Monday, October 7, 2013

Stocks Slump Most In 6 Weeks As VIX Spikes Most In Over 3 Months

Weakness at the open last night extended lower during Europe's early

session - testing the 11-month trendline levels for the S&P 500. As

the US day session opened we bounced gloriously on the shoulders of

JPY-driven mania (and absolutely and utterly no news) but as usual that

lasted only as long as POMO and the markets stumbled along for the rest

of the day - until IB raised margins and then the high volume dump

started. All equity indices dived and VIX surged by its most in over 3 months above 19%.

Away from the schizophrenia in stocks, FX markets were quiet after an

early eruption in vol (USD -0.25% on the day); Treasury yields were

1-3bps lower (but off their best levels); Silver spiked near the open

(as did Gold) and held gains. Stocks close at their lows with an ugly dump.

Did IB just burst the bubble?

The S&P 500 closed below its 50DMA (down 10 of last 13 days) and is 3.5% off its all-time highs with the biggest 1-day drop in 6 weeks...

Bonds and Precious Metals outperforming post Shutdown (red line)...

VIX jumped its most in almost 4 months but was leading stocks lower earlier in the day. S&P futures are extending losses from the cash close.

Remember we are very close to that 11-month trendline break here...

The IB margin hike appeared to drive FX carry traders crazy and USDJPY collapsed (with JPY surging back below 97 to 7 week highs against the USD) - Abe will not be happy...

Charts: Bloomberg

Bonus Chart - Still think fundamentals (and not marginal leverage) drives stocks? Think again...

Did IB just burst the bubble?

The S&P 500 closed below its 50DMA (down 10 of last 13 days) and is 3.5% off its all-time highs with the biggest 1-day drop in 6 weeks...

Bonds and Precious Metals outperforming post Shutdown (red line)...

VIX jumped its most in almost 4 months but was leading stocks lower earlier in the day. S&P futures are extending losses from the cash close.

Remember we are very close to that 11-month trendline break here...

The IB margin hike appeared to drive FX carry traders crazy and USDJPY collapsed (with JPY surging back below 97 to 7 week highs against the USD) - Abe will not be happy...

Charts: Bloomberg

Bonus Chart - Still think fundamentals (and not marginal leverage) drives stocks? Think again...

The Reason For The Selloff: Microcap Traders Punk'd With 100% Interactive Brokers Margin Hike

The massive outperformance of the smallest and

most trashy companies over the past year, month, week, day etc...

stalled this afternoon. No news; no macro data; no change in the

situation in DC. So what was it? We suspect the answer lies in the all-time record levels of margin that we recently discussed holding up the US equity market. [6] Interactive

Brokers, it would appear, have seen the light and over the next week or

so will be increasing maintenance margin to 100% - effectively squeezing the leveraged momentum chasing muppets out of the market (or at the very least halving their risk-taking abilities [7]).

[8]

[8]

As we warned previously,

Margin Debt still contrarian bearish

[9]

[9]

Using closing basis monthly data, peaks in NYSE margin debt preceded peaks in the S&P 500 in 2007 and 2000. The March 2000 peak in NYSE margin debt of $278.5m preceded the August 2000 monthly closing price peak in the S&P 500 at 1517.68. The July 2007 margin debt peak of $381.4m preceded the October 2007 monthly closing price peak of 1549.38 for the S&P 500. Margin debt reached a record high of $384.4m in April and the S&P 500 continued to rally into July, August, and September. This is a similar set up to 2007 and 2000.

Bonus Chart - Margin debt: the long-term overlay

[10]

[10]

Going back to January 1959, margin debt and the S&P 500 have moved together for the most part. But leverage is a double edge sword and can exacerbate sell-offs, leading to deeper than expected market pullbacks.

Still think the "market" is driven by earnings or fundamentals? or just leverage and marginal credit expansion (shadow banking repo... etc.)?

[8]

[8]As we warned previously,

Margin Debt still contrarian bearish

[9]

[9]Using closing basis monthly data, peaks in NYSE margin debt preceded peaks in the S&P 500 in 2007 and 2000. The March 2000 peak in NYSE margin debt of $278.5m preceded the August 2000 monthly closing price peak in the S&P 500 at 1517.68. The July 2007 margin debt peak of $381.4m preceded the October 2007 monthly closing price peak of 1549.38 for the S&P 500. Margin debt reached a record high of $384.4m in April and the S&P 500 continued to rally into July, August, and September. This is a similar set up to 2007 and 2000.

Bonus Chart - Margin debt: the long-term overlay

[10]

[10]Going back to January 1959, margin debt and the S&P 500 have moved together for the most part. But leverage is a double edge sword and can exacerbate sell-offs, leading to deeper than expected market pullbacks.

Still think the "market" is driven by earnings or fundamentals? or just leverage and marginal credit expansion (shadow banking repo... etc.)?

Where Washington Should Go for Money: Havens

As the US government shutdown enters its 7th day

today it looks as if we shouldn’t be holding our breath unless we want

to go blue in the face in the hope that there might be a compromise or

somebody might actually cave in. Talk about sticking to your guns. The

Republicans won’t come out of it any better than Obama [16] will

in standing their ground and refusing to negotiate over all of this as

hundreds of thousands get laid off. So, they might have voted back pay.

But, will they also be voting that the rent and the mortgage payments

and the utility bills and the groceries also be paid at the end of the

month? Very doubtful. No point closing the gate after the horse has

bolted at all, is it Washington? If only they stopped wasting the

people’s money in their stand-off that is holding the US economy to

hostage. Getting rid of them all and starting afresh wouldn’t be a bad

idea after all. To those that might retort that the ones that follow

will be just as bad, should have faith that new brooms might be big

enough to sweep away the debris and make a thorough clear out in

politics these days.

Alternatively, if Washington is looking for money, then they could start looking where the real greenbacks are going, apart from being thrown out of the helicopter [17] to the people down below at the banks, it should be added with haste.

The top 20 US companies listed in Fortune 50 have set aside some $743 billion in profits in accounts located in offshore tax havens [19]. According to Nerdwallet Taxes that would bring in about$119 billion extra for the Treasury if the money were in the US in accounts.

Tax-haven talk only gets little more than a few Twitter comments that fall into oblivion or a televised debate at 3 a.m. in the morning that nobody watches. The companies with the offshore accounts have the politicians tied to them, since they are the ones that will make and break their political careers. Hardly going to bite the hand that feeds you, are you?

The US budget deficit stands at $642 billion. That could be reduced if the guys in Washington had the gumption to stand up and be counted and get the companies to pay taxes here in the US.

That money is offshore today and not in the USA. It is of no benefit to the country whatsoever being overseas, improving just the financial status of the companies and not the US economy. Certainly, the US budget deficit is far from their worries. But it amounts to 10% of Gross Domestic Product of the USA that is sitting somewhere in offshore profits for companies. That’s more than there should be at a time like this. In economic times of prosperity maybe it’s acceptable to do this sort of thing (but even that’s debatable).

