Billionaire bond investor Jeffrey Gundlach recently spoke with Yahoo Finance's Julia La Roche, and reiterated a similar message from his DoubleLine Total Return Bond Fund webcast in June, of how the Federal Reserve, through extraordinary measures, is propping up the economy - distorting market signals.

Gundlach, the CEO of $135 billion DoubleLine Capital, told La Roche the Federal Reserve's "most incredible fiscal lending" is the largest policymakers have ever deployed, even dating back to the financial crisis of 2007–2008.

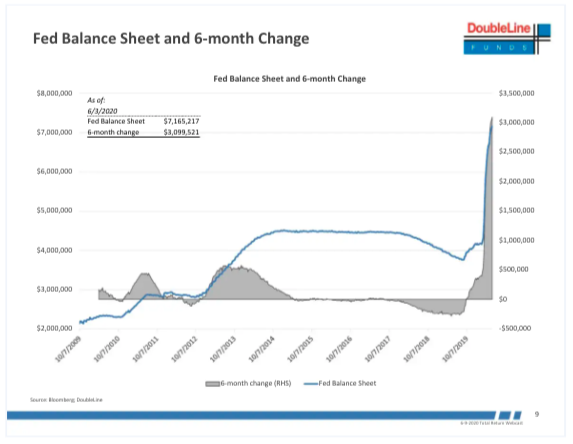

He said since the pandemic began, the central bank has printed trillions of dollars to prevent the economy from crashing further - by purchasing corporate bonds - which managed to suppress volatility. In the process, the Fed's balance sheet swelled to a mind-boggling $7 trillion.

Gundlach said the Fed has "decided that they want to pull out all the stops to reduce market and economic volatility," via unprecedented money printing. "'What they're doing is really a bridge further than they have ever gone before."

He said the Fed was motivated to keep "throwing things" at the market to rein in volatility across multiple asset classes. In his 35-years of market experience, he said the disruptions in credit markets were "far worse" than the financial crisis a decade ago.

"That led to what looked like was going to be some very substantial bankruptcies in some of the leveraged pools like mortgage-related REITs and other types of investments," he explained.

Similar to the latest DoubleLine webcast, Gundlach said the Fed's backstopping of the corporate debt markets is a violation of its charter.

"The Fed figured desperate times...require desperate measures, and the went all the way into buying corporate bonds," Gundlach said.

In the next downturn, he said the Fed "could go even further" in its ability to unleash an arsenal of tools to provide liquidity to markets.

Gundlach noted the weakest portion of the corporate bond market is low-tier investment-grade debt, commonly known as BBB, which, if re-rated to junk, could cause significant losses for investors who would have to dump into illiquid markets.

"There's been so much issuance of corporate bonds. The prices have been propped up to levels where I think the owners that own them at these levels will end up losing principal on a basket of these assets," he said.

Gundlach said the Fed's money printing is "delaying the inevitable. In the meantime, they have a lot of wherewithal to continue delaying because they are spraying money all over the place and buying all these assets."

He said, "the price of corporate bonds isn't really real. There's no price discovery mechanism that's being pegged. There's no message; there's just a target price that the Fed has been doing, and that led to a pop-up in corporate bonds."

He cautioned against buying LQD exchange-traded-fund:

"It's about the interest rate risk of the 10-year Treasury and the yield-to-no losses is about 2.25. There's not a lot of reward there, and there's a lot of risk if the bonds get downgraded because the yields on junk bonds are far higher today than the yields on BBB corporate," he said."So, if they get downgraded, we know the pricing is going to suffer very significantly."

Watch the full interview

Gundlach's message over the last month has stayed about the same. He believes the Fed's easy money policies have only delayed the crisis, BBBs are the most significant risk in corporate debt markets and remains skeptical of the stock market rally.