Update (1115ET): With VIX stubbornly holding at post-financial crisis highs, someone just bet things are about to get worse... than the peak of the financial crisis...

VIX hit 90 at the Lehman crisis peak...

And as Bloomberg reports, some traders are steeling themselves for the possibility that the VIX index hits triple digits on Tuesday.

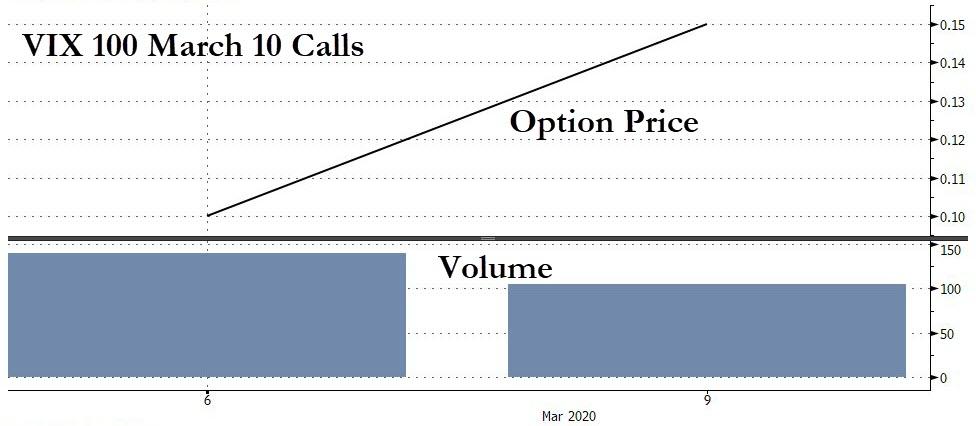

A VIX call option with a strike price of 100 that expires on March 10 changed hands at 10:25 a.m. New York Time at a price of $0.20. Less than five minutes later, 100 contracts were traded at a price of $0.15.

This particular contract has no trading history prior to Friday, when it closed at $0.10.

And that is supposed to happen by tomorrow.

As an aside, some have noted that, based on historical uncertainty, equity market uncertainty has caught up with global economic uncertainty...

* * *

With all eyes focus on the stock market indices, crude oil, and credit markets, VIX is feeling left out and so have exploded back above 60 for the first time since Dec 2008...

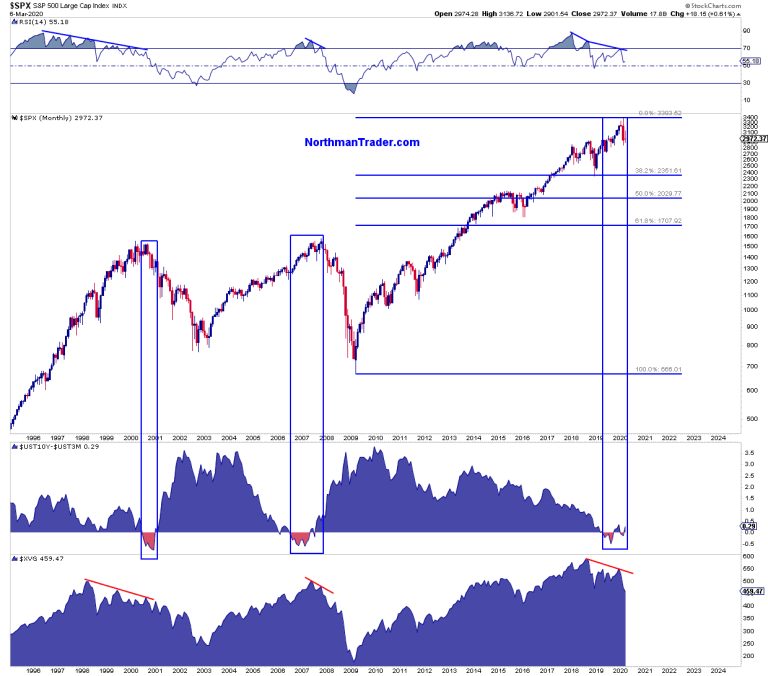

As Sven Henrich noted over the weekend, we’re faced with the most critical time since the financial crisis. That’s not my opinion, this is what the $VIX says. It’s behaving in a very unusual and rare way and everyone better pay very close attention. When I made the $VIX 46 call in January it seemed like an idiotic call to make for $VIX moves into the 40’s are extremely rare. But it happened and $VIX hit 46 a week ago and now on Friday $VIX hit 54 before again reverting below the trend line I had originally drawn in January (see Big Calls).

