A sudden awakening in markets that risk is a real thing - no matter how much liquidity central banks puke into the financial system - has sparked a massive drop in Treasury yields (and stocks have started to catch down to that reality)...

Source: Bloomberg

And as Nomura's head of cross-strategy Charlie McElligott notes, this morning sees this getting worse fast...

The 2020 resumption of the “Everything Duration” rally violently escalates to start the week as the Coronavirus contagion snowballs, with the already brutal short-squeeze in USTs experienced last week now blowing through stop-losses (10Y yields tagging1.60 earlier) and seeing UST futures across the curve at best levels since Fall ’19, with risk-assets sharply lower (Crude -3.0%) on negative global growth impact fears.

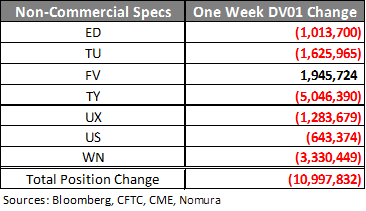

Friday’s latest COT / TFF data analysis from Ryan Plantz showed even more aggressive Spec selling of Duration in the last weekly reporting period of -$11mm / 01, which brings the total sold since November to a shocking -$110mm / 01—with WN contract an astounding 55% of that aggregate Duration selling (-$61mm alone), and Spec Shorts a remarkable 37% of the OI in WN, an all-time high.

Incredibly, 5Y Real Yields are now back to the most negative they’ve been since April 2017 - acting as a major bullish catalyst for Gold and Bitcoin.

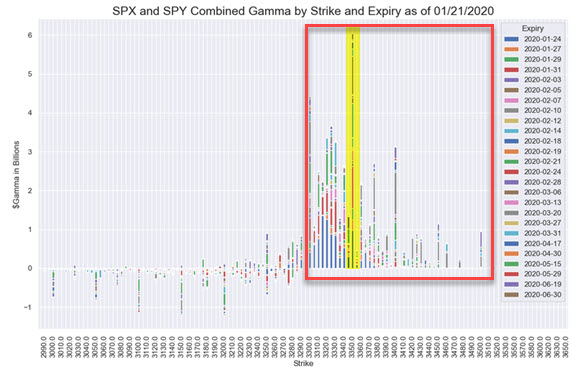

In equity markets, the sudden move over the weekend has broken the virtuous cycle higher and as McElligott explains, this Coronavirus “black swan” has shocked-out the “extremes” recently seen in SPX / SPY consolidated options positioning, with prior 95%ile + $Gamma- and $Delta- positions now acting as a source of significant “de-risking supply” ($Gamma now to 52nd %ile since 2014, $Delta now 79th %ile)...

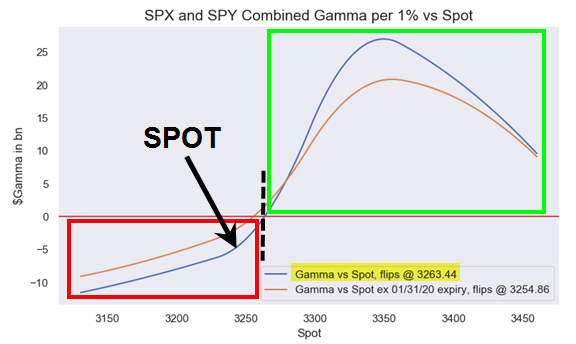

Our Dealer Gamma analysis actually shows that the Dealer Gamma position has now pivoted NEGATIVE on the move in futures below 3263 (ref 3245.50)...

...meaning that the lower we go from here, Dealers have to (perversely) “short more” into the down-move to dynamically hedge.

...meaning that the lower we go from here, Dealers have to (perversely) “short more” into the down-move to dynamically hedge.

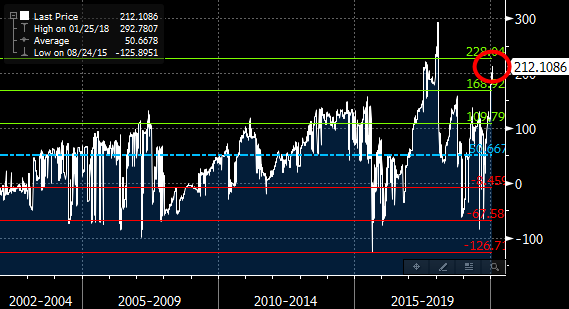

And here is where McElligott sees the big 'Minsky Moment' issue, as “Stability Breeds Instability” - the prior “short vol” halcyon referenced in Equities (“Long SPY” with a 2.2 Sharpe Ratio) has allowed for a massive accumulation of gross-exposure to US Equities futures positions for CTA Trend funds.

The Nomura QIS CTA model estimates that through last Friday, the gross-exposure of the S&P Futures position for CTAs is back to “extremes” last seen in January 2018 (a nearly +3 standard deviation gross-position dating back to 2002).

And things did not end well then.