Alternatively, if Washington is looking for money, then they could start looking where the real greenbacks are going, apart from being thrown out of the helicopter [17] to the people down below at the banks, it should be added with haste.

[18]

Washington: Offshore Profits?

Top 20 US Companies

The real money is in the havens, but none of the lawmakers or the politicians would ever dare mention that word for fear of alienating the few bucks that are left here in the USA.The top 20 US companies listed in Fortune 50 have set aside some $743 billion in profits in accounts located in offshore tax havens [19]. According to Nerdwallet Taxes that would bring in about$119 billion extra for the Treasury if the money were in the US in accounts.

Tax-haven talk only gets little more than a few Twitter comments that fall into oblivion or a televised debate at 3 a.m. in the morning that nobody watches. The companies with the offshore accounts have the politicians tied to them, since they are the ones that will make and break their political careers. Hardly going to bite the hand that feeds you, are you?

The US budget deficit stands at $642 billion. That could be reduced if the guys in Washington had the gumption to stand up and be counted and get the companies to pay taxes here in the US.

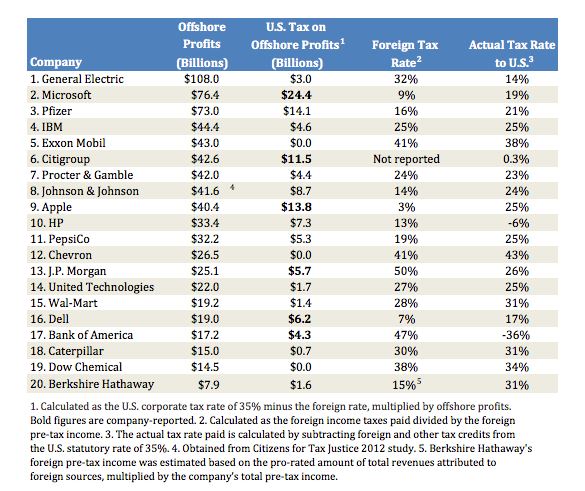

- 88% of the companies listed on the Fortune-50 list use tax havens to avoid paying taxes in their home country.

- 68% of offshore profits are generated by the top 10 companies on Fortune 50.

- General Electric for example has $108 billion in foreign earnings.

- Coming back to the US would bring in at least $3 billion in income tax for the US.

- Microsoft earns $76.4 offshore.

- Estimates show that it might pay anything around $24 billion in income tax to the Internal Revenue Service in the USA.

- Pfizer would end up paying $14.1 billion in tax to the IRS on its $73 billion in offshore profits.

- IBM pays $3 billion to foreign governments in taxation.

- It earns $44 billion in offshore profits and would end up paying an estimated $5 billion in the US.

[20]

Fortune 50 Companies Tax Havens

That money is offshore today and not in the USA. It is of no benefit to the country whatsoever being overseas, improving just the financial status of the companies and not the US economy. Certainly, the US budget deficit is far from their worries. But it amounts to 10% of Gross Domestic Product of the USA that is sitting somewhere in offshore profits for companies. That’s more than there should be at a time like this. In economic times of prosperity maybe it’s acceptable to do this sort of thing (but even that’s debatable).

- It’s not just the companies either; it’s private individuals and the world’s rich that have an estimated stash of $21 trillion hidden away in offshore accounts.

- By comparison, this is by far the greatest worry concerning the flight of capital from our home economies towards tax havens.

- That’s the conservative figure, since some estimate that it could be worth up to $32 trillion.

- That’s obviously more than the GDP of the USA and Japan added together.

- It’s only some 10 million people that have that money hidden away too.

- It’s not the shady banks and the wheeler-dealers of the finance world that have that money in their accounts either.

- It’s the bone fide banks of the world.

- The top banks such as Crédit Suisse and Goldman Sachs.

How long will those in Washington allow companies to sit on their stash of greenbacks while the country is running a deficit thus is in the trillions and they act as if it’s just a few bucks?

World's One-Time Largest FX Hedge Fund On Verge Of Shutdown

There is a reason why John Taylor of FX Concepts, founded in 1981 and

which once upon a time was the world's largest FX hedge fund, has kept a

very quiet profile lately despite his often bombastic prognostications

in 2011 and 2012: the firm may be on the verge of shut down following a

recent surge in redemptions resulting from woeful performance in the

past three years. FX Week reports that

AUM at FX Concepts "have continued to fall and the fund's chief

strategist confirms the board's ideas haven't worked so far." It adds

that the hedge fund is in "dangerous territory after the departure of

several major clients and falling assets under management, prompting the

firm's board to rethink its strategy, officials have confirmed." As a

result of a surge in redemptions, assets under management have declined

from a peak of $14.2 billion in 2007 to less than $1 billion this year,

having been at $4.5 billion in early 2012.

Earlier this year, FX Concepts saw the exit of two major clients – the Pennsylvania Public School Employees' Retirement System and the Bayerische Versorgungskammer pension fund – but further clients are understood to have left in recent weeks.

The culprit: the same affliction that is currently impairing all other hedge funds in a centrally-planned market - underperformance. FX Concepts' flagship multi-strategy fund is down 11.35% this year through August. It was down 14.47% in 2011 and down 3.11% in 2012. Overall, the fund's annualized returns since January 2002 are a paltry 3.74%, CNBC reports.

It also fell 14.47 percent in 2011 and lost 3.11 percent in 2012. The fund produced net annualized returns of 3.74 percent from January 2002 through this August.

FX Week adds:

The good news: the circus that are capital markets under Ben Bernanke is about to get that much funnier.

http://www.zerohedge.com/news/2013-10-07/worlds-one-time-largest-fx-hedge-fund-verge-shutdown

Earlier this year, FX Concepts saw the exit of two major clients – the Pennsylvania Public School Employees' Retirement System and the Bayerische Versorgungskammer pension fund – but further clients are understood to have left in recent weeks.

The culprit: the same affliction that is currently impairing all other hedge funds in a centrally-planned market - underperformance. FX Concepts' flagship multi-strategy fund is down 11.35% this year through August. It was down 14.47% in 2011 and down 3.11% in 2012. Overall, the fund's annualized returns since January 2002 are a paltry 3.74%, CNBC reports.

It also fell 14.47 percent in 2011 and lost 3.11 percent in 2012. The fund produced net annualized returns of 3.74 percent from January 2002 through this August.

FX Week adds:

But while Savage is hopeful that a rebound may take place and the firm will bounce back, the firm's fate may have been all but sealed when one of its last remaining large institutional clients, the San Fran Employees' Retirement System, voted on September 11 to pull its funds. CNBC's Lawrence Delevingne reports:"FX Concepts has lost a number of investors. We're still an ongoing business, but there is clearly a lot of pressure on us to rethink our strategy and come up with a way out. The performance of our headline fund has been very frustrating this year," says Bob Savage, chief strategist at FX Concepts in New York.