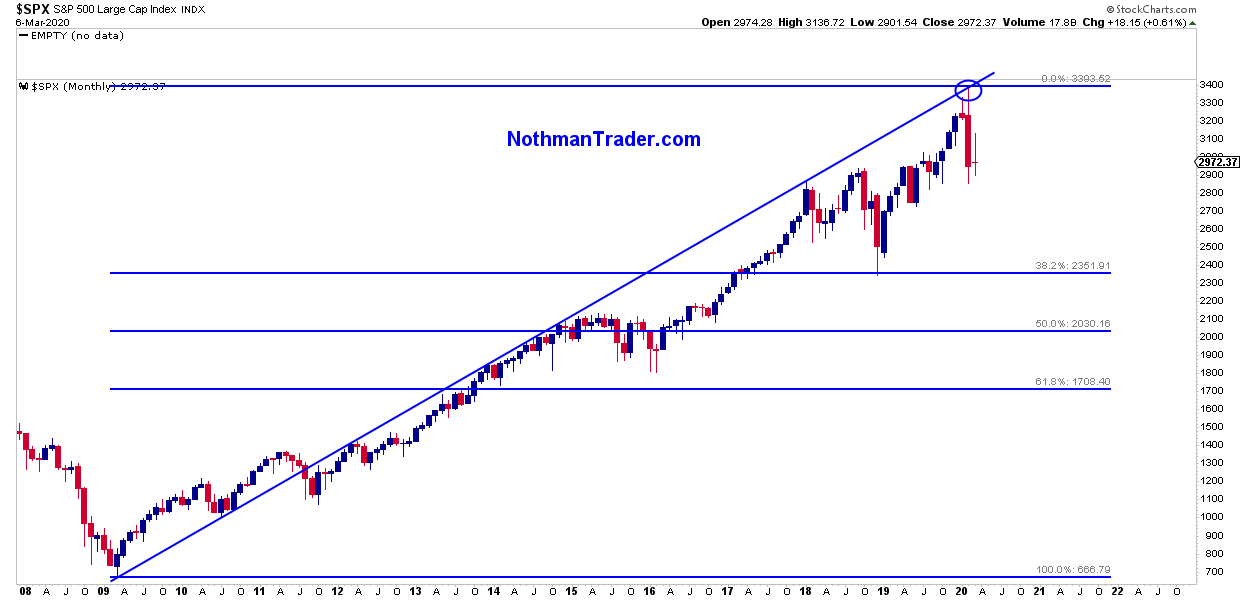

What’s the $VIX really saying here? That the Fed and every central bank on the planet are at high risk of losing total control over these markets in which case $VIX could go to 90 and $SPX could ultimate drop to 1800-2000. That’s not hyperbole, that’s what the charts say, the same charts that told you $VIX 46 was coming and that suggested a big drop was coming.

Last week’s panic rate cut by the Fed was a complete failure.

Again the Fed misread the market and the incompetence is stunning. On February 20 and 21 Fed speakers were arrogantly cheerleading and arguing no rate cuts were necessary. Two weeks later they panic cut. The Fed has been wrong and chasing reality for years now. Everything they’ve done has been in response to markets, the balance sheet roll-off was a failure and now they have expanded to record treasury holdings, their rate cuts since 2019 have all been ineffective and now coronavirus, which in fairness they couldn’t have possibly seen coming, is wreaking havoc on the entire market construct.

