At the same time as the Federal Reserve announced open-ended QE, which also included purchases of corporate bonds and loans in both the primary (as the ECB does now) and directly in the secondary market (a new twist), as well as expanding its municipal bond purchases while also reactivating the old Lehman-era favorite, TALF facility, the NY Fed announced the specific details of what the Fed's unprecedented QEternity would look like, and they were a doozy.

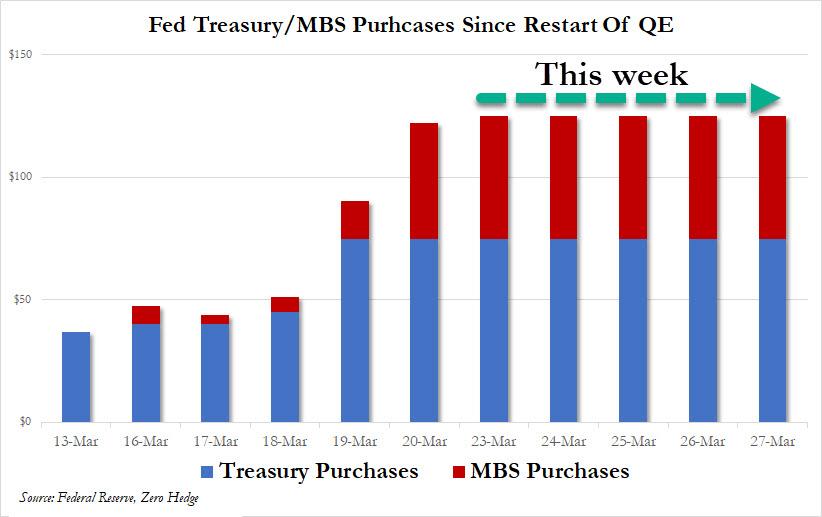

In short, every single day, the Fed will purchase $75BN in Treasurys and an additional $50BN in BMS, for a total of $125BN every day, or an unprecedented $625BN for the week, or more than the Fed's entire QE2 which was just over $500BN in purchases over 7 months.

Here is the announcement from the NY Fed:

Statement Regarding Treasury Securities and Agency Mortgage-Backed Securities OperationsEffective March 23, 2020, the Federal Open Market Committee (FOMC) directed the Open Market Trading Desk (the Desk) at the Federal Reserve Bank of New York to increase the System Open Market Account (SOMA) holdings of Treasury securities and agency mortgage-backed securities (MBS) in the amounts needed to support the smooth functioning of markets for Treasury securities and agency MBS. The FOMC also directed the Desk to purchase agency commercial mortgage-backed securities (CMBS).Consistent with this directive, the Desk has updated its plans regarding purchases of Treasury securities and agency MBS during the week of March 23, 2020. Specifically, the Desk plans to conduct operations totaling approximately $75 billion of Treasury securities and approximately $50 billion of agency MBS each business day this week, subject to reasonable prices. The Desk will begin agency CMBS purchases this week.The Desk stands ready to adjust the size and composition of its purchase operations as appropriate to support the smooth functioning of the Treasury, agency MBS, and agency CMBS markets.

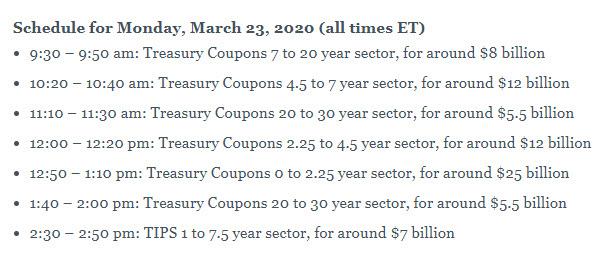

And since the Fed is purchasing securities across the entire curve, it will take no less than 7 separate operations every single day to purchase the full amount every day as per the following schedule.

Adding to this unprecedented expansion in QE the already purchased $375BN in TSYs/MBS since the resumption of QE, means that starting Friday the 13th, and ending this coming Friday, the Fed will have purchased just over $1 trillion in Treasurys and MBS securities!

And visually, the Fed's takeover of the market will look as follows: