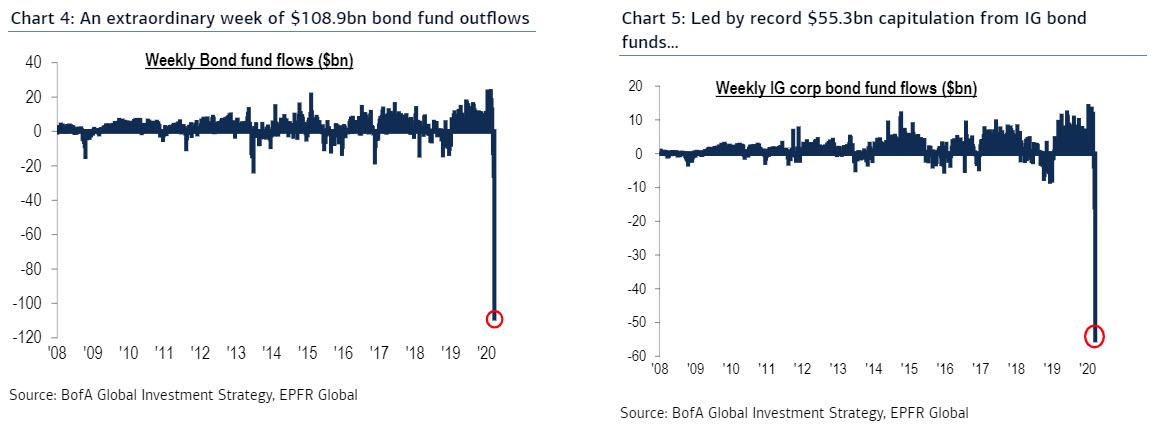

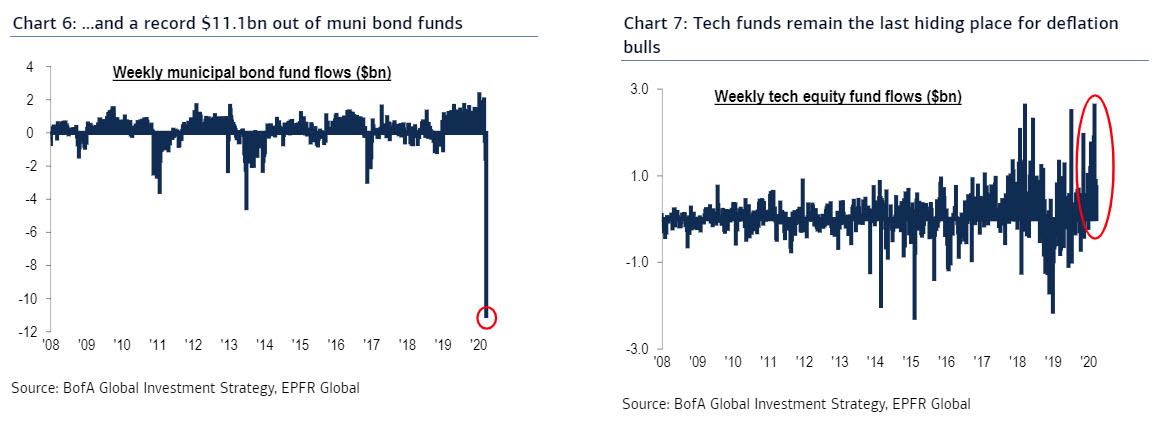

There is just one word to describe fund flows over the past week: sheer, unadulterated panic, and this time instead of dumping equities investors are also puking fixed income left and right.

Summarizing the latest weekly EPFR data, BofA's Michael Hartnett puts it thus:

- Record $108.9BN out of bonds (Monday = largest daily outflow ever at $30.2bn

- Record $55.3BN out of investment grade bonds, Monday was largest daily outflows ever ($17.8bn).

- Record one day outflow from equities on Friday, at $20.2bn

- Record $18.8bn out of EM debt, Monday was largest daily outflows ever at $4.7bn.

- Record $5.2bn out of MBS this week.

- Record $11.1bn out of municipal bonds this week (Chart 6).

- Record $3.6bn out of TIPs this week.

- Biggest 4-weeks outflow from financial ($8.6bn) ever.

- 5th largest outflow from gold ever ($2.5bn).

But...

- Record $249BN inflow into government money-market funds

- 4th largest inflow to cash ever ($95.7bn).

Guess cash is not trash after all.

The best summary of what happened to the sudden reversal in credit flows belongs to Gregory Staples, head of fixed income at DWS Investment Management, who said that "the flows into IG have been so steady over the past eight years, that it was like the farmer coming with a daily handful of grain to feed the turkey in the back yard." Only "today what the farmer had in his hand was an axe.”

”The number is off the charts, but so is the magnitude of this market correction,” Dorian Garay, a portfolio manager at NN Investment Partners, said in reference to the investment-grade bond outflows.

Despite the historic turmoil, Bloomberg reports that some investment-grade companies including Walt Disney and PepsiCo managed to find windows of opportunity to issue new debt. In fact, as reported previously, many firms selling bonds and drawing down on their revolver this week were doing so to reduce their reliance on the commercial paper market, where prices have risen rapidly amid a broad market seize-up.

Not everything was being liquidated: total assets in government money-market funds rose by $249 billion to an all-time high of $3.09 trillion in the week ended March 18, as investors plowed money into the safety of cash and cash equivalents. The previous weekly inflow record? $176 billion set in September 2008 just after Lehman Brothers filed.

Other money-market funds were not so lucky: prime funds which invest in higher-risk assets such as commercial paper, and which froze up when they "broke the buck" in 2008, received a Fed bailout this week after they suffered a mini "run" of $85.4 billion, the largest move since October 2016, as total assets fell to $713 billion.