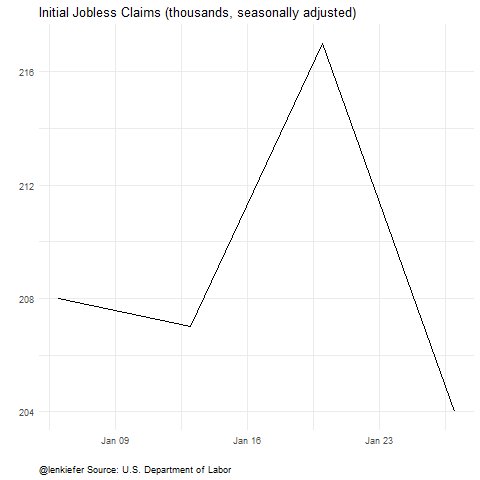

One would think that on the day the US reported 3.3 million (!) initial jobless claims, more than 5 times the weekly peak hit during the financial crisis, and a 30-sigma event...

... one which presages not a recession but an economic depression, stocks would be lower.

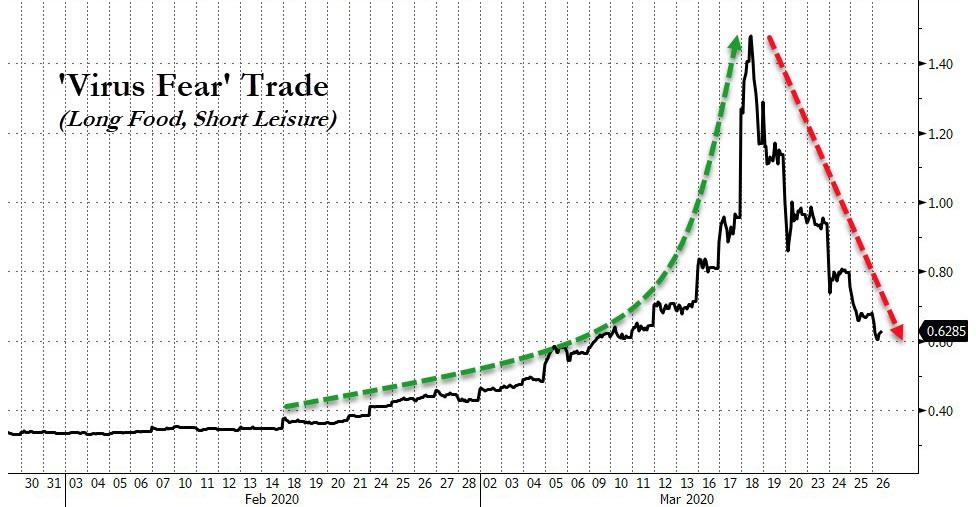

One would be wrong, because as Virus Fears abate...

Source: Bloomberg

... Liquidity fears re-appear, as FRA-OIS signals renewed tightening in funding conditions...

Source: Bloomberg

... and systemic counterparty risk concerns are soaring (LIBOR-OIS spread screaming to its highest since Dec 2008)