Savage, who joined FX Concepts a year ago after selling his research business to the firm, declined to name the latest client to leave, but confirmed that a number of major clients have been closing out their positions with FX Concepts. "We're winding down some positions in the headline fund in an organised and professional fashion," he says.

The sad but inevitable conclusion follows:"The Board approved reducing its currency overlay program target to zero percent," Huish said in an email to CNBC.com. "There is no intention at this time to redeploy the currency overlay mandate to any new currency managers."

San Francisco had more than $450 million with New York-based FX Concepts, a majority of the $661 million the firm reported managing overall in its latest Securities and Exchange Commission filing.

That redemption may have been fatal.

Sadly as more and more HFT algos move from the barren wasteland that is now stocks to dominate FX trading, yet another old-school, carbon-based investor is pulling out, meaning all those ridiculous moves we have grown to know and loathe in stocks land are about to dominate FX. The only problem is that 1000 pip moves in FX are not quite as easy to undo as a flash crash taking down any one individual stock, ETF or index to 0 or alternatively sending it to infinity.According to two people familiar with the situation, FX Concepts is in the process of liquidating its hedge funds and laid off most employees in recent weeks.

The good news: the circus that are capital markets under Ben Bernanke is about to get that much funnier.

http://www.zerohedge.com/news/2013-10-07/worlds-one-time-largest-fx-hedge-fund-verge-shutdown

Sunday, October 6, 2013

Germany’s Merkel Is Key to Currency-Trading Levy

German Chancellor Angela Merkel’s

choice of coalition partner will play a key role in deciding how far

the foreign-exchange market is burdened by a proposed

financial-transactions tax in 11 European Union states.

Merkel, who last year backed a European Commission plan for a broad-based tax on trades in stocks, bonds, derivatives and other assets, is due to start talks on forming a government with the opposition Social Democrats today. The SPD has pledged to make the delayed levy a high priority if a coalition with Merkel’s Christian Democratic bloc emerges. Currency traders are seeking an exemption from the tax, saying it would reduce liquidity and push up costs for companies and pension funds.

“Merkel is the key player and I think we’ll see Germany pushing their agenda and the other countries probably following suit,” Mark Persoff, a financial services tax partner at Ernst & Young LLP, said at the Bloomberg FX13 summit in London two days ago. “The impact on the foreign-exchange markets will obviously depend very closely on the political agreement on what the shape and scope of the FTT will be.”

The tax may increase some trading costs by as much as 4,700 percent, according to the London-based currency unit of the Global Financial Markets Association, which represents 22 firms responsible for 90 percent of the turnover in the $5.3 trillion-a-day foreign-exchange market.

Under the proposals, a levy of 10 basis points would be applied to stock and bond trades and 1 basis point on derivative transactions, with some exemptions for primary-market sales and trades with the European Central Bank.

While foreign-exchange trading for immediate delivery, so-called spot transactions, would be excluded from the levy to avoid restricting the movement of capital, the commission has not extended this exemption to other forms of currency trade. The tax, which is still under development, may be applied to forwards, swaps, non-deliverable forward contracts and options that make up two-thirds of the market.

The tax would typically increase transaction costs for currency-market participants by between 300 percent and 700 percent for corporates, and 700 percent to 1,500 percent for pension fund managers, the GFMA said. It based its estimates on a simulation of the proposed tax using last year’s currency activity by 15 end users, both within and outside the tax zone, and with annual transaction values varying between $4 billion and $400 billion. It assumed currency transaction costs to be the difference between an offer to buy a currency and an offer to sell it.

The EU Commission, the architect of the levy, says it may generate as much as 35 billion euros ($47 billion) annually. Implementing the tax was delayed six months to mid-2014 after its EU proponents failed to agree on which products to exclude.

Merkel’s Christian Democratic bloc needs a coalition partner to govern in Germany after falling short of an absolute majority as it won Sept. 22 elections with the highest share of the vote since 1990. Initial talks on a possible union with the Greens will be held on Oct. 10, Merkel’s party spokesman said on Oct. 2.

The proposals are a threat to the euro-area recovery because they may cramp businesses’ ability to hedge currency-market positions and act as a levy on trade into and out of the euro area, the GFMA says. Deutsche Bank estimates a direct cost of as much as 2.4 billion euros per year to importers and exporters in Germany, the region’s largest economy.

Lawyers for the Council of the European Union, which represents the executives of EU member states, say the tax plan goes too far and would discriminate against countries that don’t participate, according to an EU document. The legal service of the European Commission, which proposed the levy, stands by the plan and will offer a rebuttal, Emer Traynor, a spokeswoman for EU Tax Commissioner Algirdas Semeta, said on Sept. 10.

The FTT may not generate any revenue for the EU because of the damage to financial markets, ECB Governing Council member Christian Noyer said in May.

“The politicians, with the greatest of respect, need a little more education,” said Gavin Wells, chief executive officer of LCH.Clearnet Group Ltd.’s ForexClear service. “They’ve tried to raise money in a way that they don’t see the repercussions of.”

http://www.bloomberg.com/news/print/2013-10-03/merkel-is-key-to-currency-trading-levy-hsbc-says-is-terrifying.html

Merkel, who last year backed a European Commission plan for a broad-based tax on trades in stocks, bonds, derivatives and other assets, is due to start talks on forming a government with the opposition Social Democrats today. The SPD has pledged to make the delayed levy a high priority if a coalition with Merkel’s Christian Democratic bloc emerges. Currency traders are seeking an exemption from the tax, saying it would reduce liquidity and push up costs for companies and pension funds.

“Merkel is the key player and I think we’ll see Germany pushing their agenda and the other countries probably following suit,” Mark Persoff, a financial services tax partner at Ernst & Young LLP, said at the Bloomberg FX13 summit in London two days ago. “The impact on the foreign-exchange markets will obviously depend very closely on the political agreement on what the shape and scope of the FTT will be.”

The tax may increase some trading costs by as much as 4,700 percent, according to the London-based currency unit of the Global Financial Markets Association, which represents 22 firms responsible for 90 percent of the turnover in the $5.3 trillion-a-day foreign-exchange market.

Staggering, Terrifying

“The numbers are staggering,” Mark Johnson, global head of foreign-exchange cash trading at HSBC Holdings Plc, said at the event. Were the tax applied to currency derivatives called swaps, “the prospect of what it would do to people’s ability to fund is terrifying,” he said.Under the proposals, a levy of 10 basis points would be applied to stock and bond trades and 1 basis point on derivative transactions, with some exemptions for primary-market sales and trades with the European Central Bank.

While foreign-exchange trading for immediate delivery, so-called spot transactions, would be excluded from the levy to avoid restricting the movement of capital, the commission has not extended this exemption to other forms of currency trade. The tax, which is still under development, may be applied to forwards, swaps, non-deliverable forward contracts and options that make up two-thirds of the market.

