Despite the fact that the bond market refuses to sell-off (as it should in a well-behaved market sending stocks to record-er and record-er highs each and every day), the levered long crowd has never been more "all-in" than they are right now.

While stocks are at record highs, bond yields are plumbing 2 month lows...

Source: Bloomberg

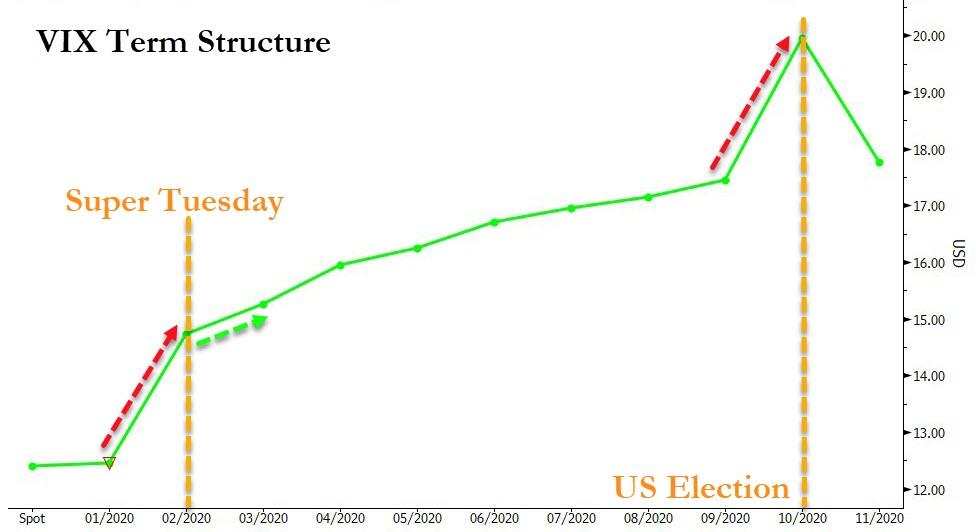

However, there are some notable anomalies in the VIX term structure that could become problematic in the next few days. As contracts expire, so the very steep term structure (fueling lots of short-vol-tilted carry trades) will flatten...

Source: Bloomberg

“This January VIX settlement is looking similar to January 2018 in that the new front month VIX spread between February and March is going to dramatically shrink the level of contango,” said Dave Roberts, independent trader of volatility and volatility products, using the trader term for an upward curve.“Combining this mechanical condition with potential risk-off factors of Sanders winning Iowa and poor earnings reports from the tech heavyweights has the ability to turn a regular pullback in something more meaningful.”

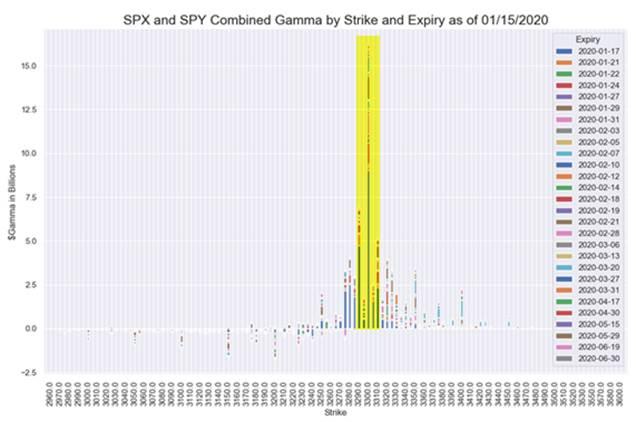

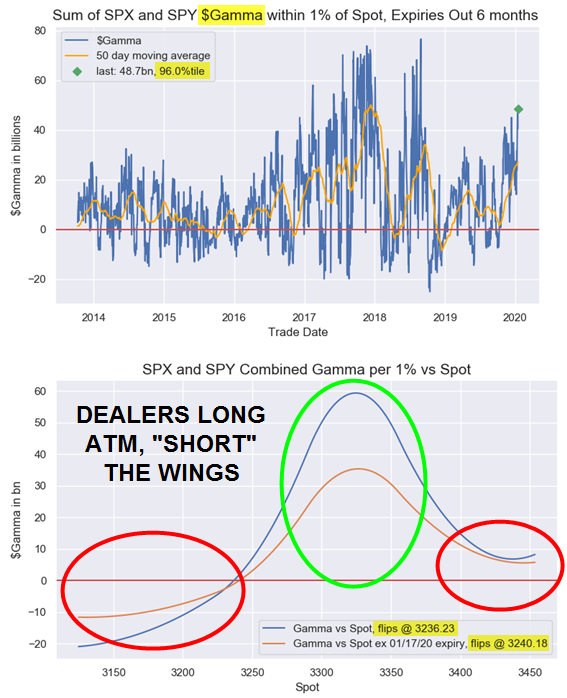

And as Nomura's Charlie McElligott notes, in risk-asset bellwether US Equities, the current 96th %ile aggregate Dealer “Long $Gamma” position (~$31B between 3290 / 3300 / 3310 alone!) continues to act as a “gravitational force” for the S&P.

Source: Nomura

But, McElligott points out, there is a potential “UN-CLENCHING” in the SPX price-action IF (and that’s a BIG “if”) we don't see these options rolled up-and-out - because per our estimates, nearly 36% of the total $Gamma across strikes is set to drop-off following Friday’s expiry, which should then allow us greater freedom to move in either direction.

Source: Nomura

However, that hasn't stopped the momentum chasers adding more and more leverage.

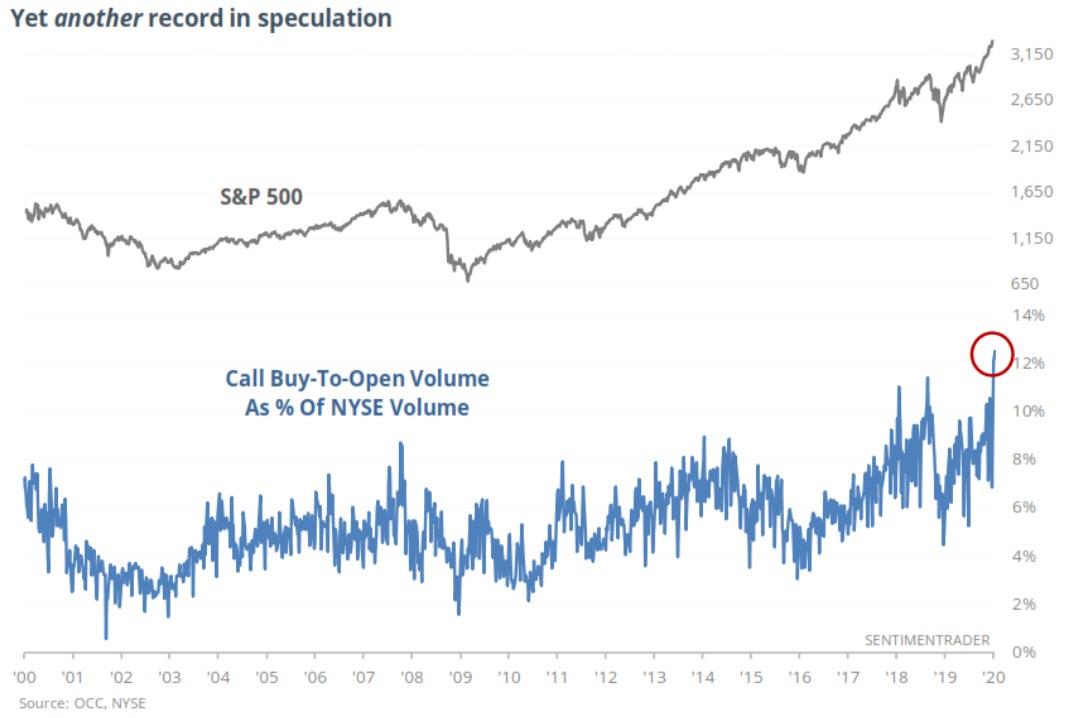

Speculative excess has hit a fresh record among U.S. options traders - and that’s a negative for stocks over the medium term, according to Sundial Capital Research Inc.

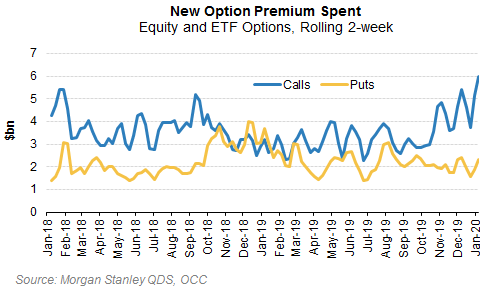

Bloomberg reports that traders established fresh bullish positions last week by buying 22.8 million new call options, according to Sundial founder Jason Goepfert. That represented 12.5% of New York Stock Exchange volume, a record high for the second week in a row, he wrote in a note to clients Tuesday.

“Among everything we follow, this kind of behavior is by far the most troublesome and should be a major worry for anyone buying with a medium-term time frame,” he wrote.“It just keeps getting crazier.”

In the options market, there is little sign of any hedging activity, according to Sundial.

“The number of contracts being open versus sold (potentially capping gains) is skyrocketing, and it’s not being offset by hedging activity,” Goepfert wrote.“We’ve never seen anything like this before.”

It's all call buying!!

What happens next?