Source: Bloomberg

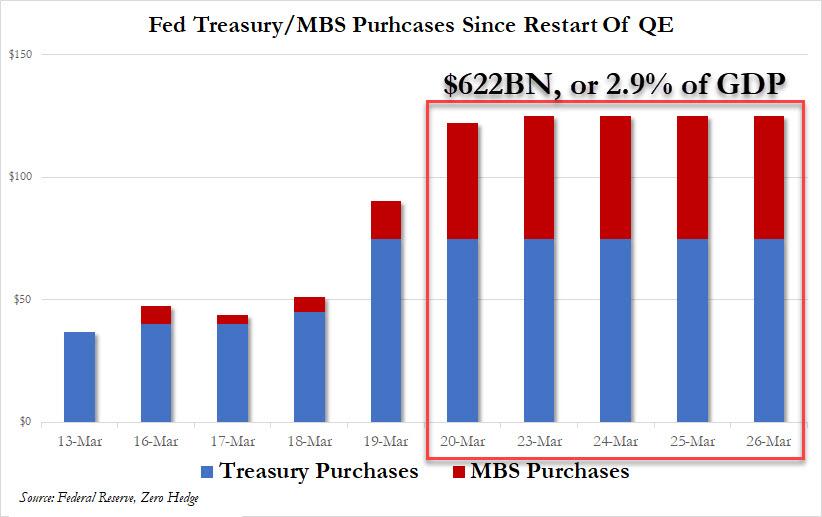

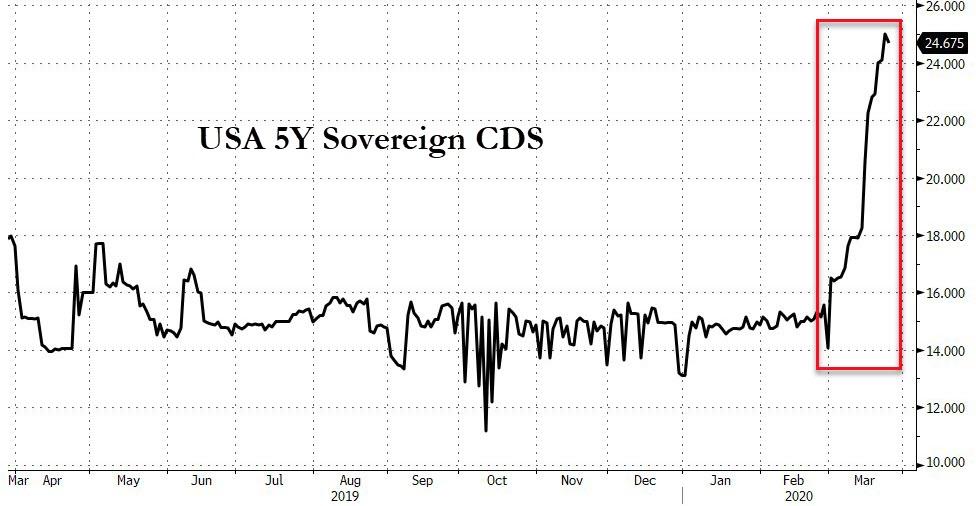

Meanwhile, the Fed's wanton monetization of debt, aka 'helicopter money'...

... has triggered growing concerns about USA's sovereign status, with the US default probability suddenly a hot topic again.

Source: Bloomberg

But for the 3rd day in a row, the cash market open in the US sparked another buying-panic (as it seems the "$850 billion buyer" in month-end rebalancing is in the market)...

... while the month-end pension rebalance suddenly appeared in the last 10 minutes of trading, sending the ES up by 40 points in literally one trade after it emerged that the Market on Close imbalance was $7 billion!

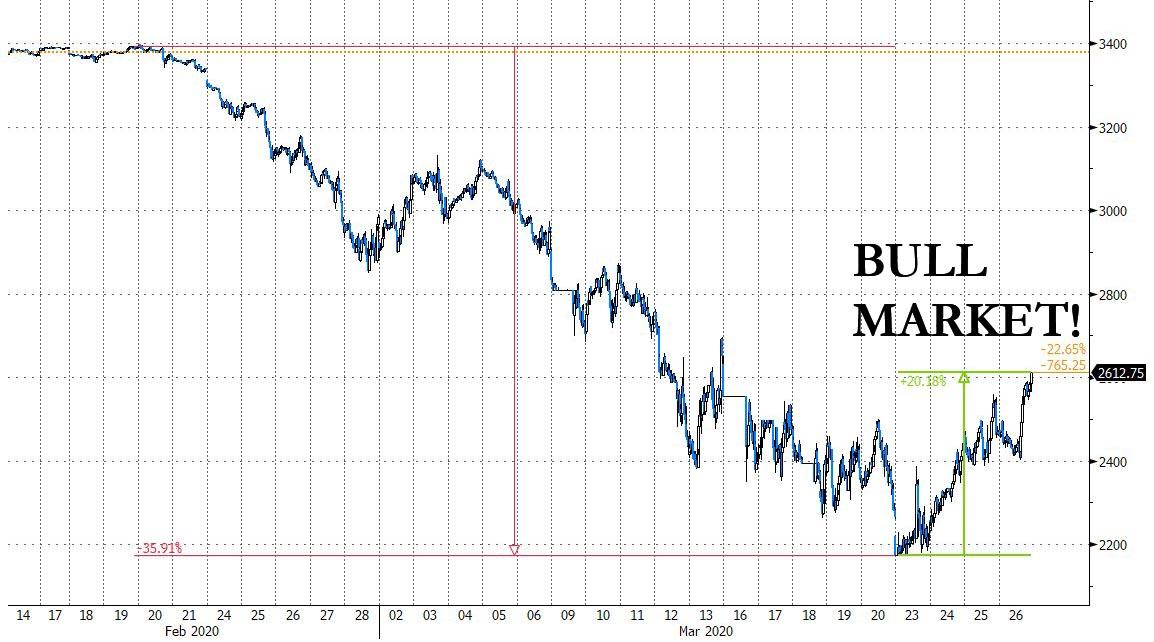

And so, after the furious rally of the past three days, and coupled with the last 10 minute Market On Close surge, the S&P is now back in a bull market, surging just over 20% from its Friday lows!