The tax would typically increase transaction costs for currency-market participants by between 300 percent and 700 percent for corporates, and 700 percent to 1,500 percent for pension fund managers, the GFMA said. It based its estimates on a simulation of the proposed tax using last year’s currency activity by 15 end users, both within and outside the tax zone, and with annual transaction values varying between $4 billion and $400 billion. It assumed currency transaction costs to be the difference between an offer to buy a currency and an offer to sell it.

‘What Benefit?’

“It’s another piece of regulation that throws sand into a very efficient, well-oiled process,” said Edward Davey, managing director for strategic planning and development at CLS Bank, the operator of the world’s largest currency-trading settlement system. “You introduce new risks as well as incremental costs, and to what benefit?”The EU Commission, the architect of the levy, says it may generate as much as 35 billion euros ($47 billion) annually. Implementing the tax was delayed six months to mid-2014 after its EU proponents failed to agree on which products to exclude.

Merkel’s Christian Democratic bloc needs a coalition partner to govern in Germany after falling short of an absolute majority as it won Sept. 22 elections with the highest share of the vote since 1990. Initial talks on a possible union with the Greens will be held on Oct. 10, Merkel’s party spokesman said on Oct. 2.

‘Rational Action’

“Politics rather than rational action is crucial in this and one has to follow the politics extremely closely over the next few months,” said Oliver Harvey, a strategist at Deutsche Bank AG (DBK) in London. “The comments that come out from the next German government and the French government will begin to give us a very good idea of what sort of products will be covered.”The proposals are a threat to the euro-area recovery because they may cramp businesses’ ability to hedge currency-market positions and act as a levy on trade into and out of the euro area, the GFMA says. Deutsche Bank estimates a direct cost of as much as 2.4 billion euros per year to importers and exporters in Germany, the region’s largest economy.

Lawyers for the Council of the European Union, which represents the executives of EU member states, say the tax plan goes too far and would discriminate against countries that don’t participate, according to an EU document. The legal service of the European Commission, which proposed the levy, stands by the plan and will offer a rebuttal, Emer Traynor, a spokeswoman for EU Tax Commissioner Algirdas Semeta, said on Sept. 10.

Revenue Generation

The 11 nations planning to apply a common FTT are: Austria, Belgium, Estonia, France, Germany, Greece, Italy, Portugal, Slovenia and Slovakia and Spain, according to the commission’s website. The U.K, Denmark and Luxembourg and Sweden rejected the plan.The FTT may not generate any revenue for the EU because of the damage to financial markets, ECB Governing Council member Christian Noyer said in May.

“The politicians, with the greatest of respect, need a little more education,” said Gavin Wells, chief executive officer of LCH.Clearnet Group Ltd.’s ForexClear service. “They’ve tried to raise money in a way that they don’t see the repercussions of.”

http://www.bloomberg.com/news/print/2013-10-03/merkel-is-key-to-currency-trading-levy-hsbc-says-is-terrifying.html

Columbia Economist Dr. Jeffrey Sachs speaks candidly on monetary reform

"Everybody, sooner or later, sits down to a banquet of consequences." Robert Louis Stevenson

"They don't have intelligence. They have what I call thintelligence. They see the immediate situation. They think narrowly and they call it 'being focused.' They don't see the surroundings. They don't see the consequences." Michael Crichton

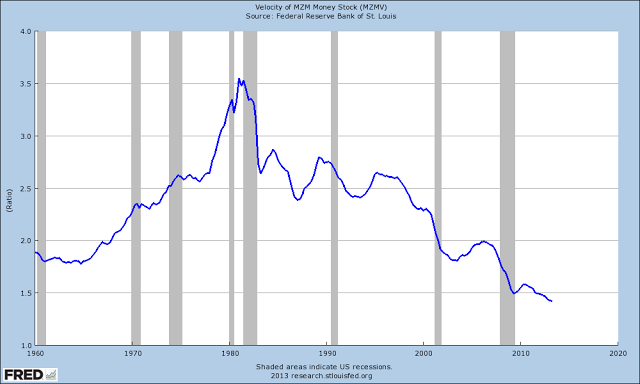

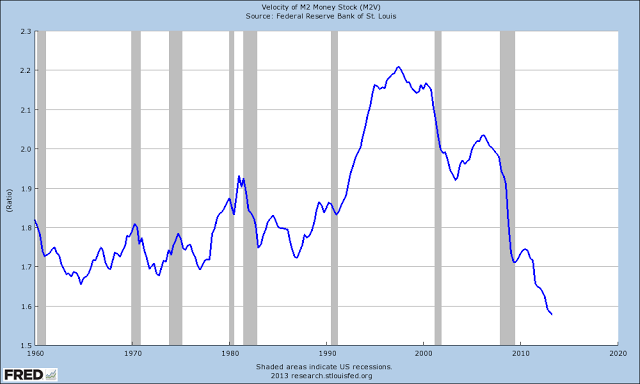

The Fed is faced with a problem that is best represented by the first two charts below.

Velocity of money is a simple ratio measure of money supply and GNP. It intends to represent the number of times a unit of money is exchanged in a transaction over a period of time.

As you can see, the velocity of the two broad money supply measures is dropping to historic lows.

Is this because the great mass of people are 'hoarding money,' which implies that one should lower real interest on savings, even taking them more deeply into the negative through monetary inflation in order to encourage spending through fear of de facto confiscation?

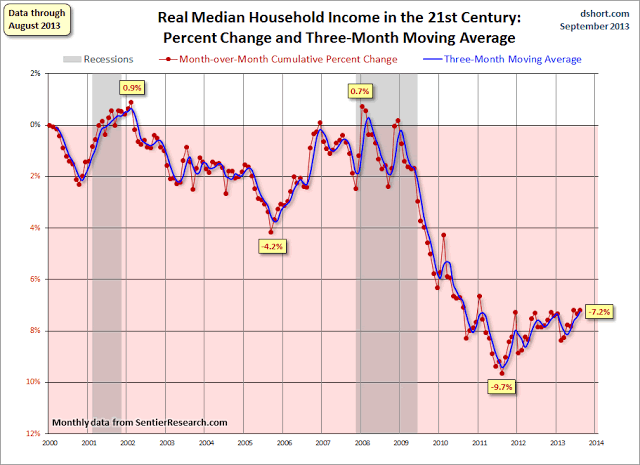

The third chart gives some insight into the true nature of the economic problem. Most of the income gains this century and for the past two or three decades of the past have been flowing to the top few percent of US households. The median household, the middle if you will, has been steadily losing ground in large part to Fed and political policy decisions driven by a mistaken ideology and a top down or trickle down approach to prosperity.

