explainer-non-americans

US government shut down

It's 12:01am, do you know where your government is?

[3]

[3]

[4]

[4]

Full Statement from The White House [4]:

Now it's getting serious...

- *WHITE HOUSE BUDGET OFFICE DIRECTS AGENCIES TO BEGIN SHUTDOWN

- *U.S. GOVERNMENT SHUTS DOWN FOR FIRST TIME IN 17 YEARS

[3]

[3] [4]

[4]Full Statement from The White House [4]:

MEMORANDUM FOR THE HEADS OF EXECUTIVE DEPARTMENTS AND AGENCIES

FROM: Sylvia M. Burwell, Director

SUBJECT: Update on Status of Operations

This memorandum follows the September 17,2013, Memorandum M-13-22, and provides an update on the potential lapse of appropriations.

Appropriations provided under the Consolidated and Further Continuing Appropriations Act, 2013 (P.L. 113-6) expire at 11:59 pm tonight. Unfortunately, we do not have a clear indication that Congress will act in time for the President to sign a Continuing Resolution before the end of the day tomorrow, October 1, 2013.

Therefore, agencies should now execute plans for an orderly shutdown due to the absence of appropriations. We urge Congress to act quickly to pass a Continuing Resolution to provide a short-term bridge that ensures sufficient time to pass a budget for the remainder of the fiscal year, and to restore the operation of critical public services and programs that will be impacted by a lapse in appropriations.

Agencies should continue to closely monitor developments, and OMB will provide further guidance as appropriate. We greatly appreciate your cooperation and the work you and your agencies do on behalf of the American people.

Now it's getting serious...

http://www.zerohedge.com/print/479603

Subscribe to:

Comments (Atom)