Yet as Morgan Stanley warned, despite the majestic gains in stocks, breadth remains disappointing......

Source: Bloomberg

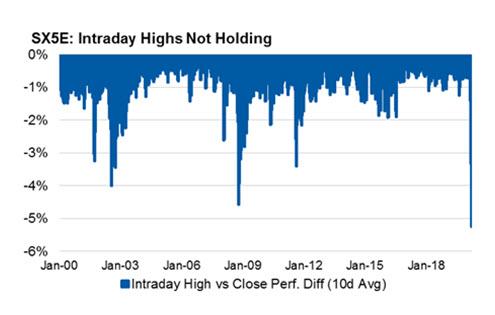

... and the rally has seen virtually no confirmation as intraday highs fail to hold.

Both IG and HY credit was bid again today...

Source: Bloomberg

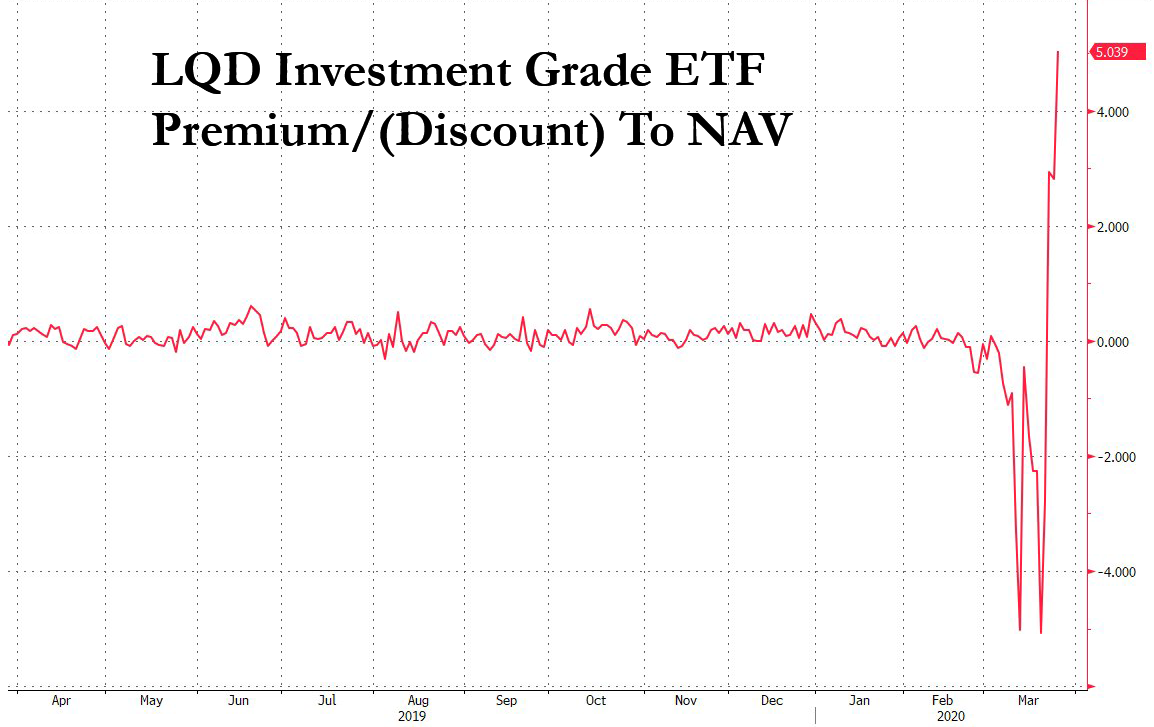

As The Fed's shocking entry into the corporate bond market has sparked a massive over-reaction, with the LQD IG ETF swing from a 5% discount to NAV to a stunning 5% premium...