If the Fed pursues monetary inflation, without taking strong steps, even through the use of its bully pulpit and actions as regulator, to correct the severe policy imbalances that lopsidedly favor the wealthy financiers, it will drive the US middle class over an economic cliff and destroy the very system which it is attempting to save.

That is the basis of the tragic policy error of the Fed and the ruling class. Jeffrey Sachs has noted it in a recent talk to the Philly Fed shown below, and Bill Black has some particularly scathing words today for the 'Hyper-meritocracy Led by Criminal Morons.' I might have said self-delusional narcissists or even sociopaths rather than morons. The majority of those who enable the abuse of power are merely careerists.

One can make the strong case that the primary responsibility for this is in the political leadership. But one cannot also deny that as policy influencer and regulator the Fed has favored, quite actively, the growth of imbalances and social and economic injustice by pursuing a blind allegiance to a mistaken theory of deregulation and oligopoly of banking capital.

An audacious oligarchy needs someone to rescue them from themselves. And this will not be an easy task because the system is corrupted and the powerful have been blinded by greed. The current political deadlock in Washington is a symptom of the problem. There is always an element that believes in a long range plan consisting of repression as required, disinformation, and plundering the weak.

The monied class do not 'create jobs.' Genuine organic and systemic demand for good and services creates jobs, and those who have the means respond to that demand. It is a virtuous cycle that begins with consumer demand, and the willingness and the ability to pay for it. Yes there may be a role for inorganic demand such as stimulus to 'kick start' an economy caught in a policy error trap, but it is the reforms that allow for organic growth that make it sustainable.

Moving offshore to find new demand for markets while abandoning one's domestic base to decline and failure, in the true colonial fashion of past economic empires, is a form of neurotic failure. It often lights a fire in men's minds, and becomes a sort of self-fulfilling cultural suicide. And perhaps this is embodied in the latest corporatist deal which is the infamously secretive Trans-Pacific Partnership.

How fitting that, having overturned most of the financial reforms of the past century, we stand here now on the brink, on the 75th anniversary of the New Deal, with essentially the same set of problems facing us that brought the world down so low in The Great Depression, and opened the door to the madness that followed.

"I believe we have a crisis of values that is extremely deep, because the regulations and the legal structures need reform. But I meet a lot of these people on Wall Street on a regular basis right now. I’m going to put it very bluntly. I regard the moral environment as pathological...

If you look at the campaign contributions, which I happened to do yesterday for another purpose, the financial markets are the number one campaign contributors in the U.S. system now. We have a corrupt politics to the core, I’m afraid to say, and no party is – I mean there's – if not both parties are up to their necks in this. This has nothing to do with Democrats or Republicans. It really doesn’t have anything to do with right wing or left wing, by the way. The corruption is, as far as I can see, everywhere.

But what it's led to is this sense of impunity that is really stunning and you feel it on the individual level right now. And it's very very unhealthy, I have waited for four years, five years now to see one figure on Wall Street speak in a moral language.

And I've have not seen it once. And that is shocking to me. And if they won't, I've waited for a judge, for our president, for somebody, and it hasn't happened. And by the way it's not going to happen any time soon, it seems...

The final point, of course, is separating the politicians from the crooks, but maybe that’s so close together that they can’t actually be separated. Maybe it’s just the same community."

Jeffrey Sachs, Fixing the Banking System For Good, Philadelphia Fed, April 17th, 2013

United States v. $35,651.11 (The cash in the account of Schott's Supermarket) Feds Seize Family Grocery Store’s Entire Bank Account

Can the government use civil forfeiture to take

your money when you have done nothing wrong—and then pocket the

proceeds? The IRS thinks so.

For over 30 years, Terry Dehko has successfully run a

grocery store in Fraser, Mich., with his daughter Sandy. In January

2013, without warning, the federal government used civil forfeiture to

seize all of the money from the Dehkos’ store bank account (more than

$35,000) even though they’ve done absolutely nothing wrong. Their

American Dream is now a nightmare.

Federal civil forfeiture law features an appalling lack of

due process: It empowers the government to seize private property from

Americans without ever charging, let alone convicting, them of a

crime. Perversely, the government then pockets the proceeds while

providing no prompt way to get a court to review the seizure.

On September 25, 2013, Terry and Sandy teamed up with the

Institute for Justice to fight back in federal court. A victory will

vindicate not just their right to be free from abusive forfeiture

tactics, but the right of every American not to have their property

wrongfully seized by government.

The Obamacare Deception: A manual

The article below is the most comprehensive analysis available of

“Obamacare” – the Patient Protection and Affordable Care Act. The

author, a knowledgeable person who wishes to remain anonymous, explains

how Obamacare works for the insurance companies but not for you.

Obamacare was formulated on the concept of health care as a commercial commodity and was cloaked in ideological slogans such as “shared responsibility,” “no free riders” and “ownership society.” These slogans dress the insurance industry’s raid on public resources in the cloak of a “free market” health care system.

http://globalintelhub.com/obamacare-deception/

Obamacare was formulated on the concept of health care as a commercial commodity and was cloaked in ideological slogans such as “shared responsibility,” “no free riders” and “ownership society.” These slogans dress the insurance industry’s raid on public resources in the cloak of a “free market” health care system.

http://globalintelhub.com/obamacare-deception/

Greece Considering Confiscation Of Private Assets

The last time we opined on the possibility of a

Cyprus-style "bail-in" in Greece, which is essentially a

legally-mandated confiscation of private sector assets held hostage by

the local financial system, until such time as the balance sheet of said

financial system is viable, we were joking [9]. Well, not really joking.

But not even we thought that a banking sector "bail in", in which unsecured bank liabilities, which include bonds and of course deposits, are used as a matched source of extinguishment of non-performing bad debt "assets" could spread to the broader economy, and specifically to unencumbered private sector assets. Alas, this is precisely what Greece, which is desperately to delay the inevitable and announce it needs not only a third but fourth bailout, appears keen on doing.

As Kathimerini reports [10], the Greek Labor and Social Insurance Ministry is "seriously considering drastic measures in order to obtain the social security contributions owed by enterprises and to avoid having to slash pensions and benefits." What drastic measures? "The ministry is planning to force companies to pay up or face having their assets seized, so that the 14 billion euros of contributions due can be recouped."

After all, it's only "fair."

Kathimerini is kind enough to layout the clear-cut problems with this plan which will further crush any potential rebound in the Greek economy:

However, none of the above gives us more confidence that things in Greece are about to go from horrifying to nightmarish, than the following FT story [11]: "John Paulson and a clutch of bullish US hedge funds are leading a charge into Greek banks, confident that Greece, long seen as the weakest economy of the eurozone periphery, is on the turn."

Right. A 360-degree turn.

The good news: at least the Greek government will have a lot of "greater fool" assets to pick and choose from when the confiscation hammer hits.

