Some quick takes here on events of the day:

The lunatics are running the asylum and they pretend to be the sane ones.

The Fed is not letting up on their liquidity machine and be clear: Every single outlook they’ve issued since inception of the program has been false. First it was temporary, then it got bigger, then it was there to meet year end requirements, and now already they’re moving the ball again.

And so here we get to see the Fed two step in one set of headlines:

“Fed’s Clarida says economy in good place, does see inflation rising to 2%. Clarida says Fed’s repo operations could continue at least through April.”

An economy that’s in a good place does not need hundreds of billion of dollars in central bank balance sheet expansion and certainly not $70B, $80B, $90B, $100B of repo every day or whatever the run rate is on any given day.

Reality is the Fed is forced to do repo or overnight rates go out of control, and if that were to last for more than a few days the economy would suddenly not be in a “good place”. The house is not on fire as long as I keep dousing it with water. But it’s in a good place.

And of course the big lie is that they have it all under control. If they had it under control they wouldn’t have to keep moving the goalpost:

The Fed's BS dance:

1. Repo is just a temporary thingy for a couple of weeks.

2. Oops, let's raise it to $120B

3. Oops, let's do it through January

4. Oops, let's do it through April

Don't believe a word they say.

Don't believe me? Check their dot plots for the past 10 years.

147 people are talking about this

No, the Fed’s liquidity injections are blowing the biggest asset bubble ever. But it’s not only the Fed doing the pumping here, this is multi front pump operation.

The pumper in chief today:

Sure, you can laugh it off as a typo, although I don’t know how you miss-type 401k as 409K as the 1 and the 9 are on opposite ends of the keyboard.

But that’s not even the issue with this tweet. It’s the glaring hype and pump.

Raoul Pal had a good take on it:

The irresponsiblity of this, telling the average person to take more risks this late in the cycle is simply staggering, regardless of what the markets do. To make them think a 50% return is low lacks any fiduciary responsibility. This is worse than the Greenspan housing comments. twitter.com/realDonaldTrum…

257 people are talking about this

FOMO by executive order I called it.

But of course the entire premise of the tweet is false on top of that. 401k’s are not up 50%.

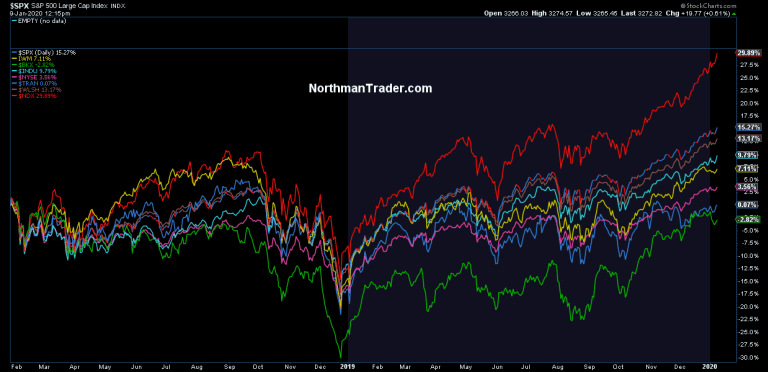

Fact is, over the past 2 years here’s your larger index performance since the January 2018 highs:

Unless your 401k is in a few select stocks and $NDX exclusively you’re not anywhere near 50%, or 70%, 80%, 90%. Complete misleading hype and misinformation. Not even the almighty $NDX is up 50% since then. And the 2019 performance is completely meaningless. People did not liquidate their 401k’s at the September 2018 highs and then bought back in at the December 2018 lows, that’s not how this works. So there was a 20% drawdown first.

But I guess we have an election to win and anything is fair game. Just get people to chase a bubble.

And speaking of election: Next week we got the “historic signing’ of a phase one trade deal with China. Also complete hype.

Not only has no one seen what’s in it, but President Xi is not only not showing up, his name won’t even be on the document:

Ministry didn’t confirm if Liu will head to DC as Special Envoy to President Xi. Xi not expected to have his name on the trade agreement - which in a Chinese context gives Xi distance in case issues arise after the deal.

25 people are talking about this

If you think that sounds like the makings of the biggest deal ever I have some 409K’s to sell you.

Reality check: The Chinese are covering their butts. So when you see the headlines next week keep a keen eye on any supposed details if they are even made public.

No, it’s all a big pump scheme on markets and it’s perpetuating a massive asset bubble:

We're witnessing the biggest market pump scheme in history.

1. Fed liquidity

2. Trump

3. Buybacks

4. Passive allocations, ETFs

Ever more money chasing less supply of shares, ever more concentrated market cap in fewer stocks, ever more disconnected from the economic basis. twitter.com/Schuldensuehne…

264 people are talking about this

Not only are a few stocks controlling much of the market cap equation that keeps getting larger and larger, now we hear via Bloomberg that only a handful of asset managers control ever more ownership of key stocks:

34 people are talking about this

Index funds controlling corporate America, just like the founders had intended.

I jest of course, but you get the message: Everybody is long, the few are getting ever larger and the Fed and Trump are both doing their parts in disconnecting asset prices ever further from underlying economic reality. We’re building an inverted pyramid here with the majority of the weight on top of the pyramid and everybody sitting up there enjoying the view but with no exit plan on how to get back down.

The economy is in a good place. Now try it without repo and balance sheet expansion. Just try it. I dare ya.

My word here: Stay cautious and critical. This is an environment of hype and non sustainability. But for now the mantra appears the same as in every bubble: Buy until you die.