Source: Bloomberg

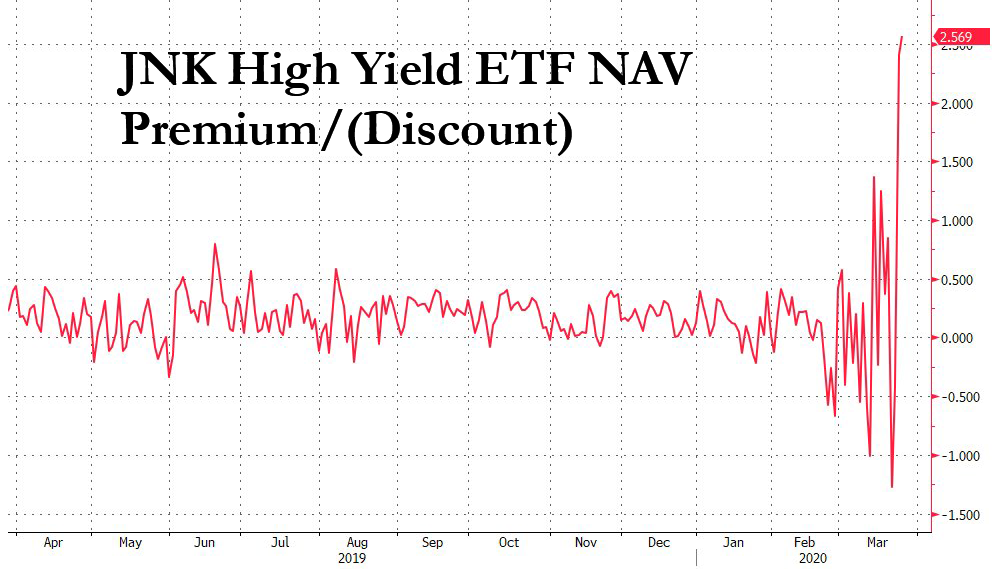

... and something similar observed in the HYG ETF, even though the Fed isn't buying junk bonds... yet.

More concerning is that Treasury yields, once again, refused to play along with stocks' exuberance...

Source: Bloomberg

... as the 10Y continued to trade completely oblivious of what's going on with stocks, and has been oddly quiet for the past 3 days.

The easing in Treasury conditions has helped send the Treasury VIX tumbling even as equity VIX remains elevated.

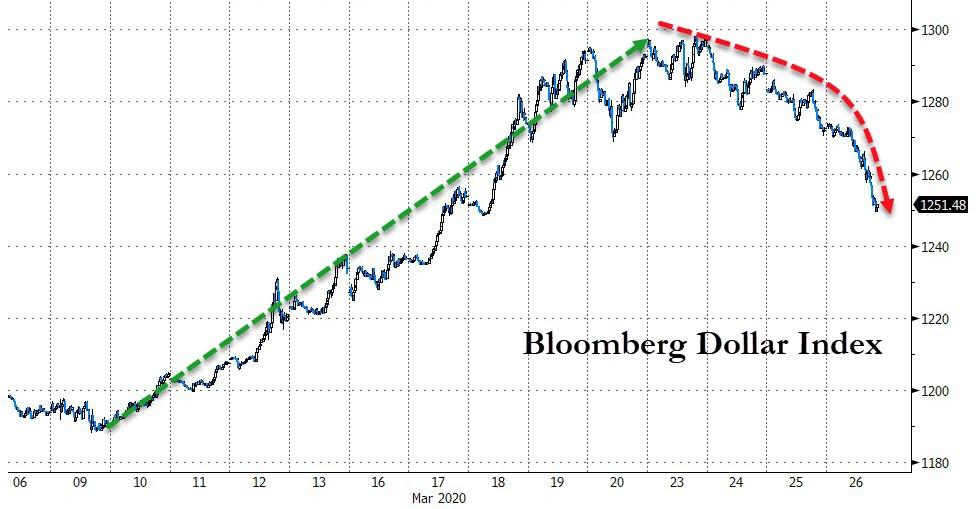

The dollar plunged today (the 3rd day in a row lower after 10 days straight up)...