But not even we thought that a banking sector "bail in", in which unsecured bank liabilities, which include bonds and of course deposits, are used as a matched source of extinguishment of non-performing bad debt "assets" could spread to the broader economy, and specifically to unencumbered private sector assets. Alas, this is precisely what Greece, which is desperately to delay the inevitable and announce it needs not only a third but fourth bailout, appears keen on doing.

As Kathimerini reports [10], the Greek Labor and Social Insurance Ministry is "seriously considering drastic measures in order to obtain the social security contributions owed by enterprises and to avoid having to slash pensions and benefits." What drastic measures? "The ministry is planning to force companies to pay up or face having their assets seized, so that the 14 billion euros of contributions due can be recouped."

After all, it's only "fair."

Kathimerini is kind enough to layout the clear-cut problems with this plan which will further crush any potential rebound in the Greek economy:

Aside from the obvious, namely that this "plan" will be merely the latest disaster to hit the long-suffering Greek economy, now caught in the worst depression in history, and where greedy and corrupt politicians will promptly "confiscate" whatever benefits there are to have been made from this confiscation plan (however instead of accusing corruption all blame will be once again fall on (f)austerity), the greater problem is that any entrepreneurial confidence that Greece just may be a sound place to do business, has just gone out of the window as nobody will know if they are safe from arbitrary persecution, and subject to a wholesale asset confiscation at any moment in time.While this amount – equal to 8 percent of the country’s gross domestic product – may be easy to calculate on paper, it is virtually impossible to collect even if the state attempts to confiscate all the real estate properties of debtors and the debts of third parties to them.

The ministry has been forced to consider asset repossessions as a result of the very poor state of social security funds. The fiscal gap expected at the end of the year from social security will at best be equal to 1.06 billion euros. This also constitutes a bad start for next year, too, when the budget will also provide for a reduction in state subsidies to social security funds by 1.8 billion euros.

However, none of the above gives us more confidence that things in Greece are about to go from horrifying to nightmarish, than the following FT story [11]: "John Paulson and a clutch of bullish US hedge funds are leading a charge into Greek banks, confident that Greece, long seen as the weakest economy of the eurozone periphery, is on the turn."

Right. A 360-degree turn.

The good news: at least the Greek government will have a lot of "greater fool" assets to pick and choose from when the confiscation hammer hits.

Welcome to the Era of Unlimited Government!

This article appeared at The Daily Beast on

Tuesday, October 1, 2013.

Read it there.

It’s a telling coincidence that the latest scandalous revelation about the National Security Agency (NSA) is hitting the front pages just as the enrollment period specified by the Affordable Care Act (ACA, a.k.a. Obamacare) is getting started.

Each of these things underscores different but related aspects of the virtually unlimited state that has ruined the peaceful slumber of libertarian-minded Americans for decades. Whether we’re talking about surveilling citizens without any sort of serious legal oversight or forcing them to participate in economic activity in the name of health care über alles, the answer always seems to favor the growth and power of the state to control more and more aspects of our lives. Is it any wonder that a record-high percentage of Americans think the federal government is too powerful?

In an explosive story, The New York Times detailed the ways in which the NSA, which was originally supposed to spy on communications among foreign agents and provide intelligence on threats posed by noncitizen actors and governments, is increasingly focused on domestic activities. Since 2010, according to an NSA memo obtained by the Times, “The agency was authorized [by officials in the Obama administration] to conduct ‘large-scale graph analysis on very large sets of communications metadata without having to check foreignness’ of every e-mail address, phone number or other identifier.”

Through a process known as “contact chaining,” the NSA is able to suck up all sorts of email addresses, phone numbers, social-media-network information, and more without regard to the physical location or citizenship of each data point. The agency, reports the Times, then “enriches” that metadata “with material from public, commercial and other sources, including bank codes, insurance information, Facebook profiles, passenger manifests, voter registration rolls and GPS location information,” and more. The result, as George Washington University law professor Orin Kerr puts it, is “the digital equivalent of tailing a suspect.”

The only restriction on the practice appears to be that the NSA must make a claim that their data-gathering serves a foreign-policy justification. Which is never a problem for the agency since, as a spokesperson told the Times, “All of NSA’s work has a foreign intelligence purpose.” While it’s clear that the contact chaining results in vast webs of information that rope in Americans completely uninvolved in terrorism, the NSA refuses to divulge any relevant numbers or incidents.

The NSA originally sought such unrestricted use of metadata and other information involving Americans back in 1999 but was rebuffed due to concerns that it was not legal under the Foreign Intelligence Surveillance Act (FISA), which governs the agency. Legal opinions within presidential administrations—and after the 9/11 attacks—change, though, and there’s some indirect evidence that the NSA may have engaged in contact chaining during the Bush years. Despite his stated interest in protecting civil liberties, Barack Obama has disappointed even his staunchest defenders when it comes to constitutional limits on executive power and the surveillance state. Indeed, he has upped the ante from the Bush administration by claiming not simply the right to hold U.S. citizens indefinitely without charging them but the right to unilaterally kill them.

The one thing we know from past experience is that the NSA has consistently abused its powers. During the Vietnam War, for instance, the agency routinely intercepted communications outside its legal purview and ran an illegal operation known as “Minaret” that spied on anti-war figures ranging from boxer Muhammad Ali to syndicated humorist Art Buchwald to Sen. Frank Church (D-ID). The latter would chair hearings in the 1970s exposing massive illegal and improper actions by the NSA, FBI, and CIA, giving rise to FISA, which was passed in 1978. In 2008, ABC News reported on NSA operatives listening in on and sharing recordings of phone-sex calls between U.S. troops and their spouses in the States and routinely listening in on Red Cross and other relief workers as well.

The legal justification for the NSA’s actions, according to the Times, is the 1979 Supreme Court ruling that found “no expectation of privacy about what numbers they had called.” A more recent yet equally unfortunate Supreme Court decision—the 2012 one upholding President Obama’s health-care-reform plan—is the reason that the Obamacare exchanges are theoretically going to be up and running come October 1 (pay no attention to the massive and mounting delays with the program).

The clearest argument against Obamacare was always the specifically libertarian one against the individual mandate, or the idea that the government could force you not only to follow certain rules if you engaged in commercial or economic activity but that it could force you to engage in commercial or economic activity in the first place.

Like most federal laws dealing with powers specifically enumerated in the Constitution, the legislative reasoning behind the mandate is derived from the commerce clause, which gives Congress the right to “regulate commerce ... among the several states.” Once interpreted by legislators and courts alike in a narrow sense, at least since the 1942 ruling Wickard v. Filburn, the commerce clause has been interpreted to allow the federal government virtually unlimited power. Indeed, during her confirmation hearing, Justice Elena Kagan granted that she believed Congress could legitimately pass a law mandating that people buy broccoli. While it would be a “dumb law,” she said it would be constitutional. (This short video,“Wheat, Weed, and Obamacare” is a concise and engaging discussion of differing views regarding the commerce clause.)