Nobody can blame the Fed for the coronavirus, but what I will blame them for is the asset bubble they have created. The multiple expansion they unleashed on markets in 2019 and into early 2020 were a complete reckless disaster and now we’re possibly staring at the greatest bull trap ever.

None of this is normal, none of this speaks of control or calm. These are signs of panic and price movements utterly out of control. A crash in various asset classes.

The risk:

That some funds are getting wiped out and over-leverage and unpreparedness and fear among retail investors will cause the calm passive investing trend to turn into ‘get me out at all cost’ panic selling. A systemic deleveraging the likes of which we have never seen before. And then it wouldn’t matter if the virus situation improves. The damage will already have been done, companies would have to tighten belts, lay off people and the business cycle would turn in earnest:

Nobody can know how this plays out. But be sure they will try to save it and global stimulus is coming. The Fed will be eager to want to rectify its embarrassment last week. They will meet again in March, so will the ECB and the BOJ. The question is: Can they afford to wait this long? Can global fiscal authorities wait this long without offering massive stimulus packages?

The $VIX says they may not be able to afford to wait.

$VIX over 60 was the highest $VIX reading since the financial crisis. This could mean a lot.

There is clearly an opportunity for control to be re-established. Central banks have managed to control volatility every single time it reared its head since the GFC. But right here and now they are challenged more than ever since the crisis. This is very binary. They either retain control or not.

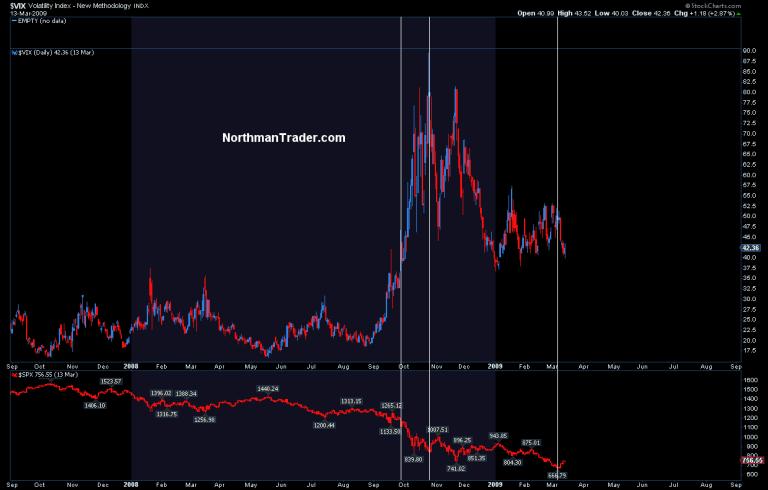

In 2008/09 when they didn’t retain control this happened:

$VIX ran to 90. What’s notable here is that the $VIX 90 spike did not happen at the beginning of the bear market. It happened later when $SPX was already down 30% off the highs.

So be clear: Just because $VIX makes a high does not mean markets bottom. It has meant that in recent years when central banks remained in control. It does not mean the same thing when they are not in control.

Bottomline here:

We’re witnessing the most profound challenge to central bankers since the GFC. Their appeasement of markets since 2009 has left us all vulnerable. The constant subsidy of markets and the economy as led us to the largest credit and asset bubble in our lifetimes and the architects of the monstrosity have left themselves weak and depleted. They are now begging for fiscal stimulus from governments that are traditionally slow to react. The big bazookas will come the question whether it will be too late.

Fact is markets last week failed to recapture the big trend line:

Unless they can recapture this fast, i.e. this in this next week or two it looks to be a massive bull failure.

The $VIX is screaming from the top of its lungs: Intervene NOW! There is massive damage inflicted underneath with potential for far reaching systemic ramifications and the very same people the called for calm and higher prices in February are suddenly waking up to all this.

Markets are massively oversold at the moment, but oversold can stay oversold if systemic selling commences in earnest. The up and down of last week highlights not only the bear market nature of this market at the moment, but also accentuates an important tactical message: Don’t be stubborn about anything. There is massive risk to the downside as well as the upside.