Source: Bloomberg

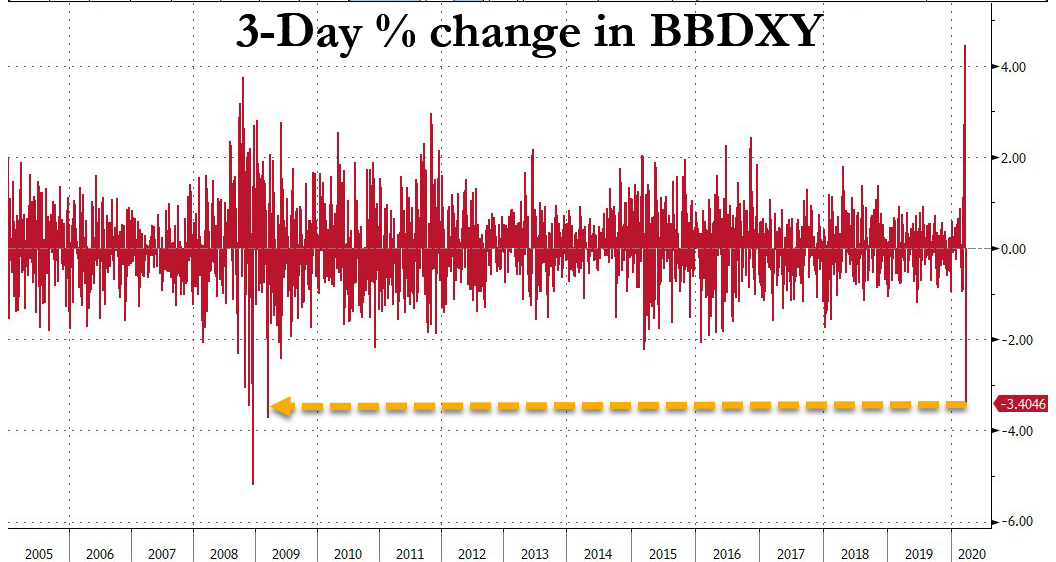

This is the biggest 3-day drop since March 2009...

Source: Bloomberg

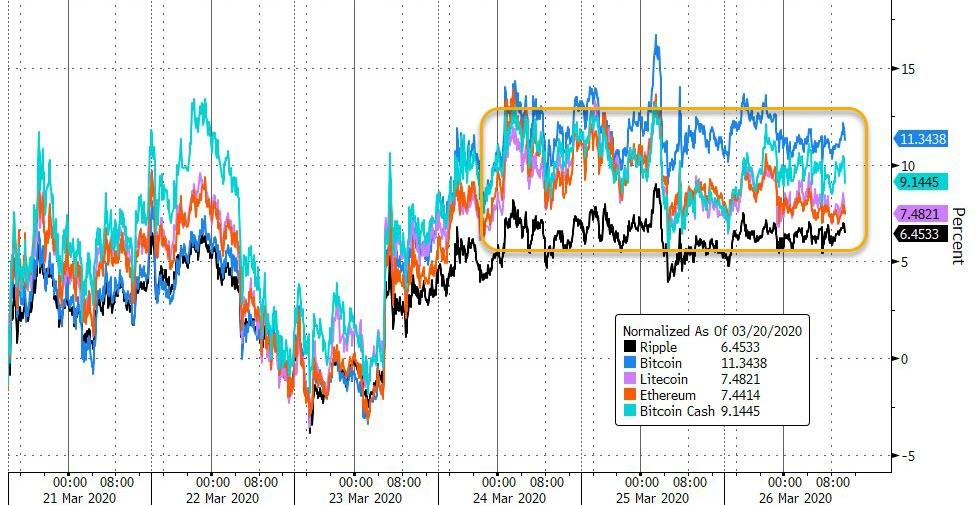

Cryptos were flat today with Bitcoin the week's best performer still...

Source: Bloomberg

In commodity-land, oil tanked despite the weak dollar, PMs gained, copper flatlined...

Source: Bloomberg

WTI tumbled back to a $22 handle as EIA forecast an even bigger than expected tumble in global demand...

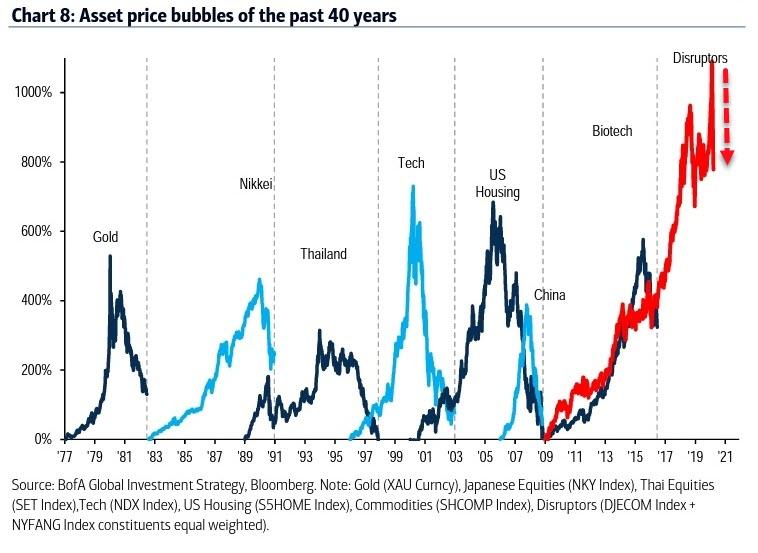

Finally, what will the next bubble The Fed will inflate to rescue the world be?

Because the "everything bubble" is done...

Source: Bloomberg

𝙻𝚎𝚗 𝙺𝚒𝚎𝚏𝚎𝚛

𝙻𝚎𝚗 𝙺𝚒𝚎𝚏𝚎𝚛