In the decision affirming the individual mandate, John Roberts effectively rewrote the legislation by saying it could be enforced through Congress’s taxing power rather than on commerce-clause grounds. Some libertarian-minded observers took solace in that fact, but the net result is the same: When the government tells you to jump, we’re legally bound to say, “How high?”

Conventional politics in terms of Team Red versus Team Blue offer little insight into the current situation, since by and large Republicans and Democrats are fine with a massive and growing state as long as most of the spending and edicts work to the benefit of each group’s favored constituencies. Whatever lip service they pay to the individual, neither party betrays much interest in limiting the size and scope of government. Indeed, it’s not an accident that Obamacare—including the individual mandate—was inspired by a proposal floated back in the ’90s by the GOP front group the Heritage Foundation. And it’s not an accident that when it comes to spending, regulating, sidestepping executive branch limits, and dropping bombs, Barack Obama resembles no one so much as George W. Bush.

Which is something to think about come tomorrow, when a new fiscal year starts without a budget because House Republicans want to spend $3.5 trillion and Senate Democrats want to spend $3.7 trillion (spending in 2001 came in at about $1.9 trillion in nominal dollars). Indeed, it’s something to think about whether you are excited to check out Obamacare’s insurance exchanges or you view their very existence as simply the latest mile marker on the road to serfdom.

And here’s something else to think about: there’s a reason why a record-high 60 percent of Americans agree that the government has too much power and why libertarian attitudes are on the rise (even among GOP legislators, of all places!). It must be because people are actually following the news, most of which is pretty appalling, even (especially?) when you get past the partisan spectacle of it all.

This article appeared at The Daily Beast on Tuesday, October 1, 2013. Read it there.

It’s a telling coincidence that the latest scandalous revelation about the National Security Agency (NSA) is hitting the front pages just as the enrollment period specified by the Affordable Care Act (ACA, a.k.a. Obamacare) is getting started.

Each of these things underscores different but related aspects of the virtually unlimited state that has ruined the peaceful slumber of libertarian-minded Americans for decades. Whether we’re talking about surveilling citizens without any sort of serious legal oversight or forcing them to participate in economic activity in the name of health care über alles, the answer always seems to favor the growth and power of the state to control more and more aspects of our lives. Is it any wonder that a record-high percentage of Americans think the federal government is too powerful?

In an explosive story, The New York Times detailed the ways in which the NSA, which was originally supposed to spy on communications among foreign agents and provide intelligence on threats posed by noncitizen actors and governments, is increasingly focused on domestic activities. Since 2010, according to an NSA memo obtained by the Times, “The agency was authorized [by officials in the Obama administration] to conduct ‘large-scale graph analysis on very large sets of communications metadata without having to check foreignness’ of every e-mail address, phone number or other identifier.”

Through a process known as “contact chaining,” the NSA is able to suck up all sorts of email addresses, phone numbers, social-media-network information, and more without regard to the physical location or citizenship of each data point. The agency, reports the Times, then “enriches” that metadata “with material from public, commercial and other sources, including bank codes, insurance information, Facebook profiles, passenger manifests, voter registration rolls and GPS location information,” and more. The result, as George Washington University law professor Orin Kerr puts it, is “the digital equivalent of tailing a suspect.”

The only restriction on the practice appears to be that the NSA must make a claim that their data-gathering serves a foreign-policy justification. Which is never a problem for the agency since, as a spokesperson told the Times, “All of NSA’s work has a foreign intelligence purpose.” While it’s clear that the contact chaining results in vast webs of information that rope in Americans completely uninvolved in terrorism, the NSA refuses to divulge any relevant numbers or incidents.

The NSA originally sought such unrestricted use of metadata and other information involving Americans back in 1999 but was rebuffed due to concerns that it was not legal under the Foreign Intelligence Surveillance Act (FISA), which governs the agency. Legal opinions within presidential administrations—and after the 9/11 attacks—change, though, and there’s some indirect evidence that the NSA may have engaged in contact chaining during the Bush years. Despite his stated interest in protecting civil liberties, Barack Obama has disappointed even his staunchest defenders when it comes to constitutional limits on executive power and the surveillance state. Indeed, he has upped the ante from the Bush administration by claiming not simply the right to hold U.S. citizens indefinitely without charging them but the right to unilaterally kill them.

The one thing we know from past experience is that the NSA has consistently abused its powers. During the Vietnam War, for instance, the agency routinely intercepted communications outside its legal purview and ran an illegal operation known as “Minaret” that spied on anti-war figures ranging from boxer Muhammad Ali to syndicated humorist Art Buchwald to Sen. Frank Church (D-ID). The latter would chair hearings in the 1970s exposing massive illegal and improper actions by the NSA, FBI, and CIA, giving rise to FISA, which was passed in 1978. In 2008, ABC News reported on NSA operatives listening in on and sharing recordings of phone-sex calls between U.S. troops and their spouses in the States and routinely listening in on Red Cross and other relief workers as well.

The legal justification for the NSA’s actions, according to the Times, is the 1979 Supreme Court ruling that found “no expectation of privacy about what numbers they had called.” A more recent yet equally unfortunate Supreme Court decision—the 2012 one upholding President Obama’s health-care-reform plan—is the reason that the Obamacare exchanges are theoretically going to be up and running come October 1 (pay no attention to the massive and mounting delays with the program).

The clearest argument against Obamacare was always the specifically libertarian one against the individual mandate, or the idea that the government could force you not only to follow certain rules if you engaged in commercial or economic activity but that it could force you to engage in commercial or economic activity in the first place.

Like most federal laws dealing with powers specifically enumerated in the Constitution, the legislative reasoning behind the mandate is derived from the commerce clause, which gives Congress the right to “regulate commerce ... among the several states.” Once interpreted by legislators and courts alike in a narrow sense, at least since the 1942 ruling Wickard v. Filburn, the commerce clause has been interpreted to allow the federal government virtually unlimited power. Indeed, during her confirmation hearing, Justice Elena Kagan granted that she believed Congress could legitimately pass a law mandating that people buy broccoli. While it would be a “dumb law,” she said it would be constitutional. (This short video,“Wheat, Weed, and Obamacare” is a concise and engaging discussion of differing views regarding the commerce clause.)

In the decision affirming the individual mandate, John Roberts effectively rewrote the legislation by saying it could be enforced through Congress’s taxing power rather than on commerce-clause grounds. Some libertarian-minded observers took solace in that fact, but the net result is the same: When the government tells you to jump, we’re legally bound to say, “How high?”

Conventional politics in terms of Team Red versus Team Blue offer little insight into the current situation, since by and large Republicans and Democrats are fine with a massive and growing state as long as most of the spending and edicts work to the benefit of each group’s favored constituencies. Whatever lip service they pay to the individual, neither party betrays much interest in limiting the size and scope of government. Indeed, it’s not an accident that Obamacare—including the individual mandate—was inspired by a proposal floated back in the ’90s by the GOP front group the Heritage Foundation. And it’s not an accident that when it comes to spending, regulating, sidestepping executive branch limits, and dropping bombs, Barack Obama resembles no one so much as George W. Bush.

