Update (March 02): With economic activity crashing in China and capital markets dislocated across the world, credit markets ground to a halt last week. Fears are emerging that the Covid-19 outbreak could derail the global economic expansion cycle.

We documented some of the first warning signs of stress developing as high yield and investment-grade spreads surged last week. On top of that, capital markets in Europe froze, with more than $650 million in IPOs pulled.

As we step into March, the containment narrative is unlikely as the virus spreads into Africa, Europe, the Middle East, and the Americas. New reports reveal how capital markets in the US are starting to lock up.

Marco Schwartz, head of KPMG's equity capital markets advisory team, warned last week, the worst thing that can happen for the global IPO market is that equity selling continues into "next week" [March 2-6].

"If the selloff continues into next week, no one will want to price with that level of weakness in the market," said Schwartz. "Our advice to companies about to launch offerings would be to hold off and wait."

With dislocations in asset markets persisting into March, the sharp tightening in financial conditions continues to weigh on the IPO market in the US. Reuters notes Monday that Warner Music Group Corp and Cole Haan ditched their IPOs this week, citing market turbulence triggered by virus fears.

Madewell, Vontier, Imara, and AZEK are companies that have all signaled IPO launches early this month, might want to rethink their debuts on secondary markets.

A source told Reuters that IPO delays for Warner and Cole Haan aren't public knowledge yet and declined to comment further on the IPO market.

GFL Environmental, North America's fourth-largest diversified waste management firm, is expected to raise $1.5 billion this week in an IPO. The source didn't specify if GFL would postpone the listing.

Warner Music is expected to be one of the largest IPOs of the year, raising upwards of $1 billion in the listing, could be shifted to next quarter, or even in the second half as volatility in financial markets remains elevated.

With economic paralysis still, a dominant factor in China's economy heading into the first week of March, central banks are offering up a slew of rate cuts and capital injections in order to prevent a further market crash. As for now, credit markets remain frozen, and the IPO market across the world is quickly shutting.

* * *

On the heels of global credit markets grinding to a halt this week as the Covid-19 outbreak, it appears the freeze has spread to equity markets as Bloomberg reports more than $650 million in IPOs to be pulled from European capital markets.

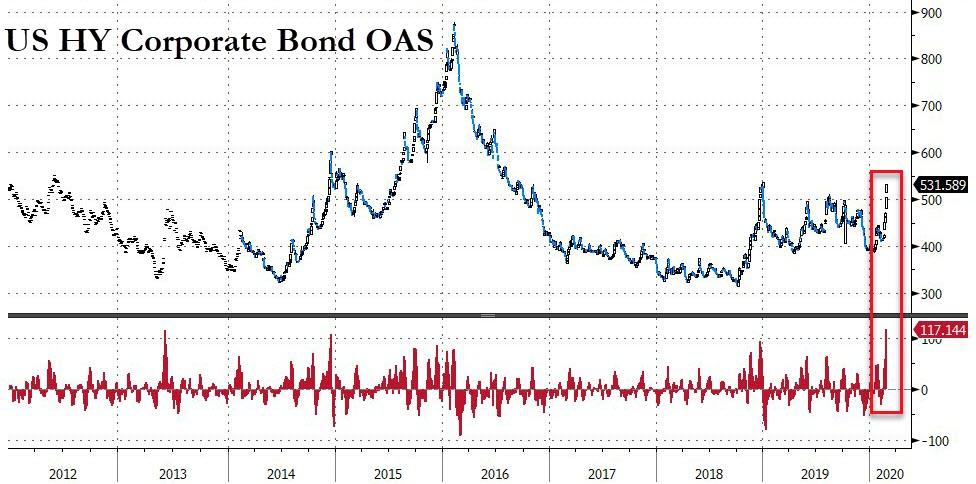

As we detailed previously, high yield and investment-grade spreads have surged this week, illustrating the stress permeating underneath markets.

In fact, high yield spreads have widened +117bps in a matter of days, the biggest move since the financial crisis.

And now that chaotic chill is rolling over to the equity market, as Bloomberg notes DRI Healthcare was the second company in days to pull a new listing in Europe, citing deteriorating market conditions driven by virus fear.

"The company [ DRI Healthcare Plc] is seeking to raise as much as $350 million in London. Raising equity capital in Europe was already tricky because of a growing disconnect between buyers' and sellers' valuation expectations. Now the market's slump is making investors even more averse to risk, thinning out an already depleted pipeline," said Bloomberg.

DRI, a fund that invests in rights to royalty-paying pharmaceuticals, didn’t set a new date for its initial public offering, which had been planned for March 11.

Somewhat stunningly, only 10 companies have priced IPOs in Europe this year, including three in London, as raising equity capital in Europe was already tricky because of a growing disconnect between buyers’ and sellers’ valuation expectations, and now the surge in risk is keeping investors even further away.

"If the selloff continues into next week, no one will want to price with that level of weakness in the market," said Marco Schwartz, head of KPMG's equity capital markets advisory team.

"Our advice to companies about to launch offerings would be to hold off and wait."

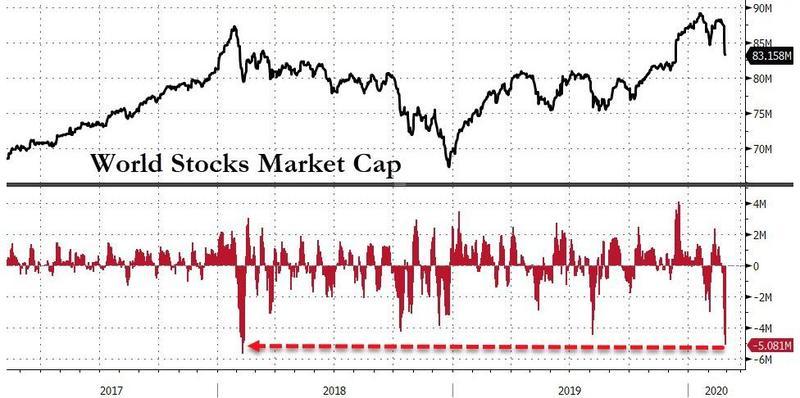

While none of this hardly a surprise considering $5 trillion in global equity value has been wiped out in the last five sessions.

Sustainable Farmland Income Trust Plc was another company this week that pulled its $300 million planned listing on the London exchange, citing market turbulence.

The IPO of Wintershall DEA, an oil and gas firm, was also postponed and could wait until the second half of the year to list.

Nacon SA, a French maker of computer parts, managed to price a $128.2 million IPO this week, despite increasing volatility in global equity markets.

The bust of the European IPO market started in 2019 when $2.85 billion worth of IPOs were postponed.

With central bankers seemingly impotent in the face of a health crisis (unable print vaccines and powerless to do anything that will help restart global supply chains or consumption), the sudden velocity of Covid-19's effect on global markets has been nothing short of astonishing and while secondary trading markets are important, contagion spreading to the primary markets, freezing IPO and credit issuance this week is a significant problem.