Which is something to think about come tomorrow, when a new fiscal year starts without a budget because House Republicans want to spend $3.5 trillion and Senate Democrats want to spend $3.7 trillion (spending in 2001 came in at about $1.9 trillion in nominal dollars). Indeed, it’s something to think about whether you are excited to check out Obamacare’s insurance exchanges or you view their very existence as simply the latest mile marker on the road to serfdom.

And here’s something else to think about: there’s a reason why a record-high 60 percent of Americans agree that the government has too much power and why libertarian attitudes are on the rise (even among GOP legislators, of all places!). It must be because people are actually following the news, most of which is pretty appalling, even (especially?) when you get past the partisan spectacle of it all.

This article appeared at The Daily Beast on Tuesday, October 1, 2013. Read it there.

A Depressed Bank Of America Predicts "Agreement Is Almost Impossible As Long As Obamacare Is On The Table"

Bank of America's latest forecast on the

resolution, or lack thereof, of the government shutdown, which now seems

virtually certain to last at least one week into Monday night, when the

House and Senate return to work, is hardly encouraging. The bank's base

case now calls for "either a two-week shutdown or for multiple

shutdowns." Additional, BofA has now cut its Q3 GDP forecast from 2.0%

to 1.7% and from 2.5% to 2.0% for 4Q. It gets worse: "Much worse

outcomes are possible. In our view, agreement is almost impossible as

long as the Affordable Care Act is on the table." Finally, and

what ties it all together, is that as a result of the lack of

"government data", BAC now expects the Fed to delay tapering to their

January meeting, or later. Which may well have been the much needed

alibi all along to delayed tapering until 2014.

From Bank of America

The shutdown of the government has created a double dose of uncertainty. It comes at a time when the economy may be about to shift from second gear into third gear, triggering the beginning of a Fed exit. The longer the shutdown and the longer the games of brinkmanship, the longer the delay in that growth pick up. At the same time, the shutdown means almost no official data releases. In the face of this uncertainty, the Fed’s motto is: when in doubt, do nothing.

Our base case is now for either a two-week shutdown or for multiple shutdowns. We have cut our forecast for GDP growth from 2.0% to 1.7% for 3Q and from 2.5% to 2.0% for 4Q. We also expect the Fed to delay tapering to their January meeting, or later.

Much worse outcomes are possible. In our view, agreement is almost impossible as long as the Affordable Care Act is on the table. The President is very unlikely to agree to cuts in his proudest legislative achievement. Moreover, in our view, he is in a strong negotiating position vis-à-vis House Republicans. He does not have to run for office again, while they are all up for reelection next fall. Surveys show Americans strongly disapprove of the shutdown and put more blame on Republicans than Democrats. Surveys also show that Americans think it is not worth shutting the government down as a means to end the ACA. On the other hand, most Republicans strongly oppose the ACA and many support shutdowns as a means to an end. Ultimately we expect Republicans to drop the effort to weaken the ACA, but this could take a while.

It is very hard to measure the impact of the shutdown on the economy, although every economist has to come up with numbers. Most of the press reports seem very much on the low side, in our view. The direct impact is easy to calculate. The Clinton-Gingrich shutdown directly reduced GDP by about 0.3% in 4Q 1995 and a two-week shutdown today would have a similar impact. However, we think these narrow estimates are wishful thinking. There will likely be numerous spillover effects and, even if the shutdowns are brief, multiple brinkmanship moments will take a toll on confidence. We hear a lot of talk about buying on dips, but getting the timing right could be very tough.

[7]

[7]

From Bank of America

The shutdown of the government has created a double dose of uncertainty. It comes at a time when the economy may be about to shift from second gear into third gear, triggering the beginning of a Fed exit. The longer the shutdown and the longer the games of brinkmanship, the longer the delay in that growth pick up. At the same time, the shutdown means almost no official data releases. In the face of this uncertainty, the Fed’s motto is: when in doubt, do nothing.

Our base case is now for either a two-week shutdown or for multiple shutdowns. We have cut our forecast for GDP growth from 2.0% to 1.7% for 3Q and from 2.5% to 2.0% for 4Q. We also expect the Fed to delay tapering to their January meeting, or later.

Much worse outcomes are possible. In our view, agreement is almost impossible as long as the Affordable Care Act is on the table. The President is very unlikely to agree to cuts in his proudest legislative achievement. Moreover, in our view, he is in a strong negotiating position vis-à-vis House Republicans. He does not have to run for office again, while they are all up for reelection next fall. Surveys show Americans strongly disapprove of the shutdown and put more blame on Republicans than Democrats. Surveys also show that Americans think it is not worth shutting the government down as a means to end the ACA. On the other hand, most Republicans strongly oppose the ACA and many support shutdowns as a means to an end. Ultimately we expect Republicans to drop the effort to weaken the ACA, but this could take a while.

It is very hard to measure the impact of the shutdown on the economy, although every economist has to come up with numbers. Most of the press reports seem very much on the low side, in our view. The direct impact is easy to calculate. The Clinton-Gingrich shutdown directly reduced GDP by about 0.3% in 4Q 1995 and a two-week shutdown today would have a similar impact. However, we think these narrow estimates are wishful thinking. There will likely be numerous spillover effects and, even if the shutdowns are brief, multiple brinkmanship moments will take a toll on confidence. We hear a lot of talk about buying on dips, but getting the timing right could be very tough.

[7]

[7]Friday, October 4, 2013

Swiss regulator investigates banks over foreign exchange deals

Switzerland's financial regulator is

investigating possible manipulation of foreign exchange rates at several

Swiss financial institutions.

The regulator, FINMA, said several banks, including some from outside Switzerland, could be implicated.It is coordinating the investigation closely with authorities in other countries.

It would give no further details on the investigations or the banks potentially involved.

Swiss Banking, the group that represents the nation's banks, said it had no further information.

The Swiss announcement follows reports in June that the British regulator, the Financial Conduct Authority (FCA), was looking into whether traders manipulated benchmark foreign-exchange rates to increase profits.

This followed an investigation by Bloomberg News that found that dealers shared information and used client orders to move the rates.

The FCA, which does not announce its investigations, only its enforcement actions, said: "We are aware of the allegations and we have been speaking to relevant parties."

London is by far the world's biggest market for foreign currency trading, with 41% of global turnover, according to the Bank for International Settlements.

New York has a 19% share, followed by Singapore, Tokyo and Hong Kong.

Switzerland accounts for 3.2% of foreign exchange trading.

http://www.bbc.co.uk/news/business-24397525

Thursday, October 3, 2013

Subscribe to:

Comments (Atom)